NQ: At the Bell 08/12/2025

The market broke above 23800 overnight on CPI, holding gains into the open. Bias bullish, but watch for responsive selling near highs.

Market briefing for the Tuesday RTH open:

📊 Nasdaq Futures Report

📆 Tuesday Open: August 12, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

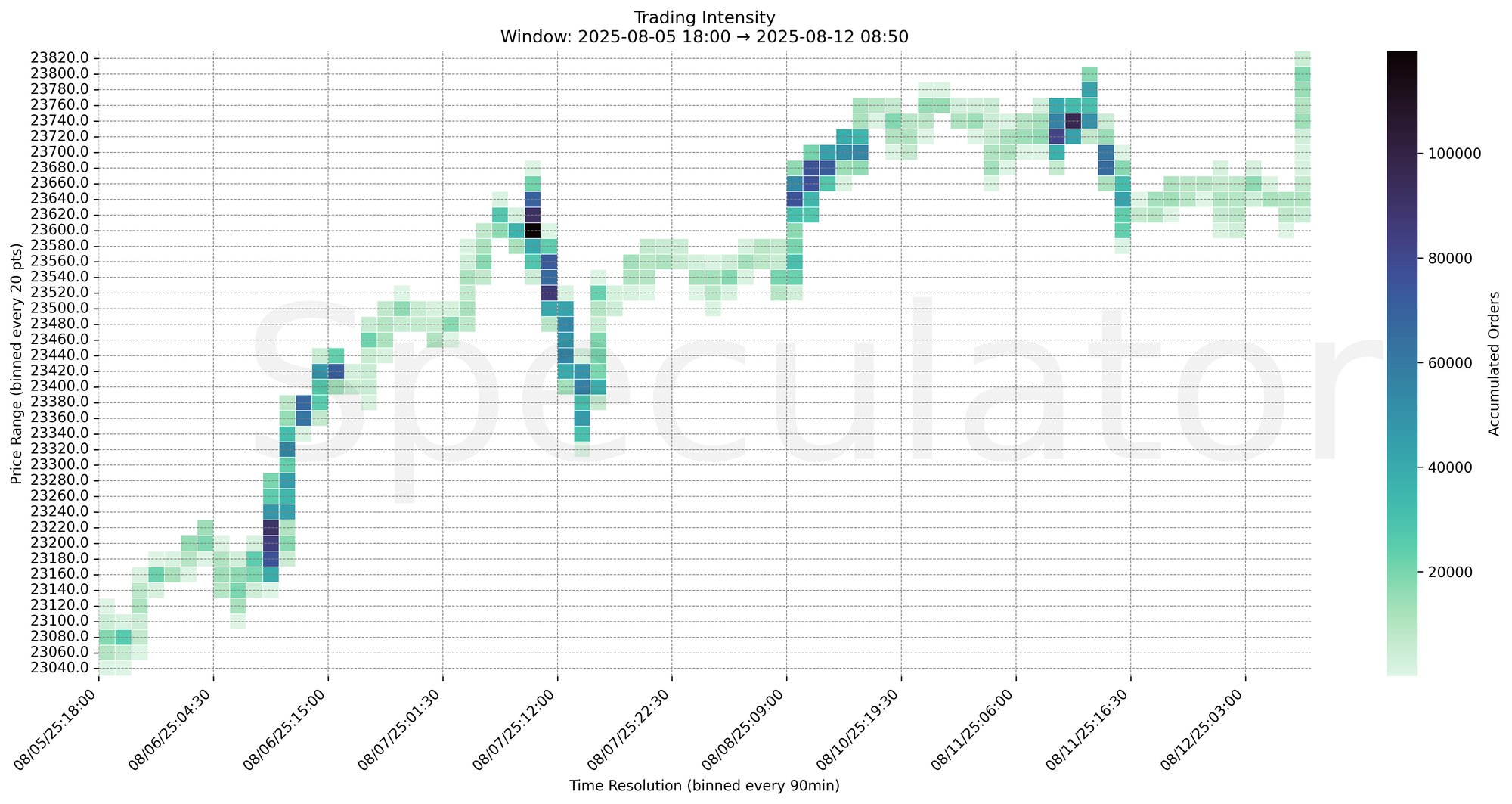

🔍 Narrative Summary

Overnight trade in Nasdaq futures was range-bound early, consolidating between 23660 and 23760 before a sharp CPI-driven breakout above 23800. The strongest order intensity was concentrated between 23740 and 23810, signaling active participation into the morning. Prior day bias was balanced-to-bullish with higher timeframe support holding firm; Globex bias shifted bullish after CPI print. Today's session opens with upward momentum, but extended prices near resistance suggest risk of responsive selling into lower HVNs before any sustained breakout attempt.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| CPI | 08/12/2025 | 08:30 |

🔮 Tuesday Game Plan

📈 Base Case – Responsive Range

Open Inside 23750–23810

→ Expect fades from 23810 into 23750–23720 zone

→ Price likely oscillates around 23750 HVN magnet zone

📉 Breakdown Risk

Loss of 23720

→ Clears Demand/support

→ Exposes 23680 → 23620 → 23550 → 23500 downside ladder

⚠️ 23620 (90m) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23810

→ Clears Supply/resistance

→ Opens path toward 23840 → 23900 → 23950 → 24020 upside ladder

⚠️ 23840 (15m) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23810 → 5,044 @ 08/12 08:30 – CPI spike, strong upside continuation

🔹 23800 → 8,037 @ 08/12 08:30 – Breakout acceptance bid

🔹 23790 → 7,569 @ 08/12 08:30 – Accumulation just prior to breakout

🔹 23750 → 9,096 @ 08/12 08:30 – Key HVN support zone

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23810, 23800, 23790, 23780, 23750, 23740 | CPI breakout and immediate reaction levels |

| 30min | 23805, 23790, 23745 | Short-term breakout and pullback reference points |

| 1H | 23720, 23760, 23740, 23680 | HVNs and demand zones from prior RTH session |

| 4H | 23600, 23700, 23750, 23725 | Higher timeframe supply/demand balance points |

| 1D | 23200, 23400, 23500 | Composite demand shelf from recent swing lows |

| 2D | 21600, 22050, 22950, 23550 | Long-term demand/support structure |

📈 Stay objective. Trade your plan with context.