NQ: At the Bell July/02/2025

MNQ broke down from 22660 overnight, accelerating through 22600 on ADP volatility. Bias is bearish below 22640.

Market briefing for the Tuesday RTH open:

📊 MNQ Report

📆 Tuesday Open: July 02, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

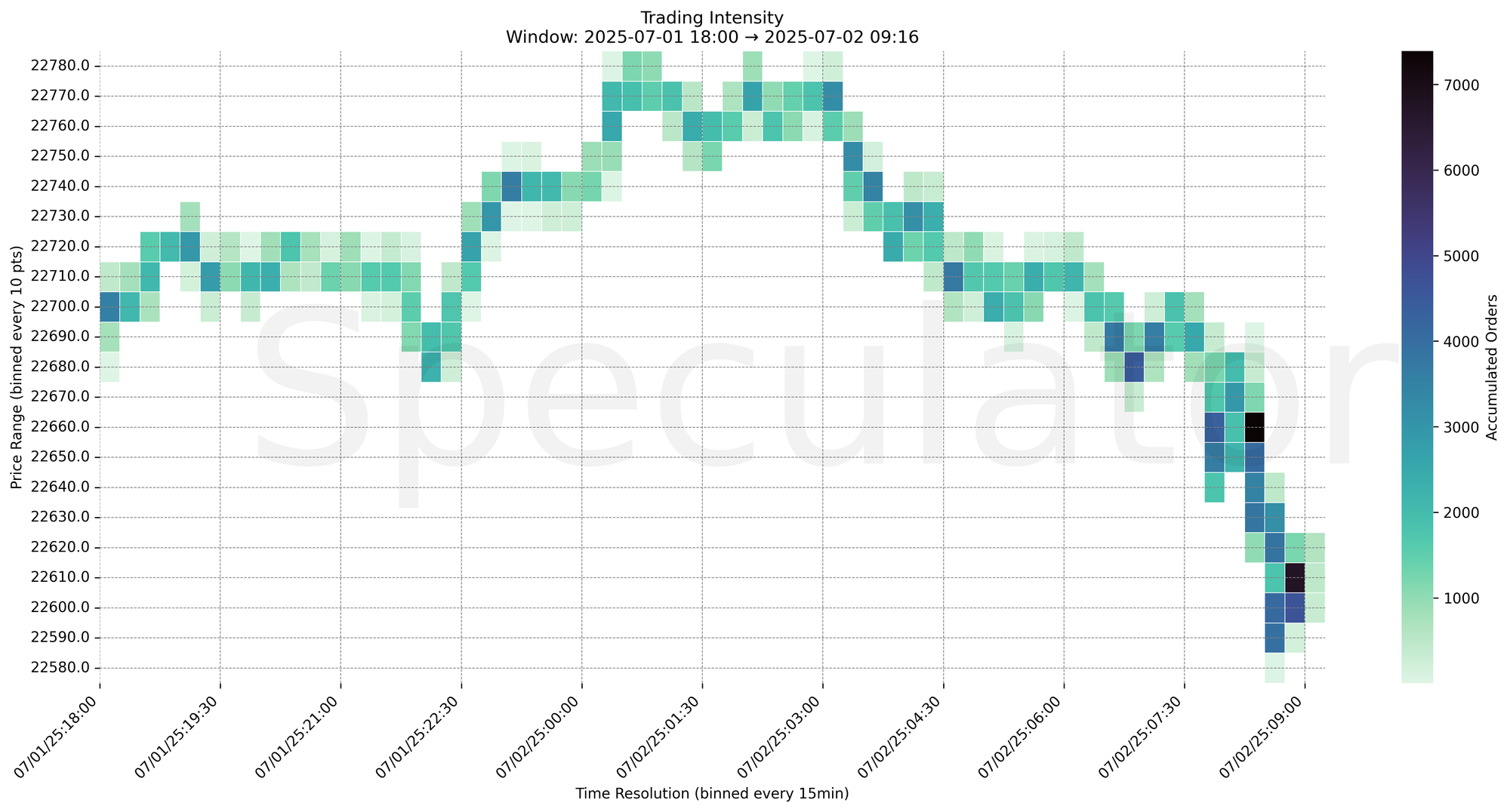

Globex session saw early rotation and balance above 22700 before distribution accelerated into 22600 during the NY premarket. Notably aggressive selling occurred in the 07:45–08:45 window, particularly at 22660 and 22600, likely responding to ADP data proximity.

Deep liquidity zones at 22800 and 22820 continue to cap upside. Breakdown through 22600–22580 exposes broader structural demand from June.

📌 Note: Today is a Red Folder News Day, trade accordingly, manage risk.

🔮 Tuesday Game Plan

📈 Base Case – Responsive Range

Open Inside 22660–22600 zone

→ Expect fades from 22700 or 22740 into 22620–22600

→ Price likely oscillates around 22640–22660 (magnet zone)

📉 Breakdown Risk

Loss of 22600

→ Clears Demand/support

→ Exposes 22580 → 22560 → 22500 → 22360

⚠️ 22500 (1D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22740

→ Clears Supply/resistance

→ Opens path toward 22800 → 22820 → 22840 → 22920

⚠️ 22820 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22600 → 4663 @ 08:45 – Held briefly but gave way, confirming heavy selling interest

🔹 22610 → 6744 @ 08:45 – Secondary block adds weight to breakdown pressure

🔹 22660 → 7390 @ 08:15 – Pre-ADP aggression points to directional conviction

🔹 22660 → 4348 @ 07:45 – Early signal of absorption failing

🔹 22680 → 4450 @ 06:45 – Prior bid zone, lost without responsive buyers

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22680, 22660, 22600, 22610 | Key intraday responses near economic release window |

| 30min | 22665, 22650, 22605 | Consolidated volume near session lows |

| 1H | 22820, 22800, 22640, 22700 | HVNs with reactive behavior |

| 4H | 22800, 22825, 22725 | Supply clustering; prior rejection levels |

| 1D | 22100, 22000, 22700 | Composite structure & June demand |

| 2D | 19200, 19800, 20100, 20400, 21600, 22050 | Macro zones, mean reversion map |

📈 Stay objective. Trade your plan with context.