NQ: Before the Bell 06/18/2025

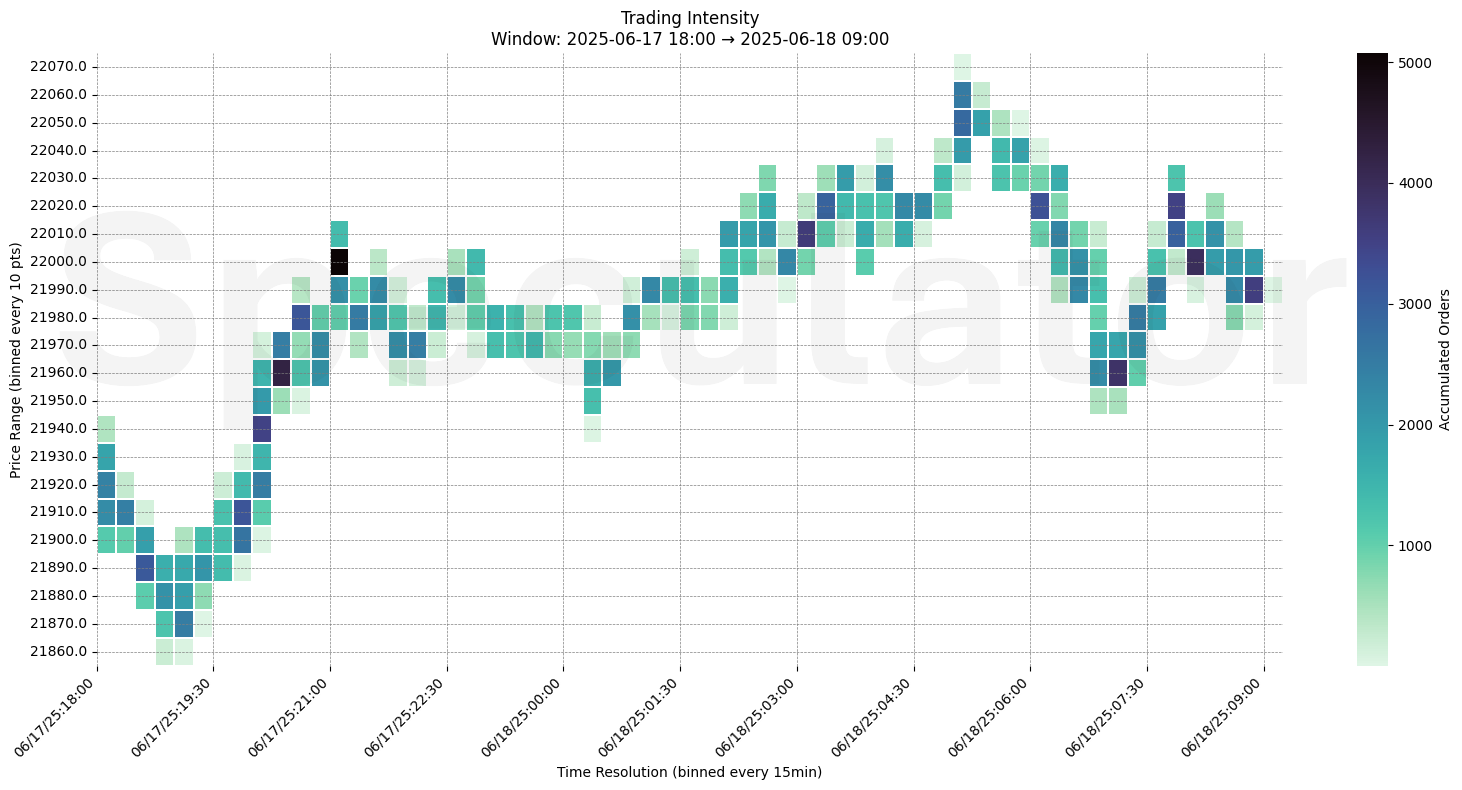

MNQ traded a wide overnight range, beginning with a downward rotation into 21860s before reversing sharply and auctioning steadily higher toward 22070s. Key volume clusters were printed in the 21940–21980 range early, showing strong accumulation around 21960–21980 during the initial bottoming.

Pre-market briefing for the Wednesday RTH open:

📊 MNQ Pre-Market Report

📆 Wednesday Open: June 18, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (00:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

MNQ traded a wide overnight range, beginning with a downward rotation into 21860s before reversing sharply and auctioning steadily higher toward 22070s.

Key volume clusters were printed in the 21940–21980 range early, showing strong accumulation around 21960–21980 during the initial bottoming.

A high-concentration of orders appeared at 22010–22030 before a continuation push into 22100s.

Price has since retraced from the 22070 high, showing two-sided behavior near key HVN levels around 21960 and 21980.

📌 Note: FOMC is today at 2:00 PM — trade accordingly, manage risk.

🔮 Wednesday Game Plan

📈 Base Case – Responsive Range

Open Inside 21960–22030 zone

→ Expect fades from 22060–22100 into 21980–21960

→ Price likely oscillates around 21980–22000 magnet zone

📉 Breakdown Risk

Loss of 21940

→ Exposes downside into 21880, possibly 21800

⚠️ 21940 (1H) = Trend support zone or structural inflection

🚀 Breakout Scenario

Sustained acceptance above 22100–22120

→ Clears resistance

→ Opens path toward 22175, then 22250+

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 21980 → 12,974 @ 13:45 – Strong demand absorption near prior base

🔹 21960 → 12,555 @ 13:45 – Key support and pivot level

🔹 22030 → 12,377 @ 13:15 – Notable offer absorption and stalling

🔹 22095 → 30,151 @ 10:30 – Heavy supply/possible short-term top

🔹 22100 → 66,813 @ 10:00 – Major resistance zone

🔹 21950 → 28,730 @ 14:00 – Structural shelf held across multiple timeframes

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 21960–22030 | Overnight activity base with multiple strong prints |

| 30min | 21945–22125 | High activity range with resistance confluence |

| 1H | 21940–22120 | Structural HVNs and recent inflection points |

| 4H | 21950–22175 | Supply shelf around 22100; responsive zone below |

| 1D | 21500, 21700, 22100 | Macro resistance at 22100; support in 21500–21700 zone |

| 2D | 21600, 22050 | Mean-reversion zone at 22050; macro structure around 21600 |

📈 Stay objective. Trade with context.