NQ: At the Bell 07/01/2025

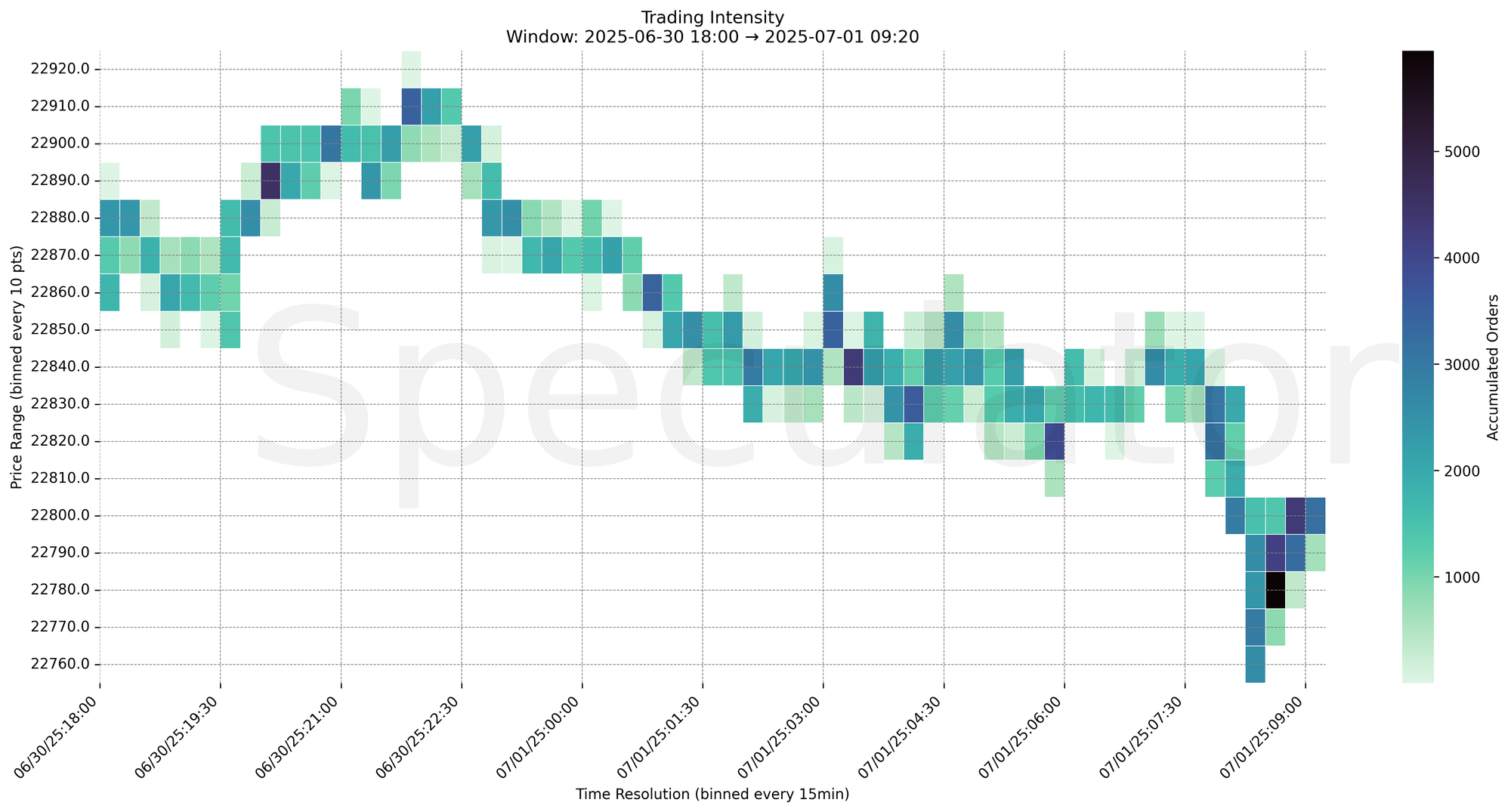

MNQ rejected 22890 overnight, breaking through 22840 into 22780 with heavy absorption. Bearish bias unless 22840 is reclaimed.

Pre-market briefing for the Monday RTH open:

📊 MNQ Report

📆 Monday Open: July 01, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

Overnight Globex began with early strength toward 22910 but quickly stalled, failing to hold above 22890. A persistent sell-side imbalance took over, driving price progressively lower throughout the session. Key volume absorption occurred between 22890–22840 before giving way, as trading intensified aggressively near 22780 into the 09:00 ET print. Notably, a dense cluster of orders near 22780–22790 suggests responsive activity into a key structural shelf.

This morning’s RTH open aligns with Fed Chair Powell’s 09:30 speech and back-to-back high-impact reports at 09:45 and 10:00, raising the likelihood of sharp reactive price action.

📌 Note: Today is a Red Folder News Day, trade accordingly, manage risk.

📌 Note: First day of Q3 — watch for quarterly positioning and potential repricing.

🔮 Monday Game Plan

📈 Base Case – Responsive Range

Open Inside 22780–22840

→ Expect fades from 22840 into 22780

→ Price likely oscillates around 22800 magnet zone

📉 Breakdown Risk

Loss of 22780

→ Clears Demand/support

→ Exposes 22720 → 22680 → 22575

⚠️ 22575 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22840

→ Clears Supply/resistance

→ Opens path toward 22890 → 22920

⚠️ 22890 (15min/30min) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22780 → 5943 @ 08:30 – Heavy absorption near prior shelf, potential responsive buying

🔹 22790 → 4141 @ 08:30 – Follow-through block buyers into zone below

🔹 22800 → 4308 @ 08:45 – Attempts to reclaim midpoint, met with selling

🔹 22840 → 4311 @ 03:15 – Structural fade zone, capped rally attempts

🔹 22890 → 4534 @ 20:00 (06/30) – Early session resistance, failed to convert

🔹 22890 → 9133 @ 20:00 (06/30) – Initial high-volume stall, key pivot

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22890, 22840, 22800, 22790, 22780 | Micro structure zones from Globex fades and reactions |

| 30min | 22890, 22800, 22785 | Consolidation and failed breakout areas |

| 1H | 22820, 22840, 22880 | HVN zones from prior sessions |

| 4H | 22575, 22800, 22825 | Key shelves and balance zone clusters |

| 1D | 22100, 22000, 21900 | Composite macro support ladder |

| 2D | 19200, 19800, 20100, 20400, 21600, 22050 | Long-term mean-reversion zones |

📈 Stay objective. Trade your plan with context.