NQ: At the Bell 07/09/2025

The market climbed above 22930 overnight, driven by buyer strength into 22950. Bullish tone unless 22900 breaks.

Market briefing for the Wednesday RTH open:

📊 Nasdaq Futures Report

📆 Wednesday Open: July 09, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

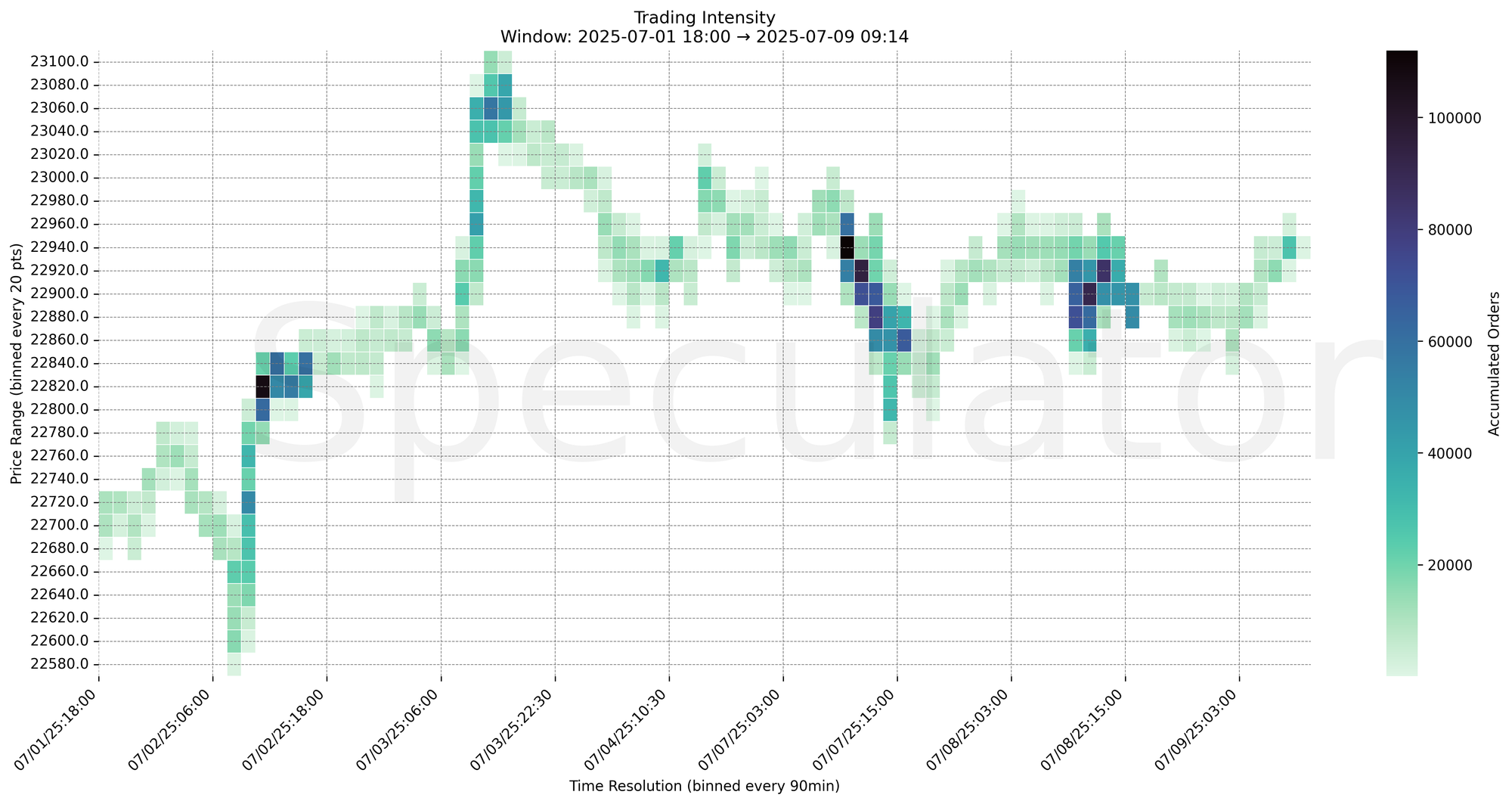

🔍 Narrative Summary

Overnight action initially trended downward to test the 22860s before reversing higher with aggressive accumulation above 22930. Intensity spiked into the 22950 zone leading into the RTH open, suggesting initiative buyers took control in the latter half of the session.

📌 Note: FOMC is today at 2:00 PM trade accordingly, manage risk.

🔮 Wednesday Game Plan

📈 Base Case – Responsive Range

Open Inside 22930–22950 zone

→ Expect fades from 22950 or 22960 into 22900–22920

→ Price likely oscillates around 22920 (magnet zone)

📉 Breakdown Risk

Loss of 22900

→ Clears Demand/support

→ Exposes 22880 → 22860 → 22840 → 22820

⚠️ 22875 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22960

→ Clears Supply/resistance

→ Opens path toward 22980 → 23020 → 23050 → 23100

⚠️ 22950 (1D/2D) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22950 → 4982 @ 07/09 08:45 – Strong late-session buyer presence into resistance zone

🔹 22940 → 3444 @ 07/09 08:15 – Accumulation spike led to upside breakout

🔹 22930 → 3613 @ 07/09 05:15 – First initiative buy response zone

🔹 22920 → 3306 @ 07/09 06:00 – Sustained absorption led to continuation

🔹 22850 → 3760 @ 07/09 02:00 – Support reaction, held the low of night session

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22850, 22930, 22920, 22940, 22950 | Microstructure clusters from Globex turning points |

| 30min | 22920, 22950, 22935 | RTH pre-open accumulation and resistance structure |

| 1H | 22920, 22880, 22900 | HVNs + recent balance areas |

| 4H | 22925, 22875, 22900 | Support/resistance clustering in last 48h |

| 1D | 22000, 22900 | Composite balance range with active HVNs |

| 2D | 22950, 21600 | Longer-term composite reference and mean-reversion |

📈 Stay objective. Trade your plan with context.