NQ: Before the Bell 06/17/2025

This morning’s structure suggests two-sided trade around the 22060–22080 magnet zone, with a breakout watch above 22120 or failure risk below 22020. The market is tightly coiled — favor reaction trades unless price breaks and accepts outside key volume zones.

Pre-market briefing for the Tuesday RTH open:

📊 MNQ Pre-Market Report

📆 Tuesday Open: June 17, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (00:00 → 09:03 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

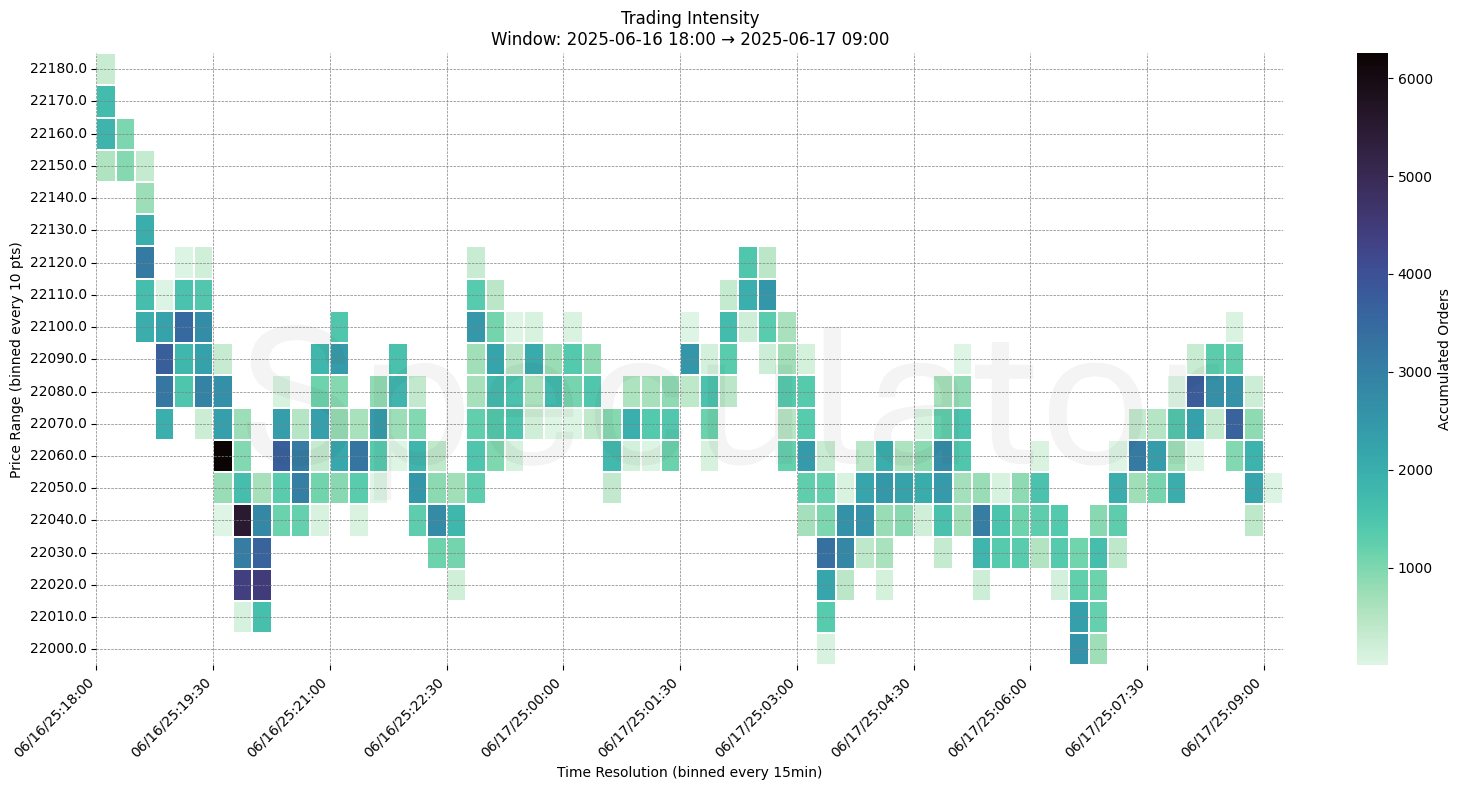

Overnight action showed buyers stepping in at 22020–22040, establishing a layered defense just above prior session support. Momentum continued into 22060–22080, with strong accumulation noted just before the U.S. open. Price probed into the 22090–22120 supply zone, triggering large volume prints, but encountered initial resistance.

This morning’s structure suggests two-sided trade around the 22060–22080 magnet zone, with a breakout watch above 22120 or failure risk below 22020. The market is tightly coiled — favor reaction trades unless price breaks and accepts outside key volume zones.

🔮 Tuesday Game Plan

📈 Base Case – Responsive Range

Open Inside 22060–22100

→ Expect fades from 22090–22120 into 22060

→ Price likely oscillates around the 22060–22080 magnet

📉 Breakdown Risk

Loss of 22020

→ Exposes 22000 → 21980 → 21960

→ Sustained failure could push into 21920 and lower liquidity shelves

⚠️ 21860–21920 (1H/4H) = Trend support zone; failure invites deeper retracement

🚀 Breakout Scenario

Sustained acceptance above 22120–22150

→ Clears 4H resistance zone

→ Opens path toward 22175 → 22250

→ Watch for volume confirmation — avoid chasing into dark zones without initiative activity

🧊 Key Heatmap Observations

🔹 22030 → 3,372 @ 03:15 – Defensive activity anchors overnight lows

🔹 22040 → 3,066 @ 05:15 – Continuation bid and defense zone

🔹 22060 → 3,150 @ 07:15 – Heavy accumulation and price acceptance

🔹 22070 → 3,430 @ 08:30 – Price pushing into supply shelf

🔹 22080 → 3,775 @ 08:00 – High intensity into resistance zone

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22030–22080 | Globex pivot zone — support base and pre-market rally path |

| 30min | 22065–22095 | Prior value shelf and short-term resistance band |

| 1H | 22060, 22020, 22000 | Historical HVNs — key support stack below |

| 4H | 22075, 22100, 22150 | Supply shelf cluster — expect responsive selling unless absorbed |

| 1D | 22100, 21700 | Composite structure — yesterday’s upper cap and macro defense |

| 2D | 22050, 21600 | Repeated composite levels — high probability mean-reversion zones |

📈 Stay objective. Trade with context.