NQ: After the Bell 07/31/2025

The market failed at 23,680 supply, reversing sharply into 23,320 support. Sellers hold bias unless 23,660 reclaimed.

Market session briefing for Thursday:

📊 Nasdaq Futures Report

📆 Thursday: July 31, 2025

🕓 Analysis Window: (18:00 → 17:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

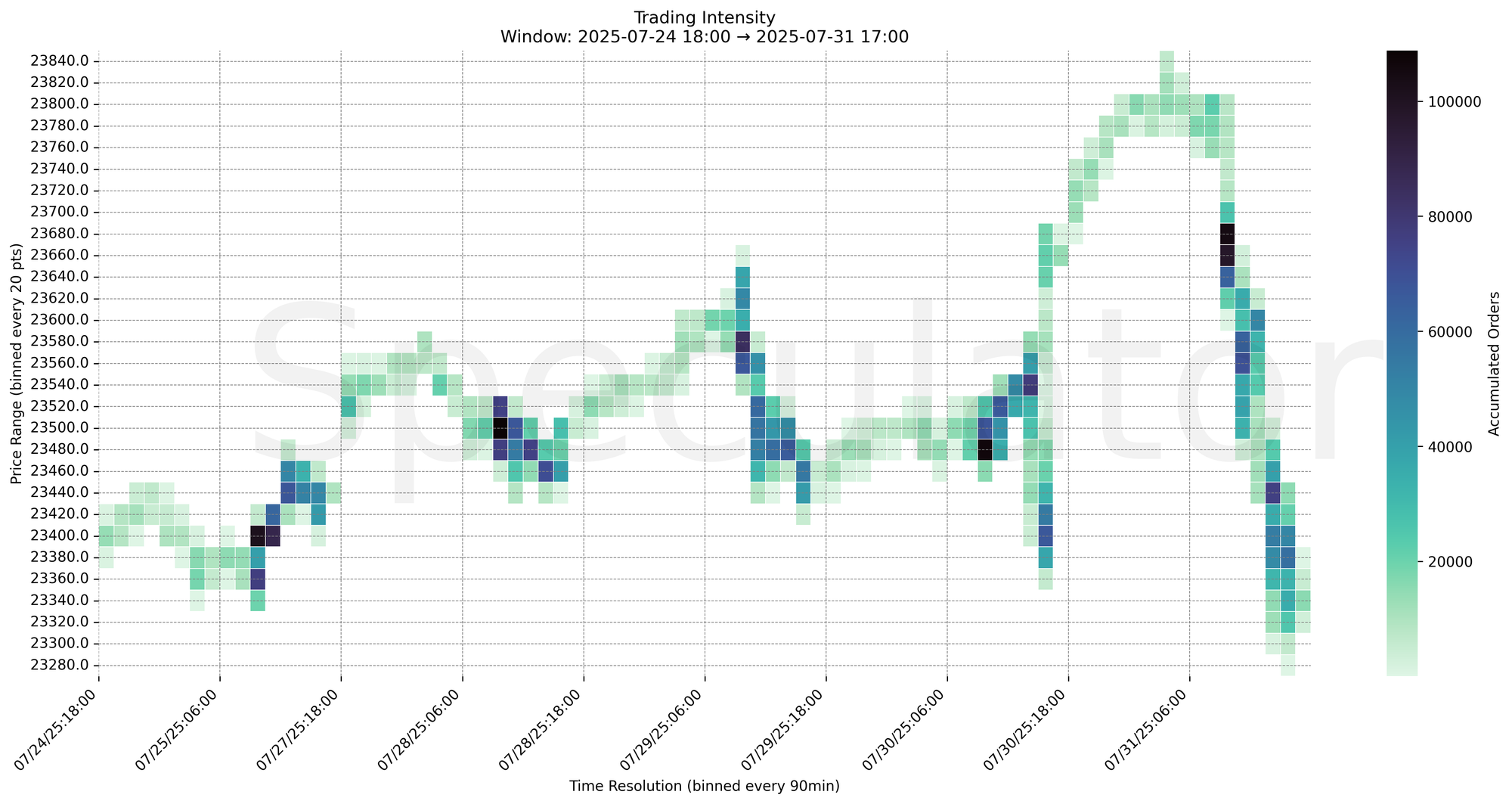

Nasdaq futures opened firm but quickly found heavy supply overhead near 23,680, triggering a sharp reversal during the late session. Strong sell programs hit into high-volume demand shelves, with the most aggressive liquidation seen after 14:30 ET, cascading price lower into 23,320 support.

Early session buying failed to convert above the key supply band (23,660–23,680), and sellers pressed control into the close.

Bias shifted to defensive: next session opens with sellers holding the short-term upper hand unless 23,660 is reclaimed.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| UC Claims | 07/31/2025 | 08:30 |

| PCE Price Index YoY | 07/31/2025 | 08:30 |

| Personal Income & Spending | 07/31/2025 | 08:30 |

📌 Note: Scheduled Red Folder Economic Events Next Session:

| Event | Date | Time (ET) |

|---|---|---|

| NFP | 08/01/2025 | 08:30 |

| Unemployment Rate | 08/01/2025 | 08:30 |

| PMI | 08/01/2025 | 08:30 |

| Michigan Consumer Sentiment | 08/01/2025 | 08:30 |

🔮 Friday - Next Session Game Plan

📈 Base Case – Responsive Range

Open Inside 23,500–23,600 zone

→ Expect fades from 23,660–23,680 into 23,520

→ Price likely oscillates around 23,540 magnet zone

📉 Breakdown Risk

Loss of 23,320

→ Clears Demand/support

→ Exposes 23,280 → 23,240 → 23,200 → 23,160

⚠️ 23,200 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23,680

→ Clears Supply/resistance

→ Opens path toward 23,720 → 23,760 → 23,800 → 23,840

⚠️ 23,800 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23,390 → 16,723 @ 07/31 15:30 – Late-session aggressive sell sweep into demand shelf

🔹 23,440 → 17,754 @ 07/31 14:30 – High-volume selling into mid-day low breakout

🔹 23,550 → 16,299 @ 07/31 13:00 – Selling failure to hold intraday recovery

🔹 23,500 → 21,953 @ 07/31 11:15 – Large offer absorption before breakdown leg

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23,680 / 23,620 / 23,570 / 23,500 / 23,440 / 23,390 | Short-term supply & demand pivots |

| 30min | 23,685 / 23,670 / 23,655 / 23,520 / 23,445 | Session supply caps and key breakdown zones |

| 1H | 23,480 / 23,520 / 23,540 / 23,400 / 23,680 / 23,660 | HVNs, intraday decision points |

| 4H | 23,500 / 23,475 | Major supply/demand clustering |

| 1D | 22,900 / 23,000 | Macro higher-volume nodes |

| 2D | 20,400 / 21,600 / 22,050 / 22,950 | Long-term composite structure reference |

📈 Stay objective. Trade your plan with context.