NQ: At the Bell 08/06/2025

The market probed 23190 overnight before fading into 23160 support. Bias cautiously bullish above 23140, breakdown risk below.

Market briefing for the Wednesday RTH open:

📊 Nasdaq Futures Report

📆 Wednesday Open: August 06, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

Overnight trade saw price extend higher into 23190 before fading back toward 23140–23160. The Globex session was defined by a responsive range, with heavy order prints clustering at 23160 and 23170. These levels remain near-term magnets. A late-session pullback tested prior demand and attracted strong buying interest.

The prior day bias was mixed-to-bullish with higher timeframe resistance overhead. Today’s projected bias is cautiously bullish while above 23140, but failure to hold 23160 could trigger a downside test toward 23080.

No Red Folder Economic Events today.

🔮 Wednesday Game Plan

📈 Base Case – Responsive Range

Open Inside 23140–23190

→ Expect fades from 23190 into 23160

→ Price likely oscillates around 23160 magnet zone

📉 Breakdown Risk

Loss of 23140

→ Clears Demand/support

→ Exposes 23120 → 23080 → 23050 → 23020

⚠️ 23080 (1H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23190

→ Clears Supply/resistance

→ Opens path toward 23220 → 23260 → 23300 → 23340

⚠️ 23260 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

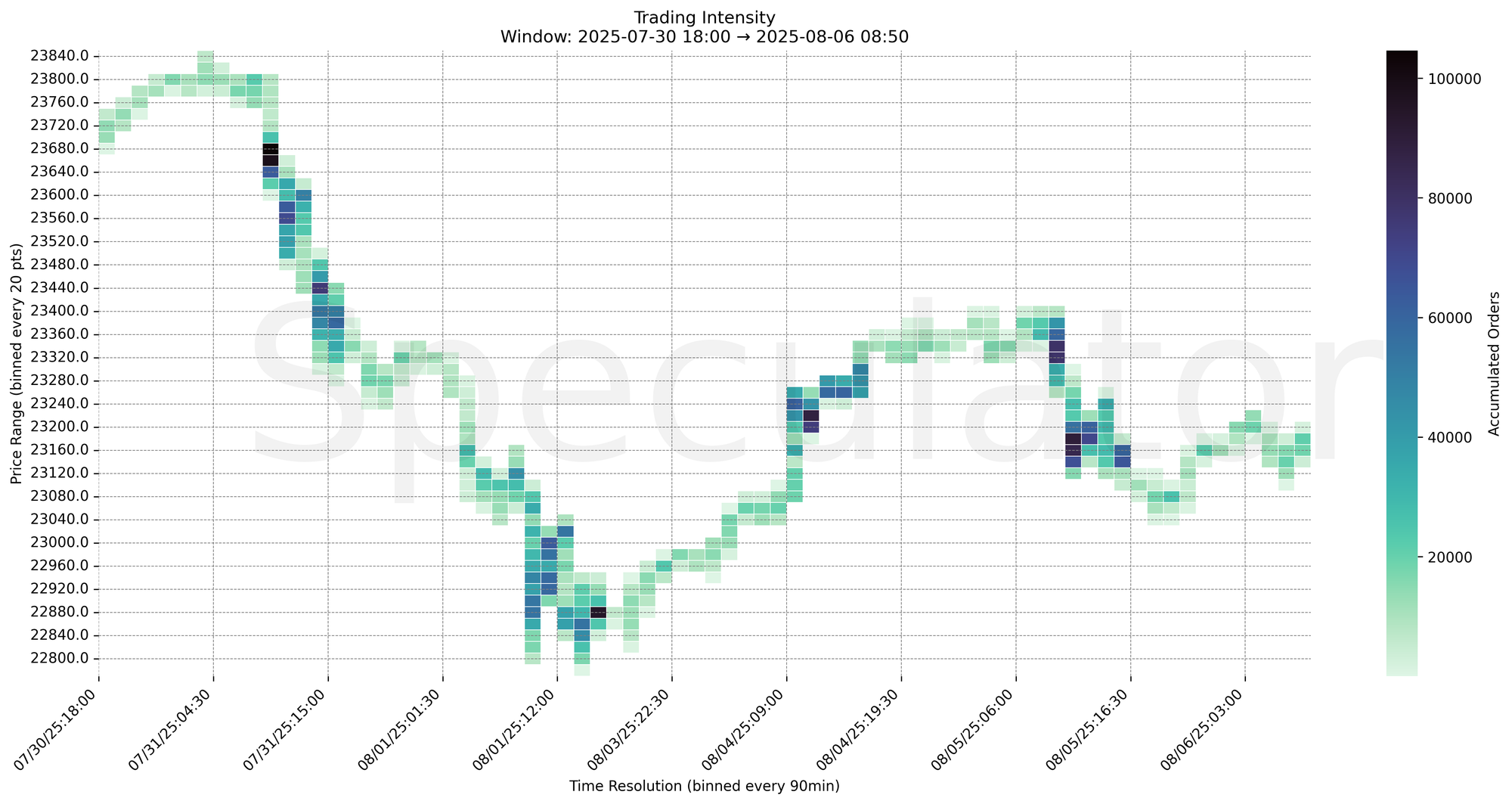

🧊 Key Heatmap Observations

🔹 23190 → 4549 @ 08/06 07:30 – Globex high print before fade

🔹 23170 → 4122 @ 08/06 07:15 – Heavy sell response capping advance

🔹 23160 → 5624 @ 08/06 07:00 – Strong absorption near key pivot

🔹 23160 → 5863 @ 08/05 22:30 – Prior evening high-volume defense

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23160, 23170, 23190 | Short-term battle zones |

| 30min | 23160 | Dominant intraday pivot |

| 1H | 23360, 23340, 23160 | Higher timeframe resistance & key pivot |

| 4H | 22925, 22875, 23225, 23275, 23150 | Major supply & demand shelves |

| 1D | 23000, 23200, 23500 | Composite structure levels |

| 2D | 21600, 22050, 22950, 23550 | Longer-term demand/supply context |

📈 Stay objective. Trade your plan with context.