NQ: At the Bell 07/15/2025

The market rallied through 23130–23190 overnight, fueled by CPI anticipation and strong absorption at prior support. Bias leans bullish above breakout zones

Market briefing for the Tuesday RTH open:

📊 Nasdaq Futures Report

📆 Tuesday Open: July 15, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

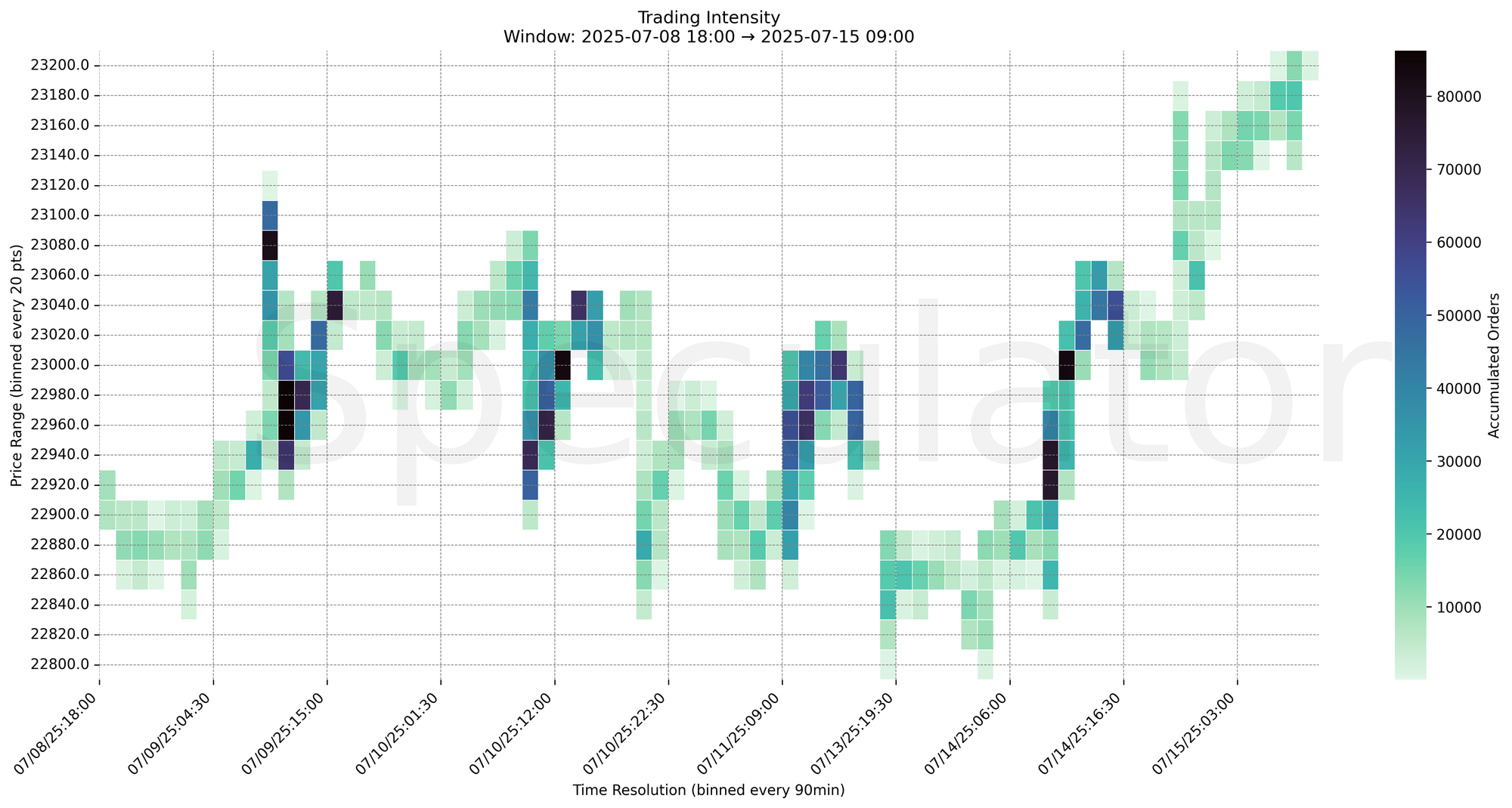

Overnight session opened with consolidation near 23000 before initiating a sharp rally post-22:00 ET with strong absorption at 23060 and 23080. The market stair-stepped higher into CPI release at 08:30 ET, pushing into the 23190–23200 zone. Pre-CPI accumulation suggested bullish intent, which was confirmed with aggressive lifting into the release.

Bias is bullish into RTH, but extended conditions near recent highs may provoke responsive selling or consolidation above breakout zones.

📌 Note: CPI is today at 08:30 AM — trade accordingly, manage risk.

🔮 Tuesday Game Plan

📈 Base Case – Responsive Range

Open Inside 23180–23200

→ Expect fades from 23200–23210 into 23150

→ Price likely oscillates around 23160 magnet zone

📉 Breakdown Risk

Loss of 23130 / 23100

→ Clears Demand/support

→ Exposes 23060 → 23000 → 22940 → 22900

⚠️ 23000 (1D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23210

→ Clears Supply/resistance

→ Opens path toward 23250 → 23300 → 23400 → 23520

⚠️ 23200 (intraday) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23190.0 → 6780 @ 07/15 08:30 – Strong CPI absorption at top of range

🔹 23160.0 → 5771 @ 07/14 21:45 – Initial breakout lift off VWAP pivot

🔹 23130.0 → 5824 @ 07/14 22:00 – Mid-zone trap / absorption before rally

🔹 23060.0 → 8811 @ 07/14 22:30 – Largest overnight accumulation, base of move

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23190, 23160, 23130, 23080, 23060 | Key CPI lift + prior base levels |

| 30min | 23190, 23175, 23055 | Pre-CPI spike + prior session range low |

| 1H | 23000, 22940, 22920 | HVNs and opening reaction clusters |

| 4H | 23050, 22975, 22950 | Demand shelf, balance zone from prior session |

| 1D | 23000, 22900 | Composite HVNs, prior support |

| 2D | 22950, 21600 | Longer-term mean reversion / accumulation base |

📈 Stay objective. Trade your plan with context.