NQ: Before the Bell 06/16/2025

Globex buyers stepped in early, defending 21730–21760 and pushing up through 21800–21840, revisiting Friday’s supply shelf. Sellers remain active into 21875–21900, a zone of heavy prior distribution. Responsive selling is expected unless buyers reclaim that zone with conviction.

Pre-market briefing for the Monday RTH open:

📊 MNQ Pre-Market Report

📆 Monday Open: June 16, 2025 @ 09:30 ET

🕓 Analysis Window: Sunday Globex + higher timeframe structure

💡 Focus: Order accumulation and key price-volume zones

🔍 Narrative Summary

Globex buyers stepped in early, defending 21730–21760 and pushing up through 21800–21840, revisiting Friday’s supply shelf. Sellers remain active into 21875–21900, a zone of heavy prior distribution. Responsive selling is expected unless buyers reclaim that zone with conviction.

Below, 21700–21730 is key for buyer defense. A loss of 21630 would invalidate this structure and target composite support zones below.

🔮 Monday Game Plan

📈 Base Case – Responsive Range

Open Inside 21760–21830

→ Expect fade reactions into 21850–21875

→ Sellers may cap any push below 21900

📉 Breakdown Risk

Loss of 21730

→ Leads to 21700 → 21645 → 21600

→ Sustained failure opens 21500, then 21400

⚠️ 21300 (2D level) = Macro support zone for reaccumulation or flush catch

🚀 Breakout Scenario

Sustained acceptance above 21900–21920

→ Clears supply wall

→ Targets fresh rally extension — monitor for volume confirmation

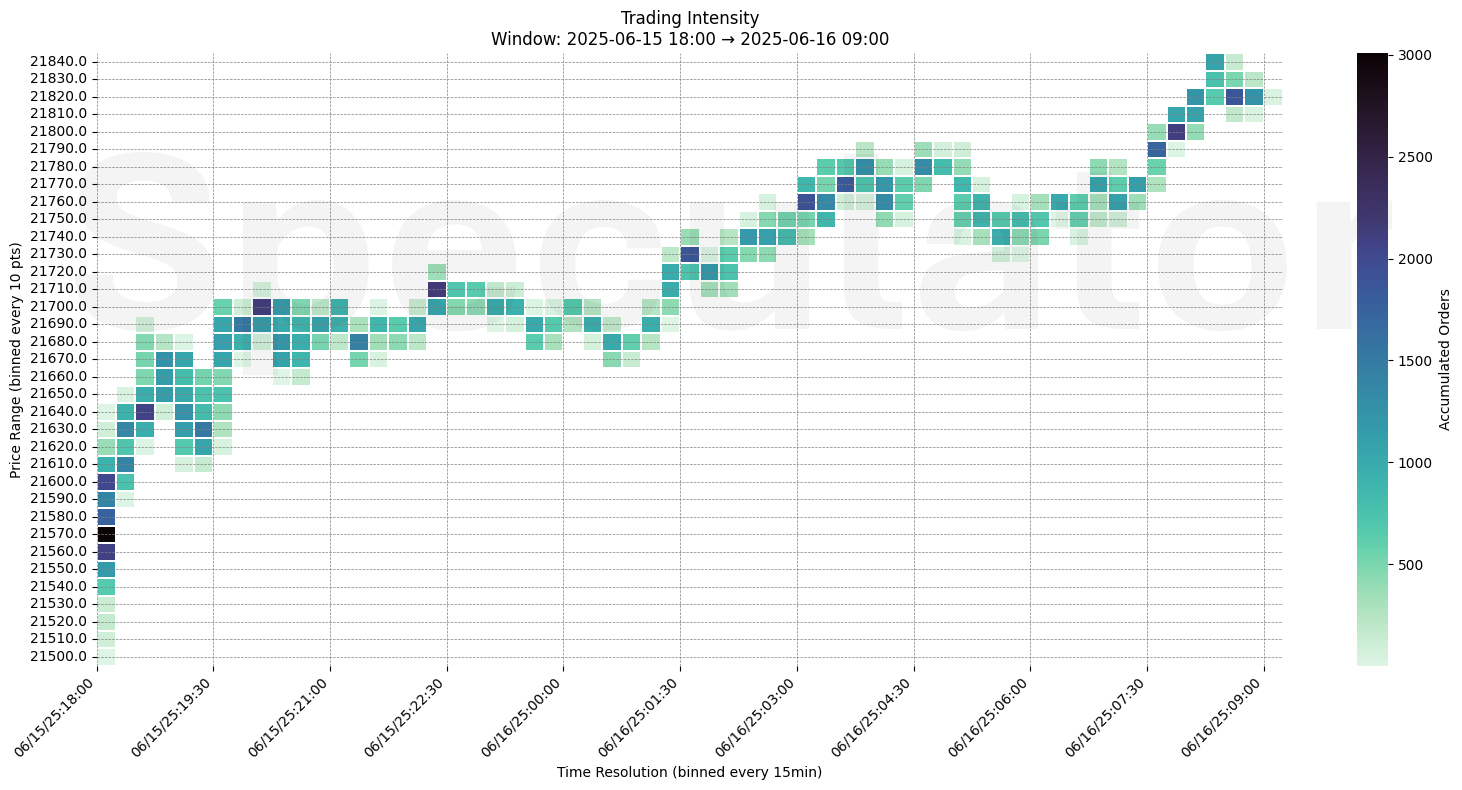

🧊 Key Heatmap Observations

- 21730 → 1,881 @ 01:30 – Early demand response

- 21760 → 1,910 @ 03:00 – Globex continuation bid

- 21770 → 1,834 @ 03:30 – Pullback buy interest

- 21800 → 2,126 @ 07:45 – Local supply re-engagement

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 21730–21800 | Globex pivot levels — intraday reaction zones |

| 30min | 21630–21765 | Friday’s structural base and responsive defense |

| 1H | 21760, 21860, 21920 | Key pivot areas — trend inflection and supply re-tests |

| 4H | 21850–21875 | High-volume shelf; upper resistance |

| 1D | 21900, 21500 | Composite structural edges |

| 2D | 21900, 21300 | Macro zones — range re-entry or broader rotation |

📈 Stay objective. Trade with context.