NQ: At the Bell July/24/2025

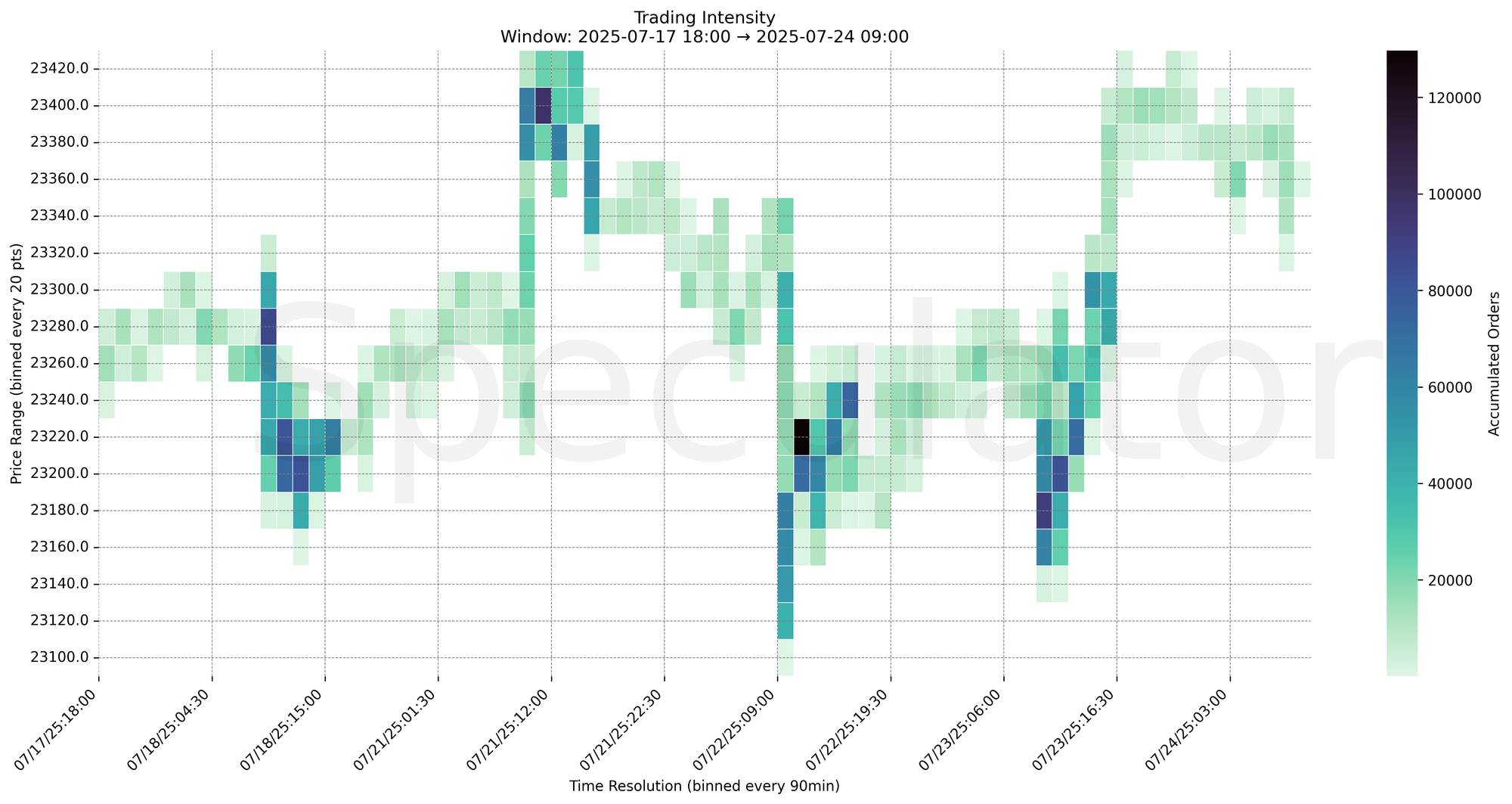

07/24/2025: The market reversed from 23340 overnight, reacting off heavy buy zones. Bias is responsive-to-upside with breakout potential above 23420.

Market briefing for the Thursday RTH open:

📊 Nasdaq Futures Report

📆 Thursday Open: July 24, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order intensity, intraday structure, and directional bias

🔍 Narrative Summary

Overnight trade printed a clear liquidation leg into 23340 before a sharp reversal pressed back into 23420. The strongest intensity was registered between 08:15–09:00 ET at 23340–23360 with responsive buy-side absorption. Earlier globex structure was compressed in range, with bids defending 23360 multiple times before reclaiming.

Key inflection held at 23340, which also aligns with clustered 15–30min zones. Breaks below could expose the structural demand shelf at 23200.

The 4H composite at 23400 remains heavy and capped recent price. A break above that region would likely unlock trapped shorts.

📌 Note: Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| UC Claims | 07/24/25 | 08:30 |

| S&P Global PMI | 07/24/25 | 09:45 |

| New Home Sales | 07/24/25 | 10:00 |

🔮 Thursday Game Plan

📈 Base Case – Responsive Range

Open Inside 23360–23390

→ Expect fades from 23400–23420 into 23360

→ Price likely oscillates around 23375 magnet zone

📉 Breakdown Risk

Loss of 23340 → 23320

→ Clears Demand/support

→ Exposes 23280 → 23240 → 23200 → 23175

⚠️ 23200 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23420

→ Clears Supply/resistance

→ Opens path toward 23450 → 23480 → 23520 → 23600

⚠️ 23400 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23350 → 4147 @ 07/24 08:45 – Heavy reactive buy response before squeeze to 23420

🔹 23360 → 6743 @ 07/24 08:30 – Large absorption zone with fast reversal print

🔹 23360 → 4447 @ 07/24 03:00 – Multiple touches signaling overnight demand defense

🔹 23390 → 3747 @ 07/23 20:00 – Initial resistance high, later retested pre-RTH

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23340–23390 | Repeated reactive prints into pre-RTH |

| 30min | 23340–23355 | Dual cluster zone with liquidity trap at 08:30 ET |

| 1H | 23160–23200 | Structural shelf from prior day liquidation |

| 4H | 23175–23400 | Composite bracket high and lower structural demand |

| 1D | 22900–23000 | Macro demand zone with strong composite shelf |

| 2D | 22950 | Long-term reversion target below composite mean |

📈 Stay objective. Trade your plan with context.