NQ: At the Bell 08/08/2025

The market defended 23530 overnight, holding firm above breakout support. Bias remains bullish with breakout watch above 23600.

Market briefing for the Friday RTH open:

📊 Nasdaq Futures Report

📆 Friday Open: August 08, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

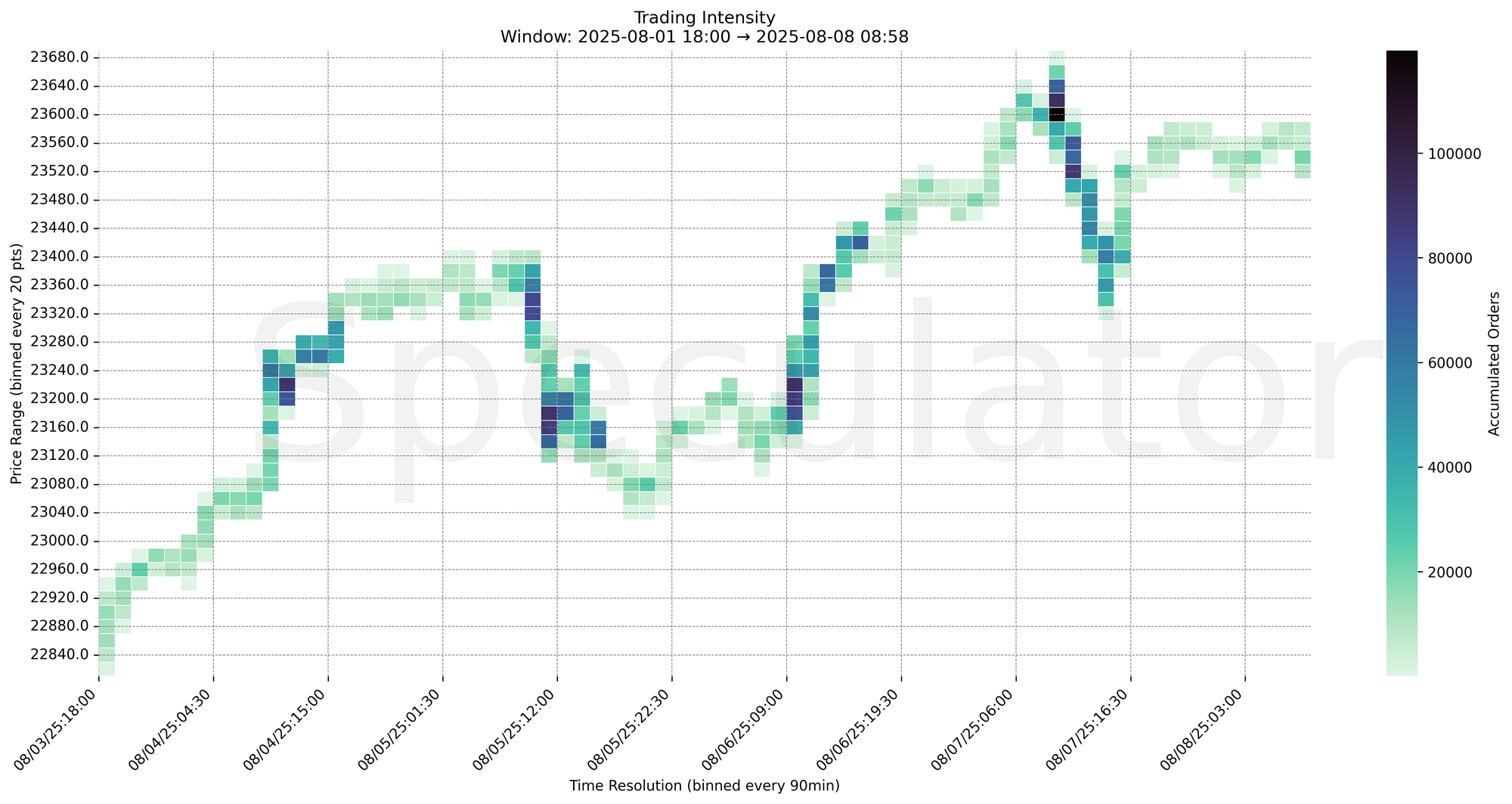

Thursday’s bullish continuation carried into the overnight Globex session, with price finding responsive demand beneath 23500. Notably, intense order flow printed at 23535 and 23530 prior to RTH, showing buyers actively defending the area after a shallow pullback. Overnight structure was balanced, holding above yesterday’s breakout zone.

The key magnet zone remains 23500–23560. A break below could pressure demand pockets near 23400 and 23320, while acceptance above 23560 may reopen the path toward the 23600–23620 cluster.

Bias remains bullish, but responsive selling may cap upside if volume fails to sustain above 23600.

No Red Folder Economic Events today.

🔮 Friday Game Plan

📈 Base Case – Responsive Range

Open Inside 23500–23560 zone

→ Expect fades from 23560/23600 into 23500

→ Price likely oscillates around 23530–23540 magnet zone

📉 Breakdown Risk

Loss of 23500

→ Clears Demand/support

→ Exposes 23400 → 23320 → 23200 → 23175

⚠️ 23375 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23600

→ Clears Supply/resistance

→ Opens path toward 23620 → 23700 → 23840 → 23900

⚠️ 23600 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23540 → 4280 @ 08/08 08:45 – Late Globex absorption near top of range

🔹 23530 → 4725 @ 08/08 08:30 – Strong defense of key level, continuation setup

🔹 23535 → 10793 @ 08/08 08:30 – Heavy accumulation during price balance

🔹 23535 → 8345 @ 08/08 08:00 – Front-run liquidity sweep before bounce

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23520–23540 | Globex response zone, buyer interest near highs |

| 30min | 23535–23550 | Consolidation zone pre-RTH |

| 1H | 23520–23620 | Prior day breakout area and continuation cluster |

| 4H | 23400–23600 | Major structural zone, both supply and demand clusters |

| 1D | 23000–23500 | Composite structure and support platform |

| 2D | 22950–23550 | Macro continuation zone, last pivot prior to breakout |

📈 Stay objective. Trade your plan with context.