NQ: At the Bell 07/21/2025

07/21/2025: The market tested supply near 23310 overnight, then rejected back to 23240. Neutral to bearish bias unless 23310 is reclaimed.

Market briefing for the Monday RTH open:

📊 Nasdaq Futures Report

📆 Monday Open: July 21, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

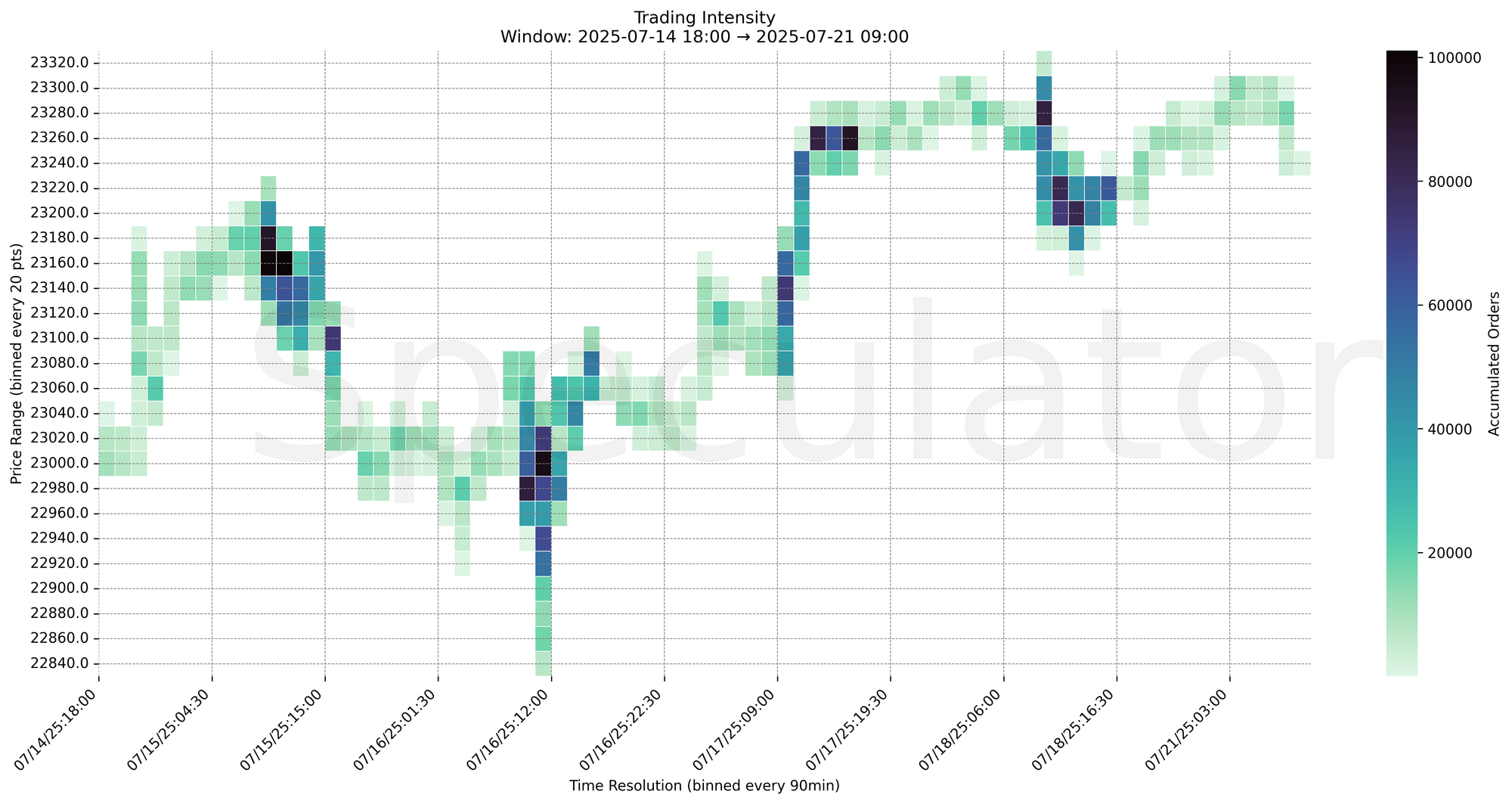

🔍 Narrative Summary

Overnight trade climbed steadily from the 23220 zone toward a peak near 23310 before pulling back sharply just before the RTH open. Key supply engagement printed near 23300–23310, followed by aggressive liquidation back toward 23240.

The initial response at 23220 (prior demand cluster) was strong, and buyers managed to squeeze above Friday’s highs before losing momentum.

Bias into the session is neutral to bearish unless buyers reclaim 23290–23310 with conviction.

📌 Note: No Red Folder Events today

🔮 Monday Game Plan

📈 Base Case – Responsive Range

Open Inside 23240–23290

→ Expect fades from 23290–23310 into 23240

→ Price likely oscillates around 23260–23280 (magnet zone)

📉 Breakdown Risk

Loss of 23220 / 23200

→ Clears Demand/support

→ Exposes 23160 → 23120 → 23060 → 23000

⚠️ 23000 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23310

→ Clears Supply/resistance

→ Opens path toward 23340 → 23375 → 23420 → 23480

⚠️ 23375 (proj) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23300 → 5156 @ 07/21 04:00 – Heavy supply response at overnight highs

🔹 23290 → 3643 @ 07/21 04:15 – Absorption after high print, exhaustion evident

🔹 23240 → 3155 @ 07/20 18:30 – Initial lift zone for buyers

🔹 23220 → 5534 @ 07/20 18:00 – First significant cluster, demand-driven move initiated

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23220, 23240, 23300, 23290 | Minor reaction zones and intraday liquidity pivots |

| 30min | 23220, 23295 | Consolidation shelf and upper fade zone |

| 1H | 23280, 23220, 23200 | HVNs and intraday inflection supports |

| 4H | 23000, 23250, 23200 | Supply/resistance clustering and trend inflection |

| 1D | 22900, 23000 | Composite supports near last week's lows |

| 2D | 22950 | Longer-term mean-reversion anchor zone |

📈 Stay objective. Trade your plan with context.