NQ: At the Bell 07/14/2025

The market dipped into 22830 overnight, saw responsive demand defend the zone. Bias remains range-bound unless 22980 breaks.

Market briefing for the Monday RTH open:

📊 Nasdaq Futures Report

📆 Monday Open: July 14, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

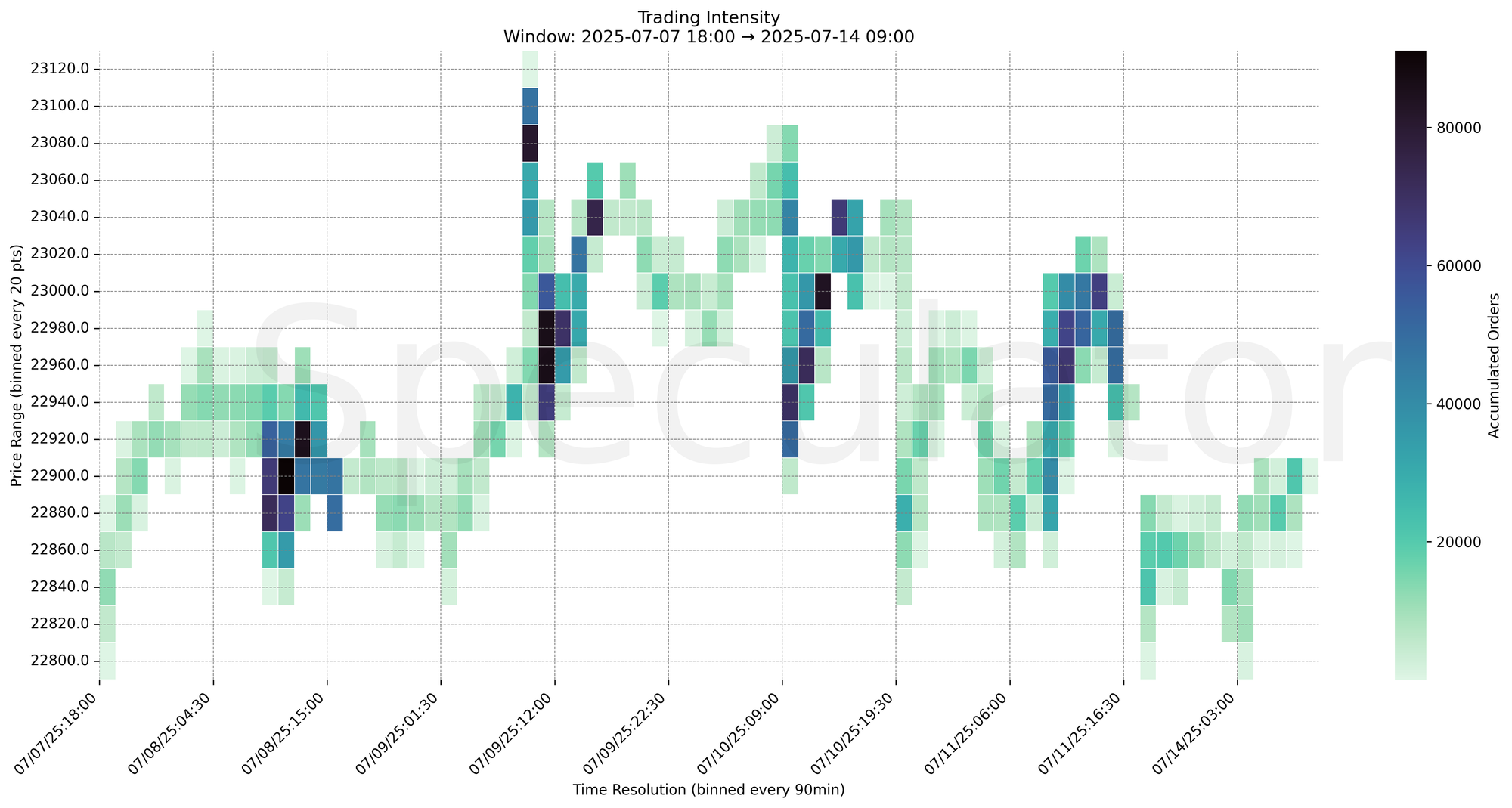

Overnight action traded lower within Friday’s lower distribution before catching responsive demand around 22820–22830. Heavy absorption was visible at 22830 early in the session, aligning with 15m and 30m clusters. There’s continued evidence of interest in the 22950–23000 range based on higher timeframe clustering and recent intensity spikes.

The session opens inside the broader 22820–22980 bracket, with intraday bias neutral to bullish above 22820 and caution warranted under this threshold.

🔑 Key bias: Range-bound unless directional volume steps in near 22980 or 22820.

🔮 Monday Game Plan

📈 Base Case – Responsive Range

Open Inside 22820–22980

→ Expect fades from 22960–22980 into 22850–22830

→ Price likely oscillates around 22900–22920 magnet zone

📉 Breakdown Risk

Loss of 22820

→ Clears Demand/support

→ Exposes 22780 → 22730 → 22650 → 22580

⚠️ 22820 (15m/30m) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22980

→ Clears Supply/resistance

→ Opens path toward 23040 → 23080 → 23120 → 23160

⚠️ 23000–23080 (1H/4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22820.0 → 4857 @ 07/14 02:00 – Responsive demand early Globex; sharp rejection of lows

🔹 22870.0 → 4998 @ 07/13 19:00 – Attempted push higher met with liquidity absorption

🔹 22840.0 → 5904 @ 07/13 18:00 – Defensive positioning builds near lower bounds

🔹 22830.0 → 5959 @ 07/13 18:00 – Major response zone tested repeatedly during early session

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22820–22880 | Local responsive buying area tested multiple times |

| 30min | 22830–22860 | Defensive cluster around session lows |

| 1H | 22960–22980 | Previous HVNs with recent intensity and reactions |

| 4H | 22950–23000 | Supply clustering; upper bound of current range |

| 1D | 22900–23000 | High-volume composite area for balance |

| 2D | 22950 | Long-term magnet and mean-reversion zone |

📈 Stay objective. Trade your plan with context.