NQ: At the Bell 07/16/2025

The market surged through 23050–23070 overnight, reacting bullishly to PPI with strong continuation. Bias: Bullish continuation with pullback risk.

Market briefing for the Wednesday RTH open:

📊 Nasdaq Futures Report

📆 Wednesday Open: July 16, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

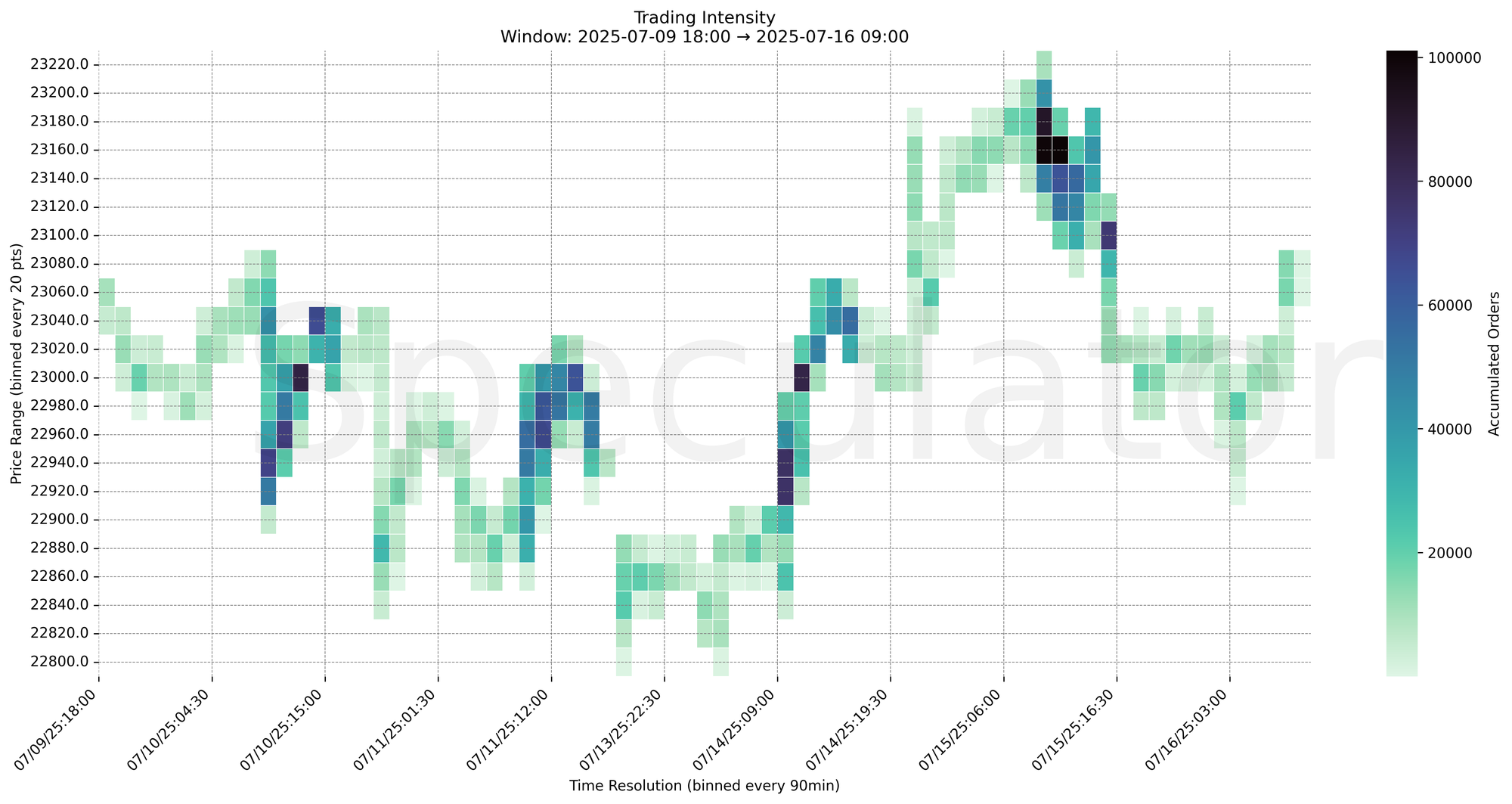

Overnight price action built a base above the 22950–22980 cluster, then rotated higher on sustained intensity into the NY open. The key thrust came during the 08:30 PPI release, where size stacked rapidly at 23050–23070, clearing resistance and extending through prior supply. This forms a potential breakout leg that may need digestion early in RTH.

Bias: Bullish continuation with pullback risk toward prior acceptance.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| PPI | 07/16/25 | 08:30 |

🔮 Wednesday Game Plan

📈 Base Case – Responsive Range

Open Inside 23050–23070 zone

→ Expect fades from 23100–23120 into 23050

→ Price likely oscillates around 23060–23070 magnet zone

📉 Breakdown Risk

Loss of 23000–22980

→ Clears Demand/support

→ Exposes 22960 → 22940 → 22920 → 22900

⚠️ 22900 (1D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23120

→ Clears Supply/resistance

→ Opens path toward 23140 → 23160 → 23175 → 23180

⚠️ 23175 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23070 → 8672 @ 07/16 08:30 – Heavy absorption as price cleared resistance

🔹 23060 → 9326 @ 07/16 08:30 – Continuation buying on PPI release

🔹 23050 → 4417 @ 07/16 08:30 – Initial reaction buy zone before launch

🔹 22950 → 4300 @ 07/16 03:00 – Globex support held during low liquidity hours

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22950, 22990, 23050–23070 | Short-term reaction levels and morning breakout prints |

| 30min | 22980, 23055–23070 | Demand shelf and recent intensity |

| 1H | 23100, 23140, 23160, 23180 | Higher timeframe offers and absorption zones |

| 4H | 22975, 23050, 23150, 23175 | Key structural inflection zones |

| 1D | 22900, 23000 | Composite demand clusters |

| 2D | 22950 | Macro reversion zone |

📈 Stay objective. Trade your plan with context.