NQ: At the Bell 08/15/2025

The market balanced near 23,900 overnight, fading from 23,925 supply into 23,880 demand. Slight bearish bias into RTH unless 23,940 is reclaimed.

Market briefing for the Friday RTH open:

📊 Nasdaq Futures Report

📆 Friday Open: August 15, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

Overnight trade maintained a balanced structure with rotations centered near 23,900–23,910, matching heavy volume clusters across 15m and 30m profiles. The prior session’s bias leaned slightly bullish, but upside momentum stalled at 23,925–23,940 where 4H and daily supply aligned. Early Globex saw responsive selling from this zone, pressing back toward the 23,880 demand shelf. Today's session opens with a neutral-to-slightly-bearish lean unless buyers reclaim 23,925 with acceptance.

📌 Note: Today is Opex

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Retail Sales | 08/15/25 | 08:30 |

| NY Manufacturing Index | 08/15/25 | 08:30 |

| Michigan Consumer Sentiment | 08/15/25 | 10:00 |

🔮 Friday Game Plan

📈 Base Case – Responsive Range

Open Inside 23,880–23,925 zone

→ Expect fades from 23,925–23,940 into 23,880–23,900

→ Price likely oscillates around 23,900 magnet zone

📉 Breakdown Risk

Loss of 23,880

→ Clears Demand/support

→ Exposes 23,860 → 23,840 → 23,800 → 23,760

⚠️ 23,760 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23,940

→ Clears Supply/resistance

→ Opens path toward 23,960 → 24,000 → 24,040 → 24,080

⚠️ 24,040 (90m) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

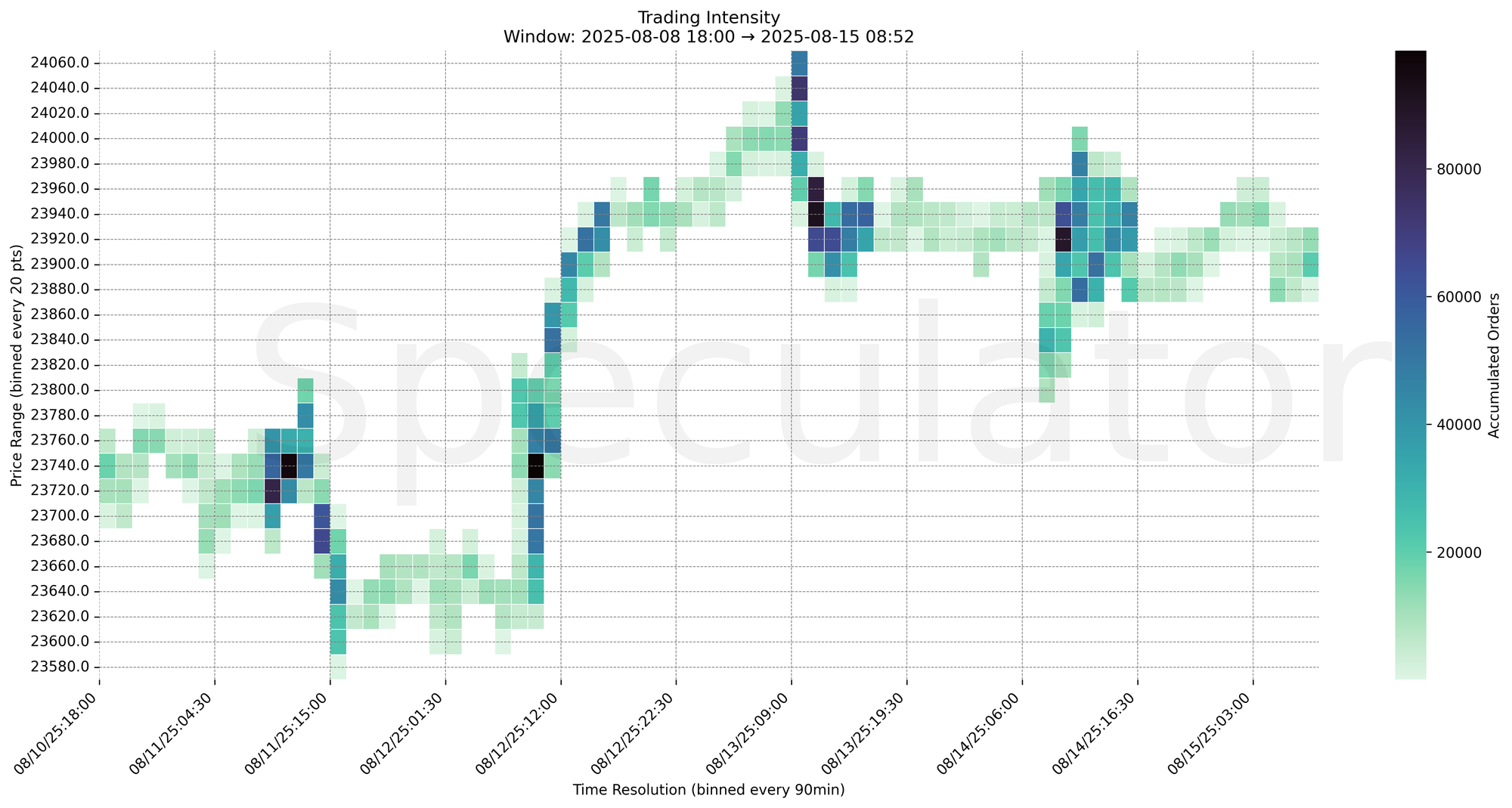

🧊 Key Heatmap Observations

🔹 23,910 → 6,025 @ 08/15 08:30 – Strong absorption into econ data release

🔹 23,900 → 4,875 @ 08/15 08:30 – Buyers defending pre-data lows

🔹 23,900 → 5,418 @ 08/15 08:15 – Responsive buying after early Globex fade

🔹 23,910 → 3,573 @ 08/15 08:00 – Test of cluster high met with moderate selling

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23,890 / 23,900 / 23,910 | Short-term HVN, overnight magnet zone |

| 30min | 23,910 | Repeated test into early morning |

| 1H | 23,880 / 23,900 / 23,920 / 23,960 | Key intraday pivots from prior session |

| 4H | 23,750 / 23,925 | Demand shelf & supply clustering |

| 1D | 23,200 / 23,500 / 23,900 | Macro structure levels |

| 2D | 22,050 / 22,950 / 23,550 | Longer-term mean reversion and major balance zones |

📈 Stay objective. Trade your plan with context.