NQ: At the Bell 07/08/2025

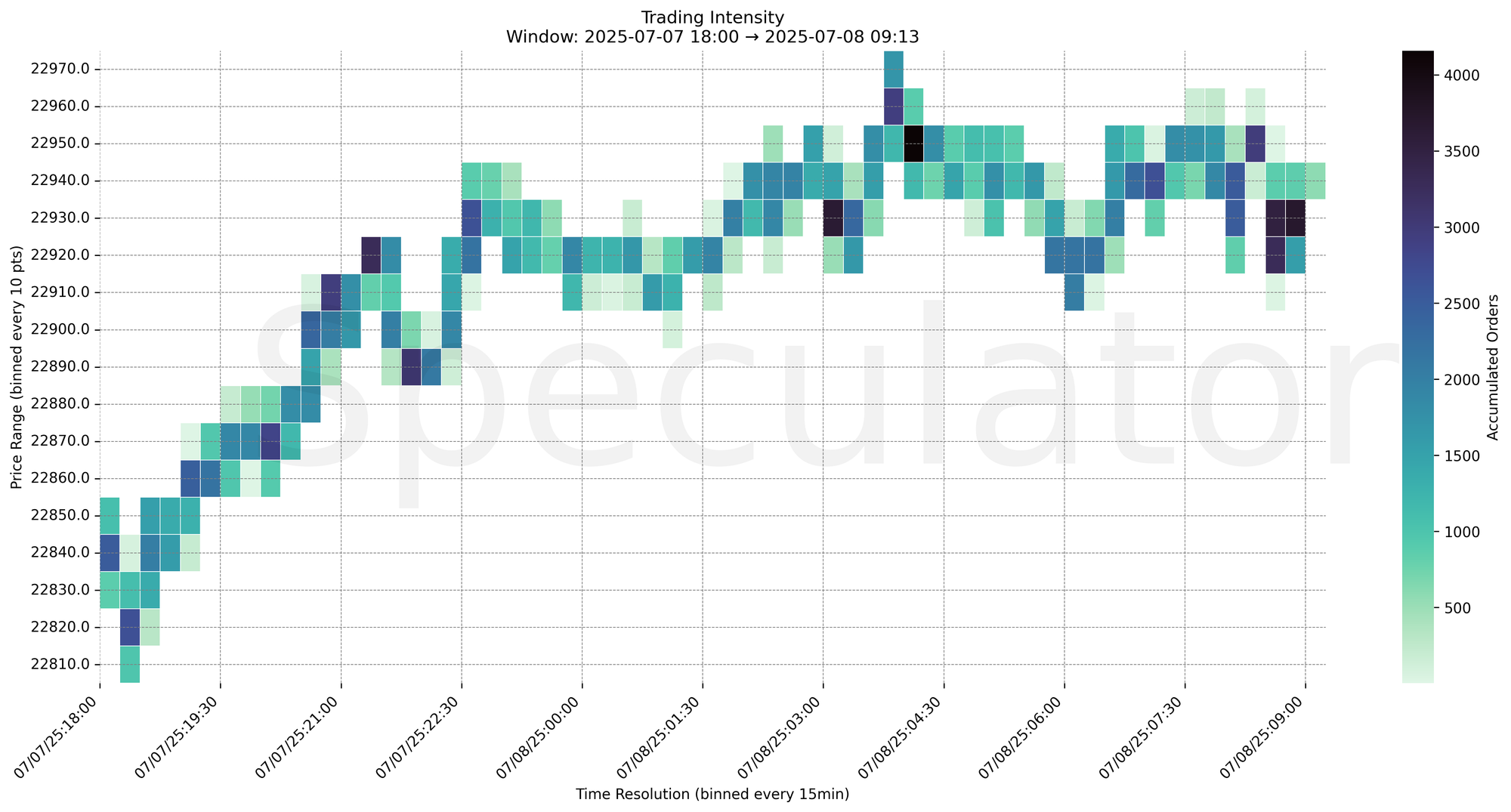

The market climbed through 22920–22950 overnight, pausing at 22930. Buyers active, 22920 key support. Watching 22950 for breakout

Market briefing for the Tuesday RTH open:

📊 Nasdaq Futures Report

📆 Tuesday Open: July 08, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

During the overnight Globex session, MNQ climbed from 22810 through the 22940 zone with multiple accumulation clusters forming along the way. Price held above key structural demand near 22860 and formed high-volume nodes at 22920 and 22930, showing buyers were active and defending pullbacks.

Toward the latter part of the session, heavier activity emerged between 22930–22950, creating a short-term balance area ahead of the cash open. This may act as a magnet during RTH.

No Red Folders today.

🔮 Tuesday Game Plan

📈 Base Case – Responsive Range

Open Inside 22920–22950

→ Expect fades from 22950–22955 into 22920

→ Price likely oscillates around 22930 magnet zone

📉 Breakdown Risk

Loss of 22920

→ Clears Demand/support

→ Exposes 22900 → 22880 → 22860 → 22820

⚠️ 22860 (1H/90min) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22950

→ Clears Supply/resistance

→ Opens path toward 22975 → 23000 → 23040 → 23100

⚠️ 22950 (12H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22930 → 3709 @ 07/08 08:45 – Strong accumulation into open, likely short-term pivot

🔹 22930 → 3513 @ 07/08 08:30 – Buyers defended re-tests here

🔹 22950 → 4158 @ 07/08 04:00 – Top-end cluster, breakout trigger or rejection zone

🔹 22930 → 3649 @ 07/08 03:00 – Mid-session balance formed

🔹 22920 → 3291 @ 07/07 21:15 – Key zone that initiated rally

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22920, 22930, 22950 | Micro-balance into RTH open |

| 30min | 22920, 22935, 22950 | Multiple responsive prints confirming short-term range |

| 1H | 22860, 22880, 22900, 22920, 22940 | High participation at swing zones |

| 4H | 22825, 22850, 22875, 22925 | High volume shelf forming near upper range |

| 1D | 22900 | Macro value area top |

| 2D | 22050 | Long-term mean reversion and previous resistance |

📈 Stay objective. Trade your plan with context.