NQ: At the Bell 08/05/2025

The market tested 23320 overnight, bounced to 23400, showing balanced-to-bullish tone into RTH. Key watch: 23320 demand vs 23400 supply.

Market briefing for the Tuesday RTH open:

📊 Nasdaq Futures Report

📆 Tuesday Open: August 05, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

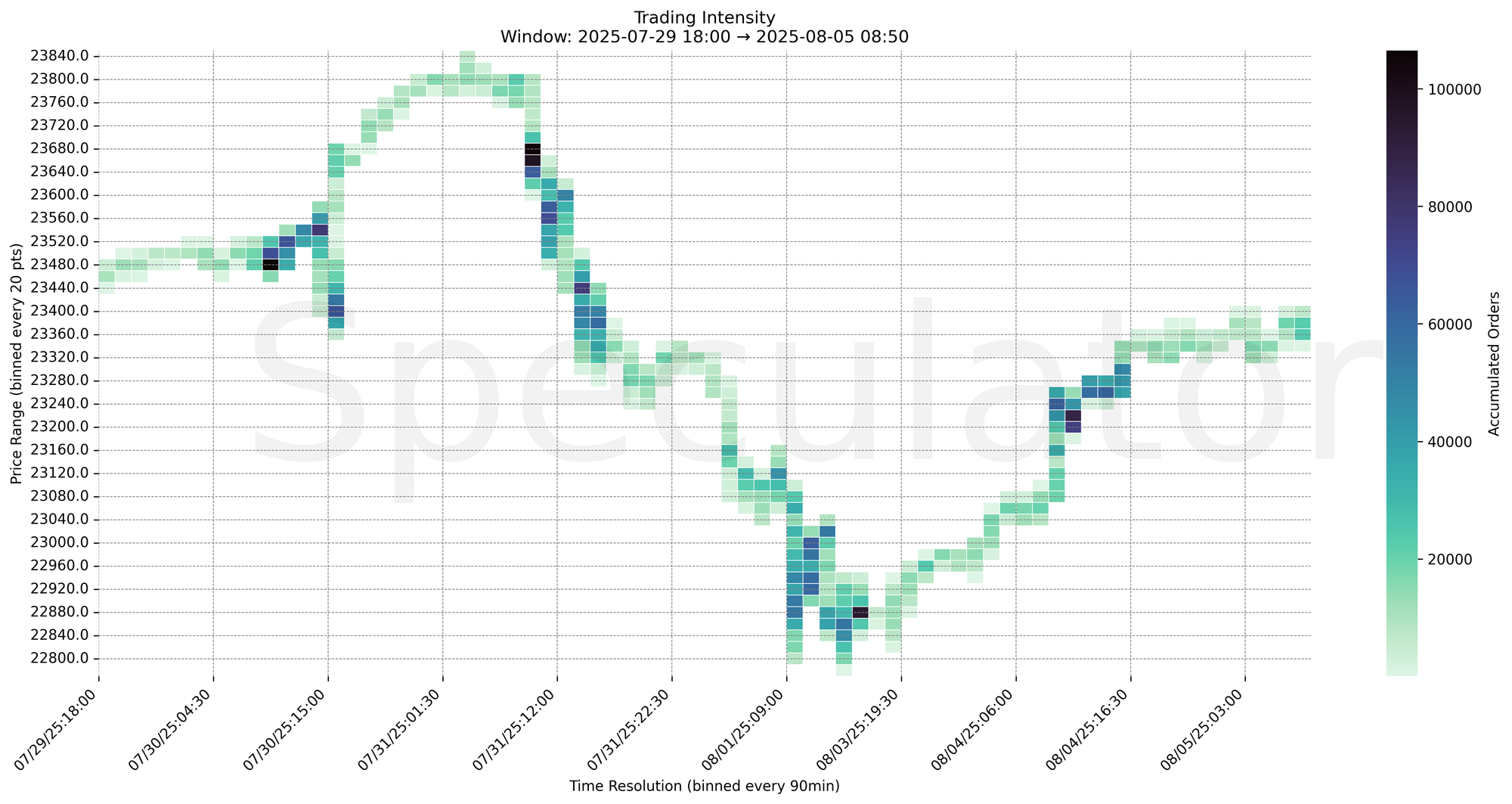

🔍 Narrative Summary

Overnight trade was two-sided but leaned bullish after an early pullback found support near 23320. Price built a dense cluster between 23340–23370 before driving higher into the 23380–23400 zone. Several pockets of concentrated order flow suggest absorption overhead, keeping upside progress measured.

Key zones to watch include 23320–23340 as intraday demand and 23380–23400 as the first supply layer. A sustained push above 23400 would likely target higher swing zones, but failure to hold above 23340 risks returning to yesterday’s mid-structure.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| PMI | 08/05/2025 | 09:45 |

| ISM | 08/05/2025 | 10:00 |

🔮 Tuesday Game Plan

📈 Base Case – Responsive Range

Open Inside 23340–23380

→ Expect fades from 23380–23400 into 23340–23320

→ Price likely oscillates around 23360 as a magnet zone

📉 Breakdown Risk

Loss of 23320

→ Clears Demand/support

→ Exposes 23275 → 23225 → 23200 → 23000

⚠️ 23275 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23400

→ Clears Supply/resistance

→ Opens path toward 23475 → 23500 → 23550 → 23675

⚠️ 23550 (2D) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23360 → 8,213 @ 08/05 08:15 – Heavy buy-side clustering ahead of RTH open

🔹 23370 → 6,546 @ 08/05 08:15 – Resistance build just under 23400 handle

🔹 23320 → 3,969 @ 08/05 04:00 – Buyers defending early Globex dip

🔹 23350 → 4,109 @ 08/05 03:30 – Absorption in mid-structure

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23340 / 23350 / 23320 / 23370 / 23360 | Globex balance & RTH test zones |

| 30min | 23340 / 23325 / 23370 | Short-term balance with overhead resistance |

| 1H | 23240 / 23220 / 23200 / 23260 | Prior session structural demand |

| 4H | 23675 / 23400 / 22875 / 23225 / 23275 | Supply/demand shelves |

| 1D | 23000 / 23200 / 23500 | Macro composite balance |

| 2D | 21600 / 22050 / 22950 / 23550 | Long-term structural pivots |

📈 Stay objective. Trade your plan with context.