NQ: Before the Bell 06/15/2025

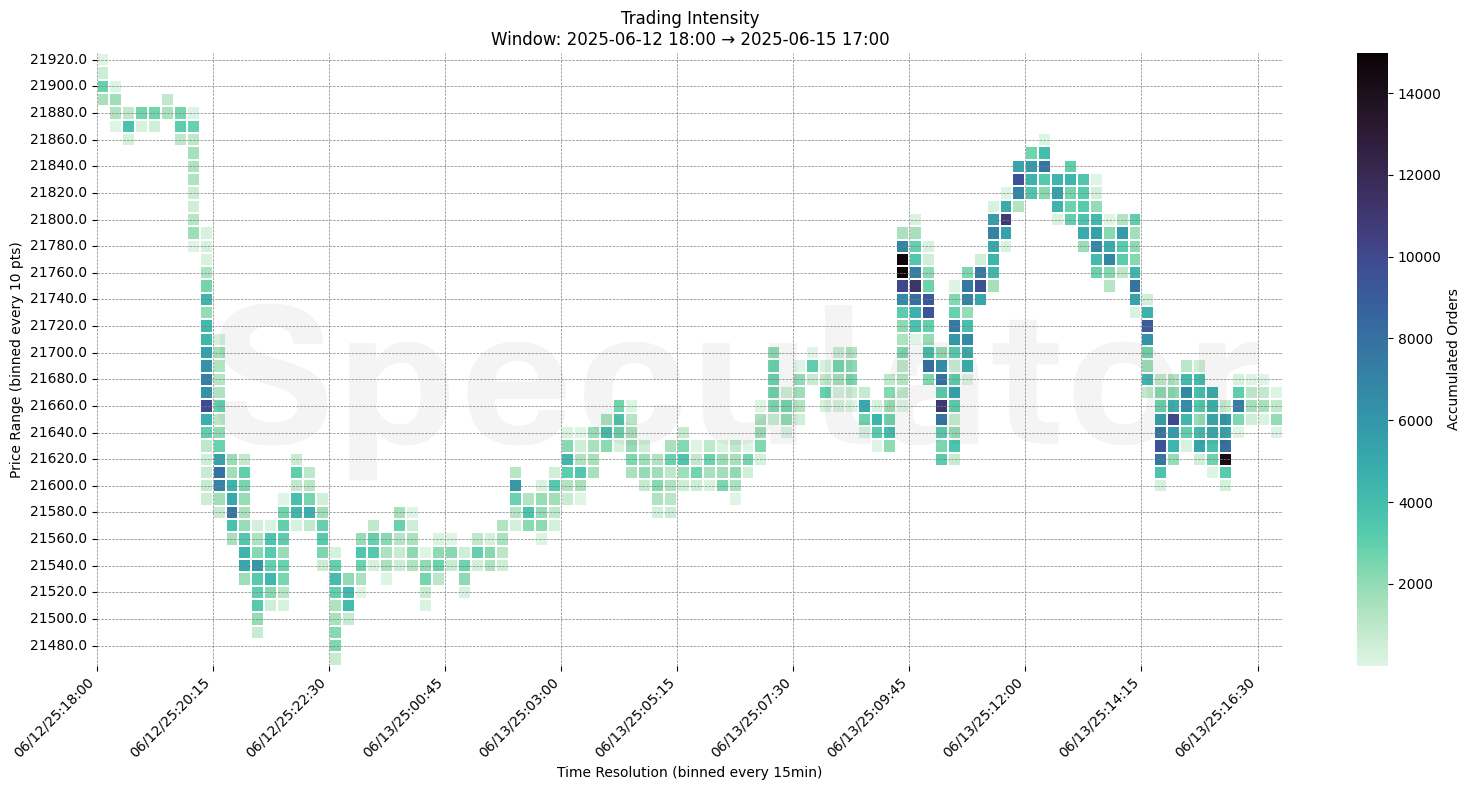

Friday's session showed buyer interest around 21620–21650, creating a base after morning supply emerged at 21800–21830. Sellers remain in control above 21830, with layered supply through 21940. Composite and macro resistance builds above 21900, while demand is firming just below.

Pre-market briefing for the Sunday evening futures open:

📊 MNQ Pre-Market Report

📆 Sunday Open: June 16, 2025 @ 18:00 ET

🕓 Analysis Window: Friday’s session + higher timeframe structure

💡 Focus: Volume-based effort vs. price-based result

💡 Analysis: Market data analysis not financial advice.

💡 Future Results: Past performance does not guarantee future results.

🔍 Narrative Summary

Friday's session showed buyer interest around 21620–21650, creating a base after morning supply emerged at 21800–21830. Sellers remain in control above 21830, with layered supply through 21940. Composite and macro resistance builds above 21900, while demand is firming just below.

🔮 Sunday/Monday Game Plan

📈 Base Case – Range Trade Likely

Opening Above 21760

→ Expect initial rejection at 21830–21875

→ Short-term bias neutral to bearish below 21900

Opening Below 21630

→ Watch for buyer defense at 21600–21620

→ Bounce likely on first test; failure risks deeper flush

🚨 Breakdown Scenario

Clean acceptance below 21600

→ Triggers possible breakdown into 21500 (1D level)

→ Extended downside targets 21400 → 21300

⚠️ 21300 = 2D macro level → potential re-accumulation or range return zone

🚀 Breakout Continuation

Hold above 21900–21940 with volume

→ Would clear all visible supply

→ Opens up fresh leg higher (watch liquidity structure for continuation zones)

🧊 Key Observations

- 21620 → 14,232 @ 15:45 – Strongest late-session demand

- 21650 → 10,062 @ 14:45 – Layered buyer defense

- 21800 → 10,914 @ 11:30 – Supply emerged post-rally

- 21830 → 9,531 @ 11:45 – Trap / responsive seller zone

🔧 Price Clusters by Timeframe

| Timeframe | Zone(s) | Notes |

|---|---|---|

| 15min | 21620–21830 | Microstructure pivot zones |

| 30min | 21630–21765 | Responsive base post-selloff |

| 1H | 21760, 21860, 21920 | Major liquidity turns |

| 4H | 21850–21875 | High-volume shelf |

| 1D | 21900, 21500 | Composite structure boundaries |

| 2D | 21900, 21300 | Macro structure – range return potential |

📈 Stay objective. Trade with context.