NQ: At the Bell 07/18/2025

07/18/2025: The market tested 23290 overnight and rejected, rotating into 23260 support on econ prints. Neutral-to-bearish bias into RTH unless buyers reclaim highs.

Market briefing for the Friday RTH open:

📊 Nasdaq Futures Report

📆 Friday Open: July 18, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

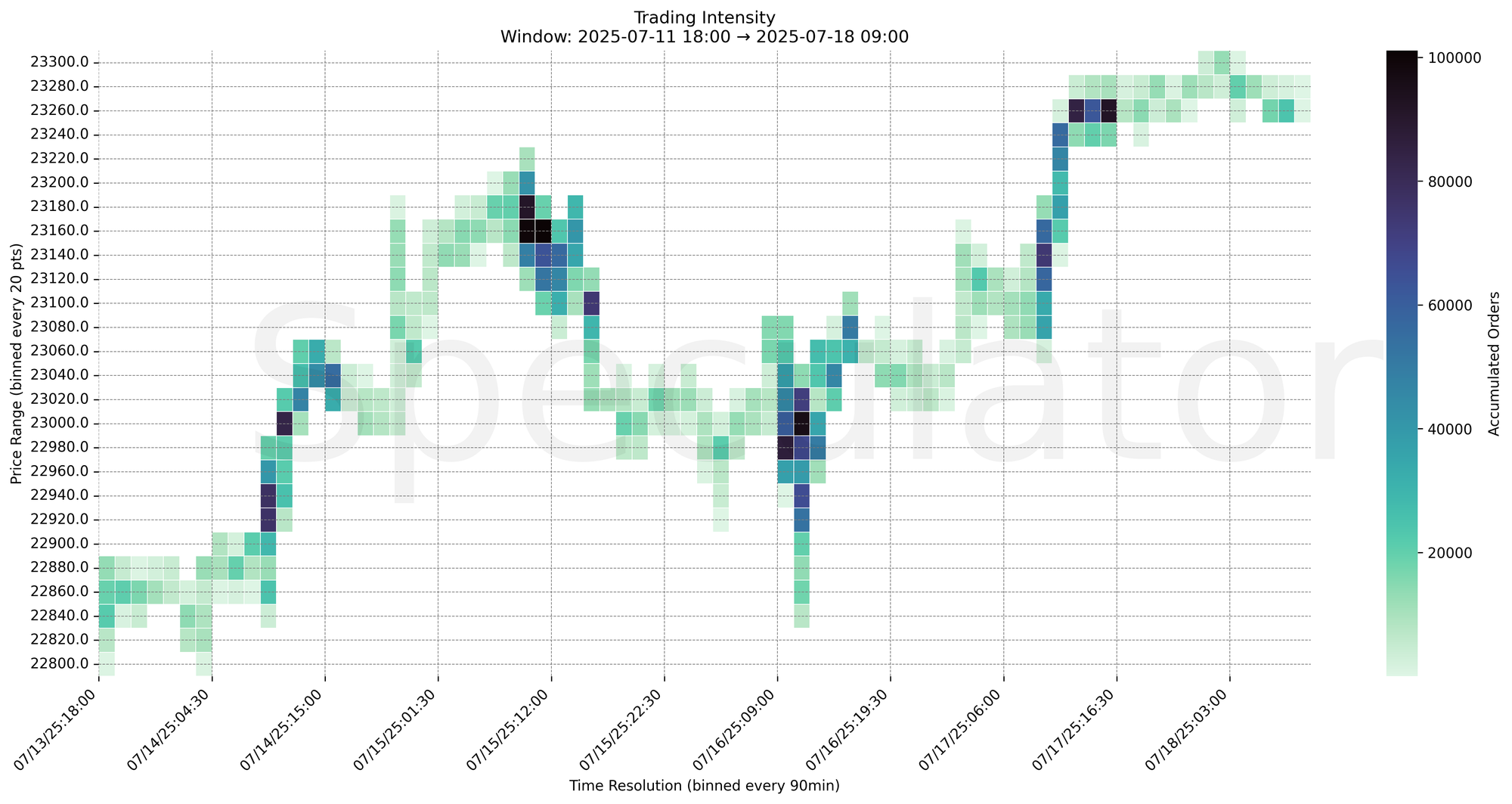

🔍 Narrative Summary

Overnight Globex auction held a tight 40-point range between 23250–23290, with trading intensity clustered at 23260 near the 08:30 AM red folder print. Price defended 23250 demand throughout Asia and Europe, rotating back toward 23280–23290 supply before softening into the U.S. open. Notably, the most intense cluster of the session hit 5051 orders at 23260 during the 08:30 econ release, forming a short-term control zone. Price has rejected both upside continuation and downside breakdown so far, indicating compression.

🧭 Bias: Neutral-to-bearish into RTH unless buyers reclaim and hold above 23290.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Housing Starts | 07/18/2025 | 08:30 |

| Building Permits | 07/18/2025 | 08:30 |

| Michigan Consumer Sentiment | 07/18/2025 | 10:00 |

🔮 Friday Game Plan

📈 Base Case – Responsive Range

Open Inside 23250–23290 zone

→ Expect responsive fades from 23290–23300 into 23250–23260 control

→ Price likely oscillates around 23260–23265 magnet zone

📉 Breakdown Risk

Loss of 23250

→ Clears Demand/support

→ Exposes 23220 → 23180 → 23150 → 23120

⚠️ 23150 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23290

→ Clears Supply/resistance

→ Opens path toward 23310 → 23340 → 23380 → 23420

⚠️ 23300+ (no clear cluster) = Thin zone, potential air pocket above

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23260 → 5051 @ 07/18 08:30 – High-intensity spike on Housing/Permits print, short-term control zone

🔹 23260 → 3834 @ 07/18 06:15 – Prior session high-volume shelf, early support

🔹 23280 → 3607 @ 07/17 19:45 – Asia session resistance zone, rejected multiple times

🔹 23250 → 3615 @ 07/17 18:00 – Globex session base, initial demand entry

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23250, 23280, 23260 | Short-term responsive levels around econ data prints |

| 30min | 23265 | Micro composite balance near session POC |

| 1H | 23160, 23240, 23260 | HVNs and balance clusters from prior session |

| 4H | 23150, 23175, 23250 | Shelf of demand from earlier week, key structural hold |

| 1D | 22900, 23000 | Macro demand zone from last week |

| 2D | 22950 | Long-term support shelf, potential mean reversion zone |

📈 Stay objective. Trade your plan with context.