NQ: At the Bell 07/10/2025

The market tested 22990–23000 overnight, buyers defended and pushed into 23060–23080 resistance. Holding above 23040 favors continuation. Watch 23080 for breakout.

Market briefing for the Thursday RTH open:

📊 Nasdaq Futures Report

📆 Thursday Open: July 10, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

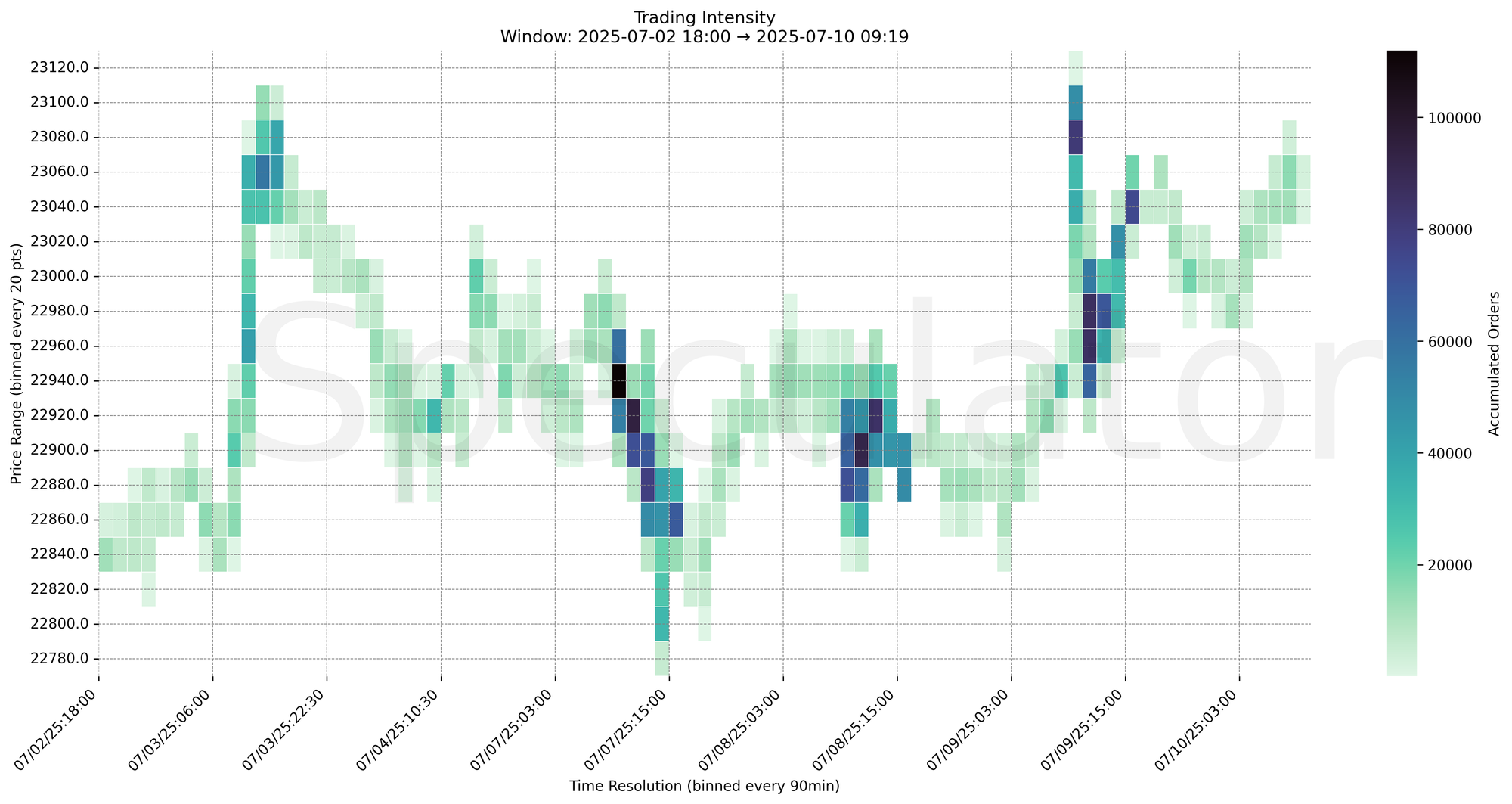

Overnight Globex session saw responsive buyers defend the 22980–23000 zone after an early dip, lifting price steadily into the 23060–23080 resistance band. The most intense accumulation occurred at 23040 (08:30 ET), coinciding with the UC Job Claims print, suggesting institutional positioning around the release.

Sellers remain active above 23060, with exhaustion noted at 23080. Buyers must hold 23000–22990 to maintain control.

Intraday structure is constructive short-term, with a focus on continuation or rejection from 23060–23080.

📌 Note: Red Folder Economic Event this morning at 08:30 AM ET – UC Job Claims.

🔮 Thursday Game Plan

📈 Base Case – Responsive Range

Open Inside 22990–23040

→ Expect fades from 23060–23080 into 23010–22990

→ Price likely oscillates around 23020–23025 magnet zone

📉 Breakdown Risk

Loss of 22990

→ Clears Demand/support

→ Exposes 22960 → 22940 → 22920 → 22900

⚠️ 22900 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23080

→ Clears Supply/resistance

→ Opens path toward 23120 → 23150 → 23190 → 23240

⚠️ 23080 (1H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23050 → 5299 @ 07/10 08:30 – Surge in buy interest on UC claims release

🔹 23040 → 3799 @ 07/10 08:45 – Continuation volume holding above support

🔹 23020 → 3653 @ 07/10 03:45 – Defended base during early session lows

🔹 22990 → 3718 @ 07/10 03:00 – Key low-volume shelf under threat overnight

🔹 23010 → 6637 @ 07/09 20:30 – Heavy absorption post-Globex rally

🔹 23025 → 6528 @ 07/09 20:00 – Short-term magnet zone above initial push

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23050, 23040, 23020, 22990 | Microstructure reaction zones in overnight action |

| 30min | 23040, 23010, 23025 | Volume magnets around balance zones |

| 1H | 23040, 23000, 22980, 22960 | HVNs and balance support zones |

| 4H | 22925, 22875, 22900 | Support shelves from prior session and weekly demand |

| 1D | 22900, 22000 | Composite value and long-term demand base |

| 2D | 22950, 22050, 21600 | Longer-term reference zones for swing bias |

📈 Stay objective. Trade your plan with context.