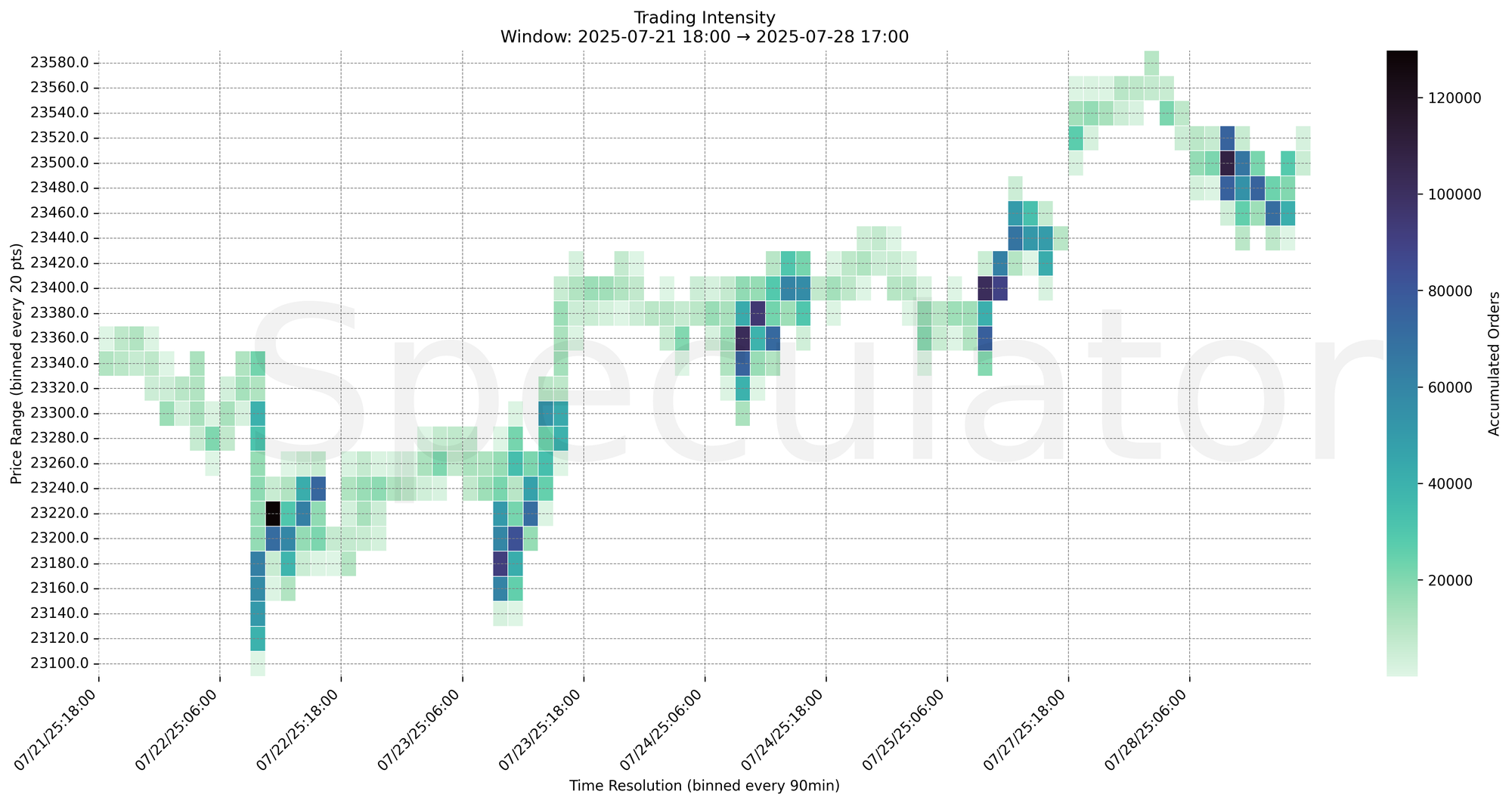

NQ: After the Bell 07/28/2025

The market tested 23580 during the session, rejecting after aggressive buying failed to extend. Short-term bullish, but watch 23580 for failed breakout risk.

Market session review Monday Game Plan Tuesday:

📊 Nasdaq Futures Report

📆 Monday: July 28, 2025

🕓 Analysis Window: (18:00 → 17:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

Monday’s RTH session opened with a tight consolidation in the upper 23400s before resolving upward into a series of high-volume tests above 23500. The sharpest order flow spike occurred between 09:45 and 10:15 ET, with over 25K accumulated orders printing around 23510 before sellers reversed the move.

The midday session saw a rotation back down into the 23460–23480 demand shelf, printing another cluster of absorption before a secondary rally developed late session, closing near the 23530s.

Volume was concentrated heavily during the NY open through the first two hours, suggesting strong institutional participation. Structure remains bullish short-term with constructive pullbacks, though price is nearing the top of a multi-day range.

📈 Bias: Bullish intraday structure holding higher lows

📉 Next session bias: Watch for potential failed breakout above 23580 if NY lacks follow-through.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Goods Trade Balance | 07/29/2025 | 08:30 |

| Jolts Job Openings | 07/29/2025 | 10:00 |

🔮 Tuesday - Next Session Game Plan

📈 Base Case – Responsive Range

Open Inside 23480–23540

→ Expect fades from 23570–23580 into 23490–23510 zone

→ Price likely oscillates around 23500–23520 as magnet zone

📉 Breakdown Risk

Loss of 23460

→ Clears Demand/support

→ Exposes 23420 → 23360 → 23320 → 23280

⚠️ 23400 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23580

→ Clears Supply/resistance

→ Opens path toward 23620 → 23680 → 23740 → 23820

⚠️ 23580 (1H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23510 → 29,448 @ 07/28 09:45 – Initiative buying spike at breakout level

🔹 23520 → 24,867 @ 07/28 10:00 – Follow-through absorption, top of session impulse

🔹 23490 → 26,972 @ 07/28 09:30 – Strong volume at initial breakout level

🔹 23460 → 15,341 @ 07/28 11:15 – Absorption during midday pullback

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23490–23520 | NY open breakout and response cluster |

| 30min | 23490–23520 | Layered effort over multiple prints |

| 1H | 23500 | Strong initiative continuation level |

| 4H | 23400–23500 | Key demand shelf with prior reactions |

| 1D | 22900, 23000 | Macro shelf from early July |

| 2D | 22950 | Longer-term composite support, mean-reversion anchor |

📈 Stay objective. Trade your plan with context.