NQ: At the Bell 08/13/2025

The market pushed into 24020 overnight, holding 23950 support. Bias leans bullish into the open unless 23950 fails.

Market briefing for the Wednesday RTH open:

📊 Nasdaq Futures Report

📆 Wednesday Open: August 13, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

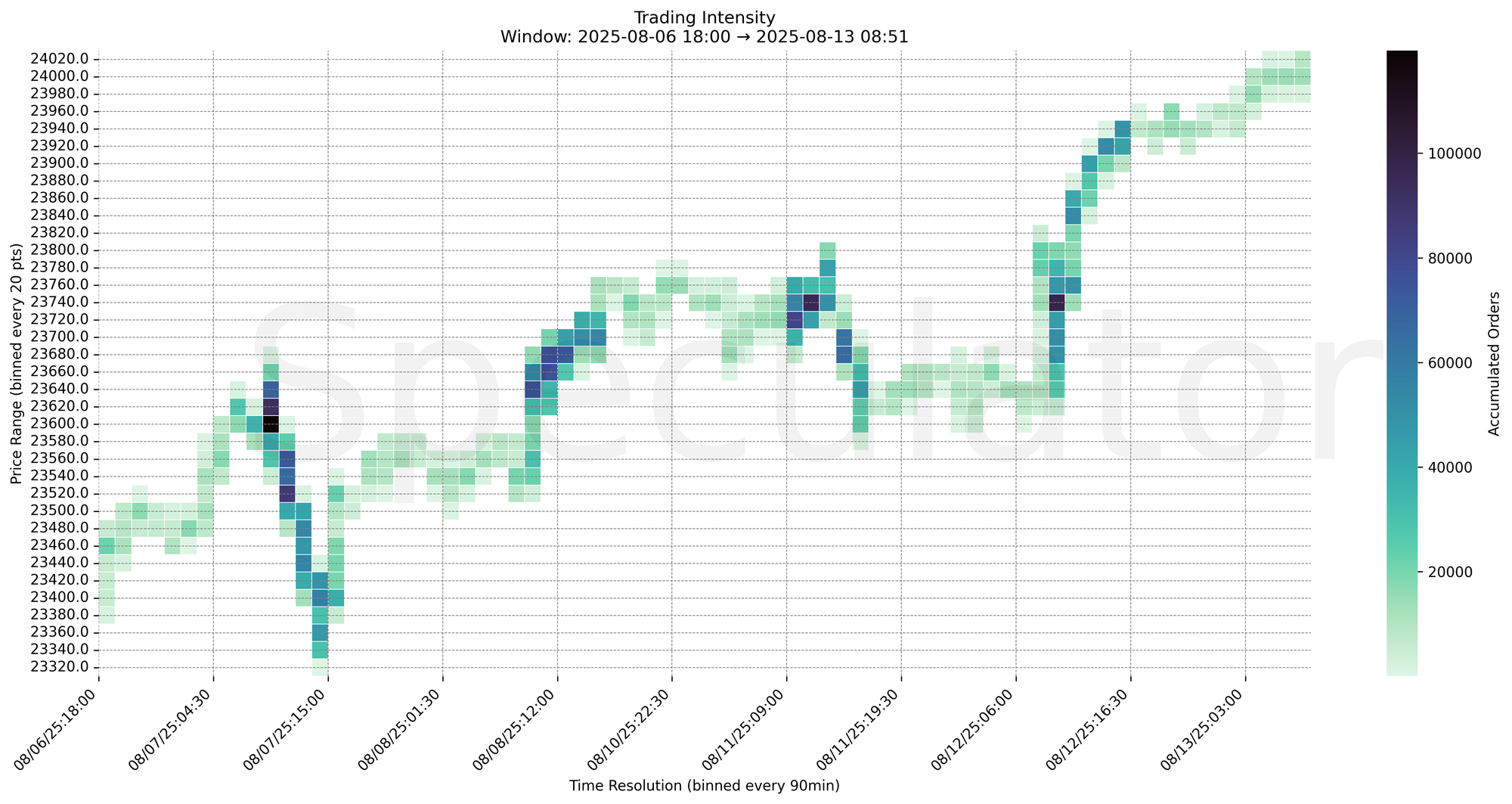

Overnight trade extended the prior day’s late-session rally, lifting from the 23920s toward a 24020 high print into the European session. Order flow showed sustained bid absorption and continued accumulation above 23960, with repeated defenses of the 23930–23940 zone acting as intraday demand.

Key resistance now sits at 24020–24030, where high-intensity prints registered just before the RTH open. Above this, buyers could quickly target new highs given the thin liquidity overhead.

Failure to hold 23950 would expose a rotation back into the prior consolidation base near 23920.

Bias remains moderately bullish into the open, with the path of least resistance still upward unless 23950 fails.

No Red Folder Events today.

🔮 Wednesday Game Plan

📈 Base Case – Responsive Range

Open Inside 23950–24020

→ Expect fades from 24020 into 23960–23970

→ Price likely oscillates around 23960 magnet zone

📉 Breakdown Risk

Loss of 23950

→ Clears Demand/support

→ Exposes 23920 → 23880 → 23840 → 23780

⚠️ 23840 (1H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 24020

→ Clears Supply/resistance

→ Opens path toward 24050 → 24080 → 24120 → 24160

⚠️ 24080 (Intraday) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 24020 → 5,203 @ 08/13 08:30 – Heavy buy-side absorption at morning high print

🔹 23960 → 4,265 @ 08/12 19:45 – Early session resistance turned support overnight

🔹 23955 → 8,322 @ 08/12 20:00 – Large rotation pivot level during Globex

🔹 23740 → 98,467 @ 08/12 09:00 – Higher timeframe demand test holding

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23960, 23950, 24020 | Short-term resistance and demand flips |

| 30min | 23955, 24000 | Key rotational pivot and round number magnet |

| 1H | 23740, 23760, 23840 | HVNs, higher timeframe reaction zones |

| 4H | 23700, 23725, 23750 | Demand shelf and consolidation base |

| 1D | 23200, 23400, 23500 | Macro composite levels |

| 2D | 21600, 22050, 22950 | Long-term mean-reversion and structural inflection |

📈 Stay objective. Trade your plan with context.