NQ: At the Bell 07/11/2025

The market rejected 23040 overnight, reversed into 22880 absorption zone. Buyers defended balance at 22920–22970. Bias: neutral-to-bullish above 22950, risk of breakdown below 22860.

Market briefing for the Friday RTH open:

📊 Nasdaq Futures Report

📆 Friday Open: July 11, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

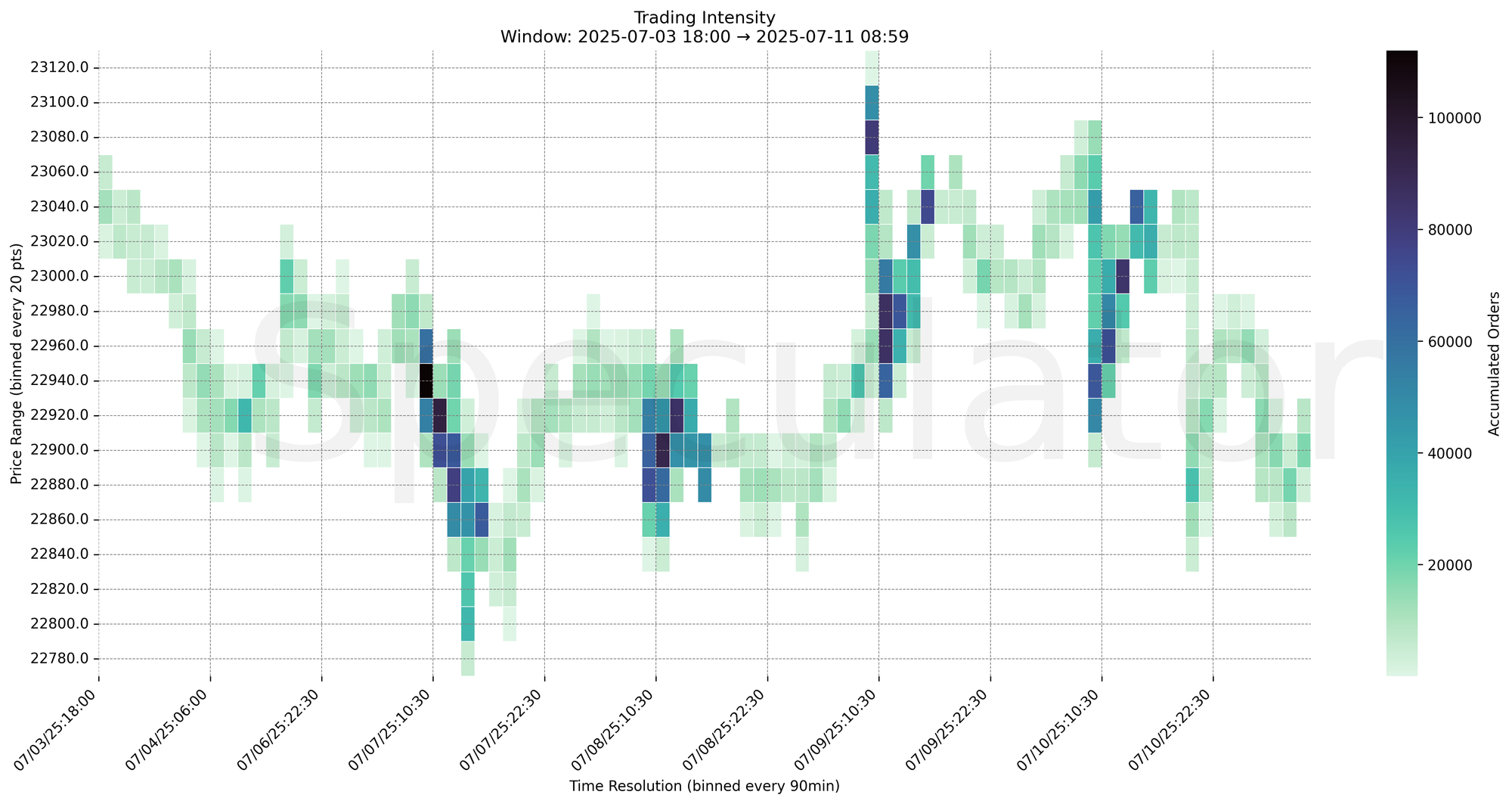

Overnight Globex saw a sharp rejection off the 23040s during the Thursday afternoon session, followed by a fast liquidation event into 22870s. This led to heavy absorption (notably 8.8k+ orders at 22880), followed by responsive buying pushing price back into 22930–22970s. Price found balance through the Tokyo and London sessions before slightly weakening near 22890s into the U.S. open.

Key inflection lies in the 22940–22970 band (multiple HVNs across timeframes).

Breakdown risk increases under 22860 as prior absorption may no longer hold.

Upside reaction zones seen near 23000–23040 supply shelf.

🔮 Friday Game Plan

📈 Base Case – Responsive Range

Open Inside 22920–22970 Zone

→ Expect fades from 23000–23040 into 22920–22890

→ Price likely oscillates around 22950 HVN

📉 Breakdown Risk

Loss of 22880 / 22860

→ Clears Demand/support

→ Exposes 22830 → 22800 → 22760 → 22720

⚠️ 22800 (1H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23040

→ Clears Supply/resistance

→ Opens path toward 23080 → 23120 → 23160 → 23200

⚠️ 23080 (90min) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22880 → 8821 @ 07/10 20:30 – Heavy absorption after liquidation; initiated responsive buying

🔹 22875 → 14239 @ 07/10 20:30 – Clustered liquidity and order resting

🔹 22930 → 4447 @ 07/10 21:15 – Responsive buyers defending prior structure

🔹 22920 → 4220 @ 07/11 03:15 – Held overnight, midpoint of consolidation range

🔹 23010 → 4425 @ 07/10 20:00 – First seller reaction following upward test

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23010, 22930, 22920, 22890, 22880, 22870 | Reactive intraday zones with heavy volume |

| 30min | 23010, 22890, 22875 | Strong reactions and clustered liquidity |

| 1H | 23040, 23000, 22960, 22940 | Key HVNs, reaction zones from yesterday’s session |

| 4H | 22950, 22900, 22875 | Multi-session clustering, potential inflection zones |

| 1D | 23000, 22900 | Composite HVNs; balance and inflection zones |

| 2D | 22950, 22050 | Long-term context and mean-reversion reference zones |

📈 Stay objective. Trade your plan with context.