NQ: At the Bell 07/25/2025

The market auctioned down into 23340–23350 overnight, with responsive buyers reengaging below 23330. Bias: upward skew if 23310 holds.

Market briefing for the Friday RTH open:

📊 Nasdaq Futures Report

📆 Friday Open: July 25, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

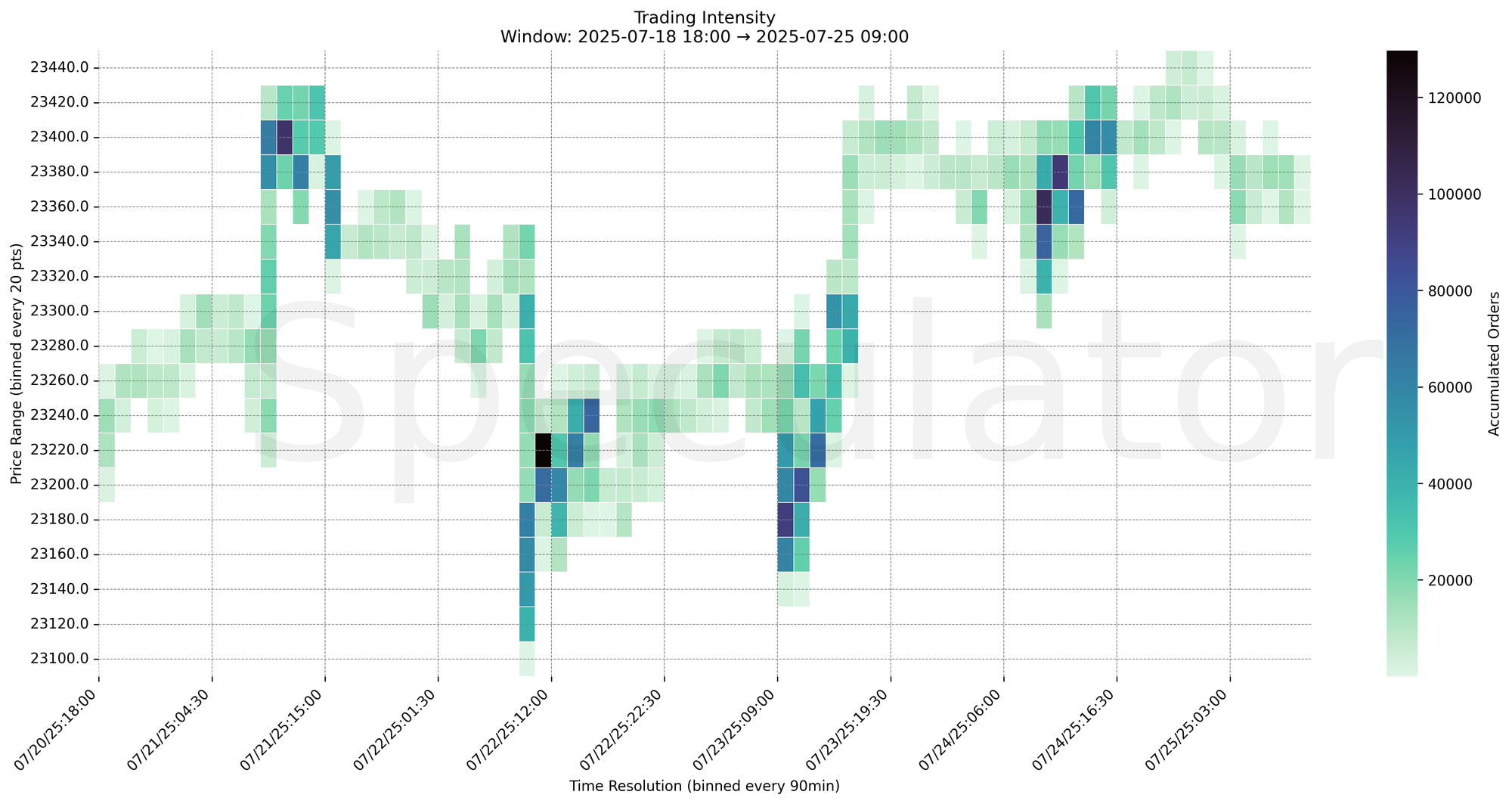

🔍 Narrative Summary

The overnight Globex session saw a downward auction from 23420 into the 23340–23350 demand shelf, with notable absorption in the 23310–23330 range. Multiple intensity prints accumulated during the 04:00 to 05:00 window, suggesting buyer interest returning below 23330. This pullback sits within a broader 4H structure where 23350–23375 has acted as a responsive zone. Durable Goods data at 08:30 injected a burst of activity, briefly spiking into 23380 before retracing.

Bias into the open: responsive with upward skew if 23310 holds.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Durable Goods | 07/25/2025 | 08:30 |

🔮 Friday Game Plan

📈 Base Case – Responsive Range

Open Inside 23340–23380 (4H shelf)

→ Expect fades from 23380–23400 into 23340–23350

→ Price likely oscillates around 23360 magnet zone

📉 Breakdown Risk

Loss of 23310–23320

→ Clears Demand/support

→ Exposes 23260 → 23220 → 23180 → 23120

⚠️ 23180 (90m) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23400

→ Clears Supply/resistance

→ Opens path toward 23430 → 23470 → 23500 → 23540

⚠️ 23400 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23380 → 4186 @ 07/25 08:30 – Durable Goods reaction spike

🔹 23370 → 4877 @ 07/25 04:00 – Intense buying pressure on pullback

🔹 23360 → 4348 @ 07/25 03:45 – Continued absorption near demand shelf

🔹 23370 → 4118 @ 07/25 03:30 – Cluster forms prior to Europe session

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23360–23380 | Microstructural fade and Durable Goods spike |

| 30min | 23370–23385 | Stacked prints during Europe/early U.S. session |

| 1H | 23340–23380 | Rejection zone from Thursday session |

| 4H | 23350–23375 | Structural demand shelf on pullback |

| 1D | 22900–23000 | Long-term macro demand composite zone |

| 2D | 22950 | Mean-reversion anchor within July's range |

📈 Stay objective. Trade your plan with context.