NQ: At the Bell July/17/2025

The market surged through 23100 overnight, encountering absorption at 23120–23140. Moderately bullish bias into NY open

Market briefing for the Thursday RTH open:

📊 Nasdaq Futures Report

📆 Thursday Open: July 17, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

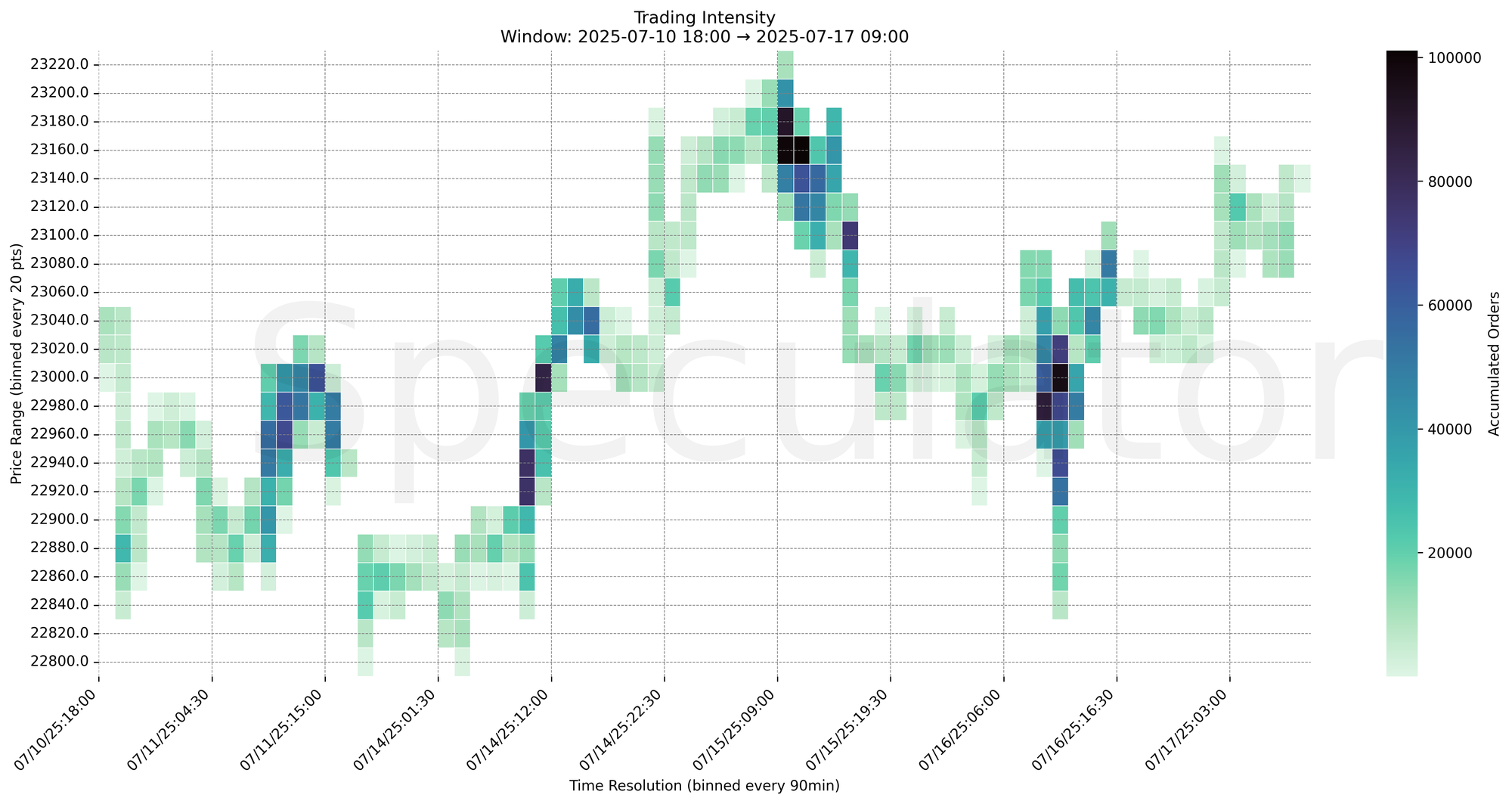

The overnight Globex session opened with initial weakness near 23070 before rotating through a shallow accumulation zone. A sharp upward move around 01:30 ET triggered demand-led price discovery, pushing through layered supply zones into 23140s.

Heavy absorption occurred around 23120–23130, with notable activity at 03:00 and 04:30 ET where selling met aggressive buyers.

The NY open is coiled below key resistance and within a zone of dense trade — continuation or rejection from 23140–23150 will determine directional conviction.

🎯 Bias: Moderately bullish above 23130. Watch for early fade setups back to 23100, then breakout validation on sustained volume through 23150.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Retail Sales | 07/17/2025 | 08:30 |

| Auto Sales | 07/17/2025 | 08:30 |

| UC Claims | 07/17/2025 | 08:30 |

🔮 Thursday Game Plan

📈 Base Case – Responsive Range

Open Inside 23110–23130 zone

→ Expect fades from 23140–23150 into 23110–23100 zone

→ Price likely oscillates around 23120 magnet zone

📉 Breakdown Risk

Loss of 23100

→ Clears Demand/support

→ Exposes 23080 → 23040 → 23000 → 22950

⚠️ 22950 (2D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23150

→ Clears Supply/resistance

→ Opens path toward 23175 → 23220 → 23250 → 23300

⚠️ 23175 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23130 → 5481 @ 07/17 08:30 – Strong buying interest after red folder release, potential breakout cue

🔹 23120 → 5703 @ 07/17 03:00 – Intense two-way trade, seller absorption

🔹 23110 → 4964 @ 07/17 08:30 – Defensive bid zone before breakout test

🔹 23085 → 8110 @ 07/17 07:00 – Key responsive buy zone during early Globex balance

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23120, 23110 | Repeated absorption during Globex |

| 30min | 23085, 23115, 23145 | Transition range of buyers and sellers |

| 1H | 22920–23000 | HVN zones, high volume participation |

| 4H | 22975–23175 | Large demand shelf below, supply shelf overhead |

| 1D | 22900–23000 | Composite structure support beneath RTH lows |

| 2D | 22950 | Long-term support, mean reversion anchor |

📈 Stay objective. Trade your plan with context.