NQ: After the Bell 07/25/2025

The market surged through 23400–23420 supply during the session, holding gains into the close. Bullish tone confirmed. Next session bias: bullish while above 23350.

Market session briefing for Friday:

📊 Nasdaq Futures Report

📆 Friday: July 25, 2025

🕓 Analysis Window: (18:00 → 17:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

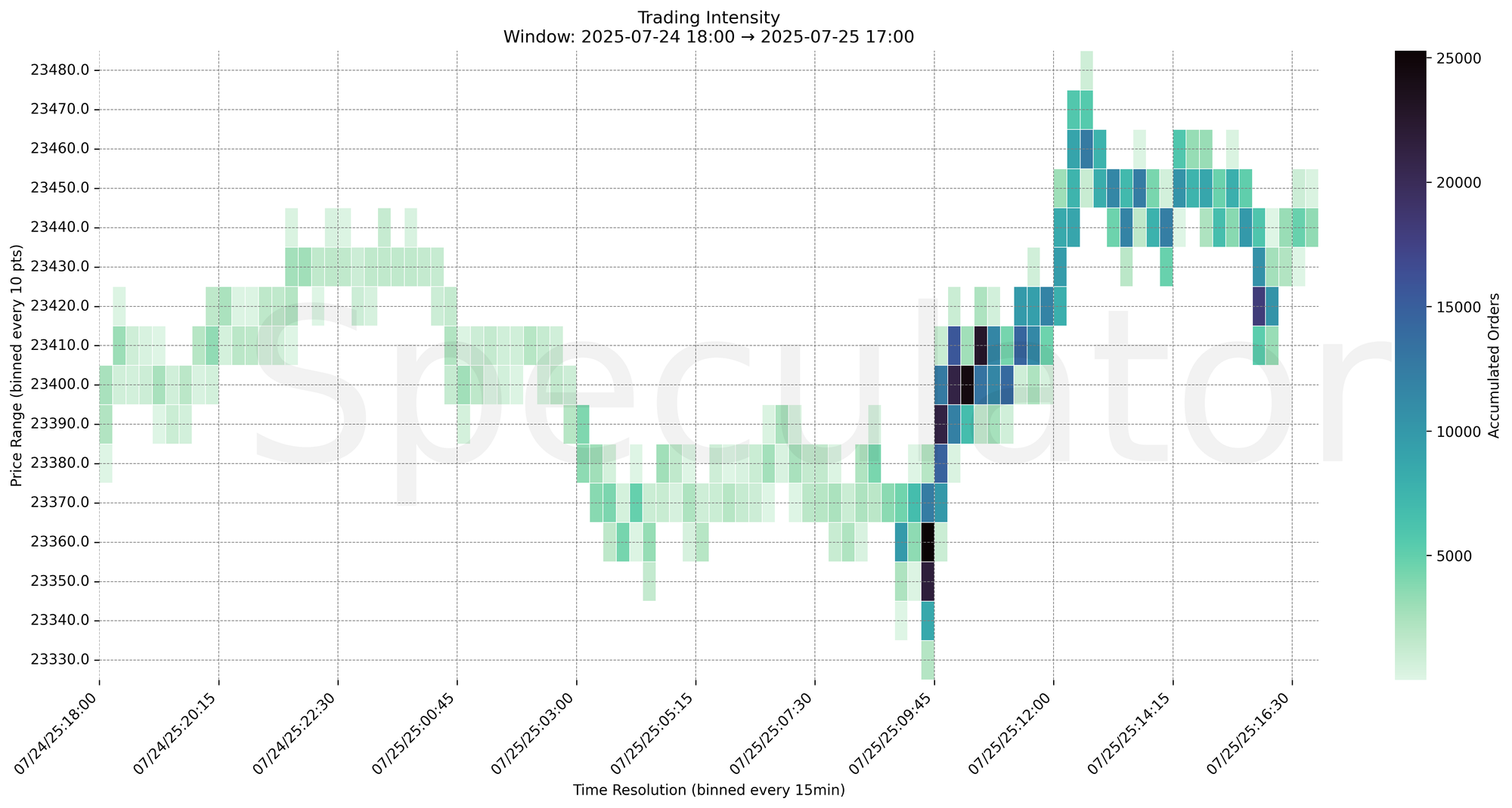

Friday’s RTH NQ session opened with balance near 23360 before a sharp morning initiative leg launched through prior resistance levels. Heavy order flow appeared at 23400–23420 — a region already identified as supply from Thursday's clustering. Following the Durable Goods data at 08:30, buyers showed conviction, accelerating through that zone and building value above it. Afternoon consolidation maintained price near highs, validating demand shift.

Notable order intensity was observed in the 23380–23420 band, confirming responsive interest and possible absorption of supply. The late session push into 23480 capped the week with strength.

The tone into Sunday–Monday's session leans bullish, with higher timeframe structure aligning above 23400. Immediate bias for the next session remains bullish while above 23350.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Durable Goods | 07/25/25 | 08:30 |

| No Event | 07/28/25 |

🔮 Monday/Next Session Game Plan

📈 Base Case – Responsive Range

Open Inside 23380–23440 zone

→ Expect fades from 23480 into 23400–23380 zone

→ Price likely oscillates around 23400 as a magnet zone

📉 Breakdown Risk

Loss of 23350

→ Clears Demand/support

→ Exposes 23320 → 23260 → 23220 → 23180

⚠️ 23180 (1H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23480

→ Clears Supply/resistance

→ Opens path toward 23520 → 23560 → 23600 → 23650

⚠️ 23560 (Projected) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23420 → 18,141 @ 07/25 15:45 – Strong close led by aggressive buyers defending upper range

🔹 23410 → 22,694 @ 07/25 10:30 – Absorption of sellers, transition to new value

🔹 23400 → 24,444 @ 07/25 10:15 – Major inflection zone with dense liquidity interaction

🔹 23360 → 25,279 @ 07/25 09:30 – Initial support and balance at session open

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23360, 23390, 23400, 23410, 23420 | Active support/resistance rotation during NY session |

| 30min | 23370, 23355, 23400 | Pre-market absorption zone led breakout |

| 1H | 23360, 23380, 23400 | HVNs and breakout confirmation area |

| 4H | 23350, 23400, 23450 | Demand zone buildout and continuation range |

| 1D | 22900, 23000 | Long-term value shelf anchoring current move |

| 2D | 22950, 21600, 20400 | Macro mean-reversion context and structural foundation |

📈 Stay objective. Trade your plan with context.