NQ: At the Bell 07/04/2025

MNQ held above 23040 overnight, absorbing into 23080. Bias remains bullish while 23040 holds; watch 23085 for breakout. Failure to hold 23040 exposes downside magnet zones near 22970–22965.

Market briefing for the Friday RTH open:

📊 MNQ Report

📆 Friday Open: July 04, 2025 @ 09:30 ET

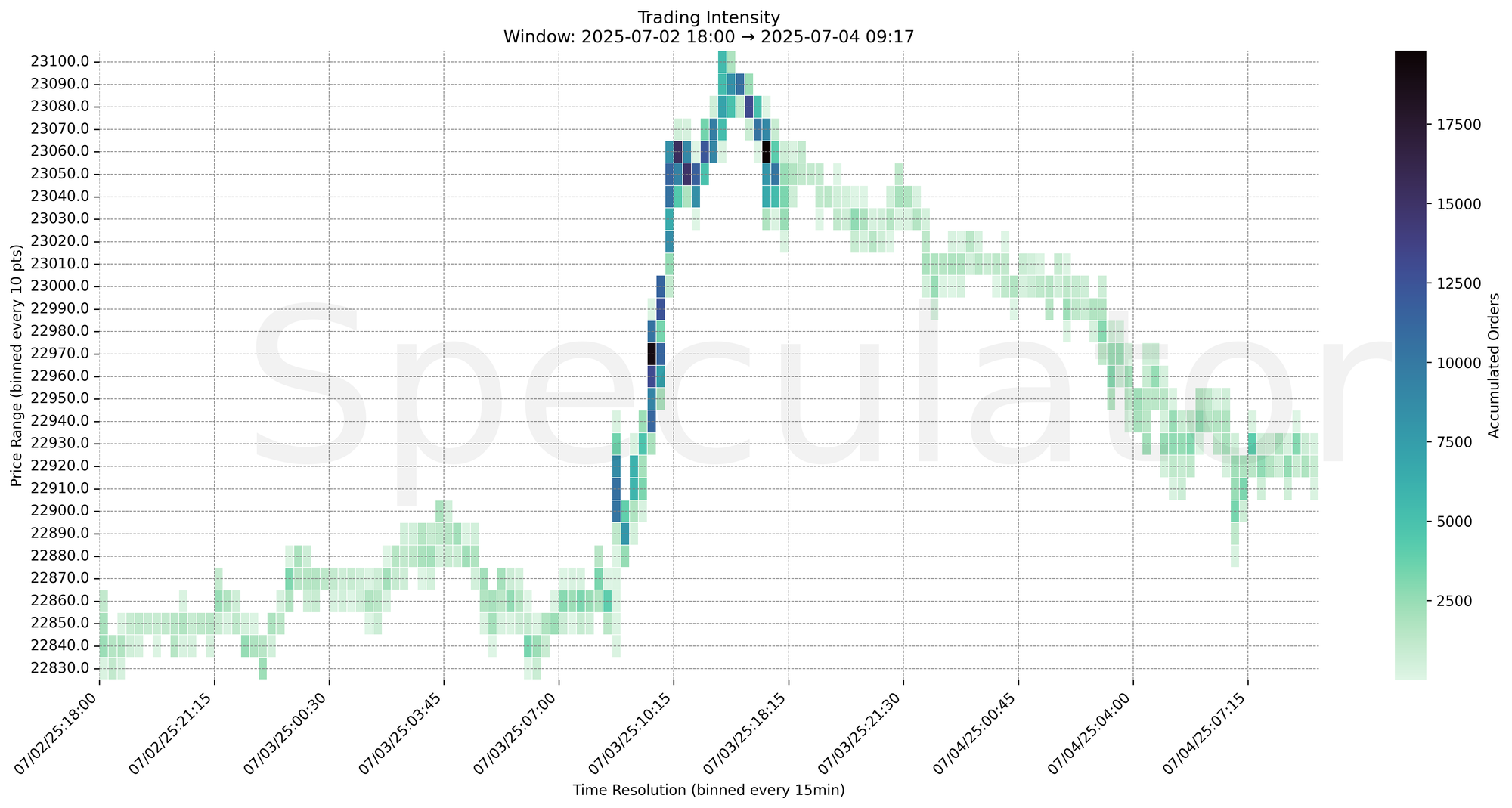

🕓 Analysis Window: Overnight Globex (18:00 → 09:17 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

MNQ continued its upside drift overnight following the July 3rd RTH session breakout. Accumulation near 22800–22820 supported Thursday’s rally, with persistent demand now shifting to the 23060–23085 zone where absorption is building.

A breakout through 23085 unlocks upside continuation potential, though liquidity is thinning into the early close. Failure to hold 23040 exposes downside magnet zones near 22970–22965.

📌 Note: Today is a holiday (Independence Day) and a partial trading day the market closes early, trade accordingly, manage risk.

🔮 Friday Game Plan

📈 Base Case – Responsive Range

Open Inside 23040–23085

→ Expect fades from 23085 into 23040

→ Price likely oscillates around 23060 magnet zone

📉 Breakdown Risk

Loss of 23040

→ Clears Demand/support

→ Exposes 22970 → 22920 → 22880 → 22820

⚠️ 22820 (1H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23085

→ Clears Supply/resistance

→ Opens path toward 23120 → 23180 → 23240 → 23300

⚠️ 23085 (30min) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23060 → 19811 @ 12:45 – Strong absorption area late Thursday session

🔹 23080 → 13185 @ 12:15 – Heavy cap during final RTH ramp

🔹 23060 → 15438 @ 10:15 – Repeated volume cluster and rotational pivot

🔹 23050 → 14943 @ 10:30 – Significant supply reaction zone

🔹 22965 → 40013 @ 09:30 – Major node from open breakout thrust

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23000, 22990, 22970, 23050, 23060, 23080 | Microstructure pivots and breakout levels |

| 30min | 22965, 23040, 23055, 23085, 23070 | Strongest intraday volume clusters |

| 1H | 22800, 22820, 22840, 23040, 23060 | Reversal and demand zones with prior conviction |

| 4H | 22800, 22825, 22725 | Composite demand shelf |

| 1D | 22700, 22000, 22100 | Macro value zones and long-term accumulation |

| 2D | 21600, 22050, 20100, 20400 | Long-term support and reversion targets |

📈 Stay objective. Trade your plan with context.