NQ: At the Bell 08/07/2025

The market climbed into 23640 overnight, absorbing offers at highs. Upward bias continues with 23520–23620 key for support. Breakout above 23640 opens higher targets.

Market briefing for the Thursday RTH open:

📊 Nasdaq Futures Report

📆 Thursday Open: August 07, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

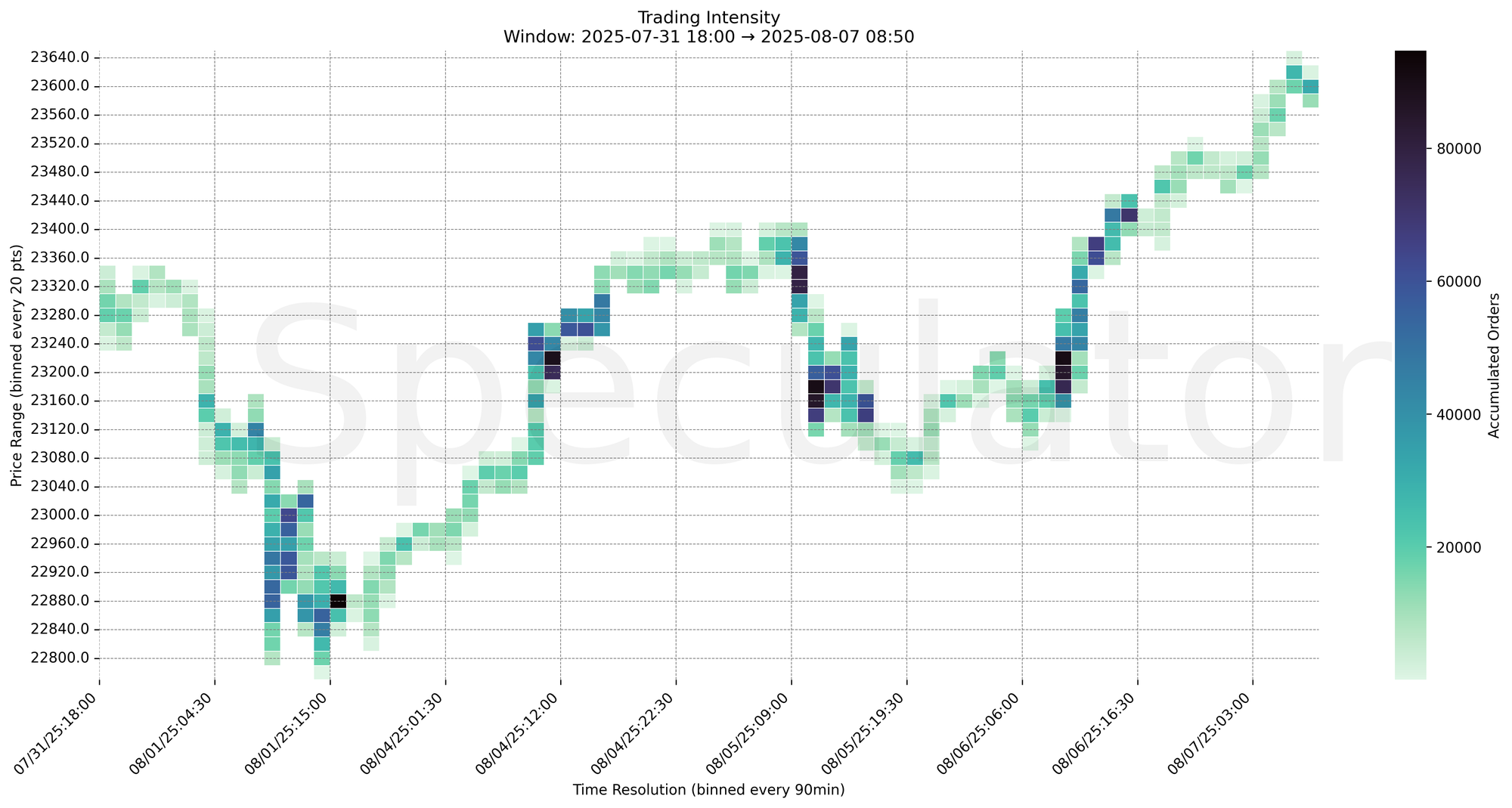

Wednesday’s session maintained upward pressure, continuing the rebound off Tuesday’s lows. Globex held steady with a grind higher, eventually pushing toward new local highs near 23640. Key buying pressure was observed building from 23470 up to 23620, as seen in the latest intensity chart.

Responsive demand was noted near 23420 during the prior day, providing a strong foundation for the late-session rally. Globex built value above 23500, absorbing offers and building a shelf near 23600–23620. If buyers can defend this zone post-open, momentum continuation is in play.

The upward bias remains intact for today with support well-established below and no major rejection at highs. Watch for absorption or failure around 23640 for clues.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Jobless Claims | 08/07/2025 | 08:30 |

🔮 Thursday Game Plan

📈 Base Case – Responsive Range

Open Inside 23520–23620

→ Expect fades from 23640 into 23550–23520

→ Price likely oscillates around 23550 as a magnet zone

📉 Breakdown Risk

Loss of 23500–23490

→ Clears Demand/support

→ Exposes 23420 → 23375 → 23320 → 23200

⚠️ 23320 (1H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23640

→ Clears Supply/resistance

→ Opens path toward 23680 → 23740 → 23800 → 23900

⚠️ 23640 (local) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23600 → 7875 @ 08/07 08:30 – Absorption and continuation at top of range

🔹 23610 → 6238 @ 08/07 06:00 – Initiated breakout above prior range

🔹 23490 → 4835 @ 08/06 20:30 – Support held on minor pullback

🔹 23470 → 4996 @ 08/06 18:30 – Initial launch point for Globex rally

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23470, 23490, 23600, 23610, 23620 | Globex rally staging and absorption points |

| 30min | 23595, 23610 | Volume shelves from overnight value |

| 1H | 23200, 23220, 23240, 23420 | Prior RTH demand shelves and reaction levels |

| 4H | 23150, 23225, 23275, 23375 | Trend demand shelf and prior resistance |

| 1D | 23000, 23200, 23500 | Long-term composite and structural zones |

| 2D | 22950, 23550 | Higher timeframe supply/support band |

📈 Stay objective. Trade your plan with context.