NQ: Before the Bell 06/23/2025

MNQ climbed from 21600 overnight, stalling at 4H supply near 21900. Bias is neutral-to-bullish while above 21730, breakout needs 21960+.

Pre-market briefing for the Monday RTH open:

📊 MNQ Report

📆 Monday Open: June 23, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (00:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

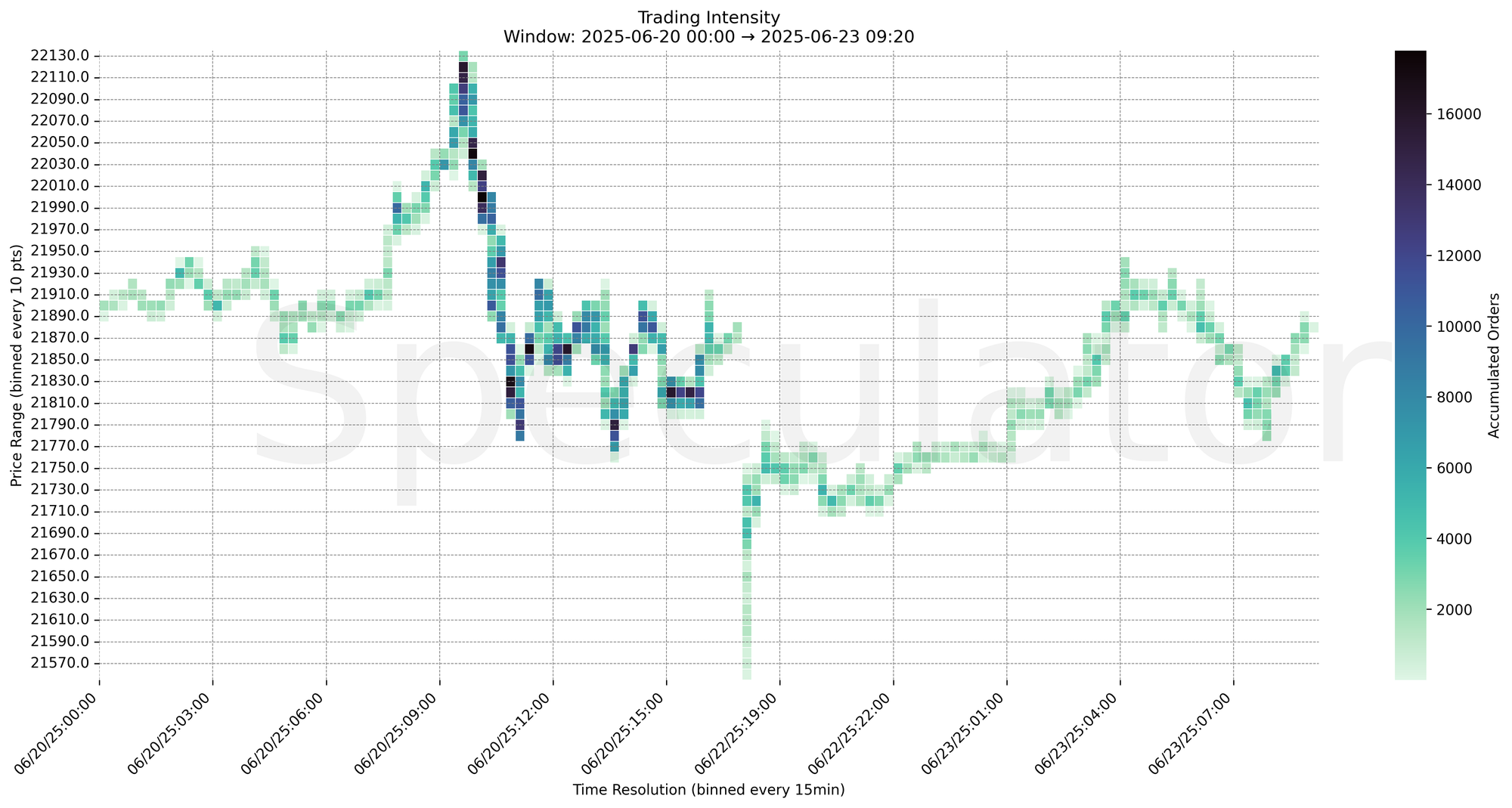

🔍 Narrative Summary

Overnight MNQ traded within a rising channel, recovering from a low near 21600 and climbing toward the 21880–21900 area into the early morning. This lift followed heavy demand activity between 21730–21750. Notably, strong buying emerged after a sweep below 21700, with order accumulation spiking at each thrust higher.

Price has reached a region of 4H supply (21875–21950) and is showing some responsive selling. Watch for acceptance above 21950 to signal continuation, or a fade back to 21810–21780 if supply holds.

🔮 Monday Game Plan

📈 Base Case – Responsive Range

Open Inside 21820–21880 zone

→ Expect fades from 21950 and 21730 into 21820–21860 zone

→ Price likely oscillates around 21860 (magnet zone)

📉 Breakdown Risk

Loss of 21730

→ Clears Demand/support

→ Exposes 21600 → 21500 ladder

⚠️ 21600 (2D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 21960–21980

→ Clears Supply/resistance

→ Opens path toward 22050 → 22100

⚠️ 22100 (1D/4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 21740.0 → 5400+ @ 06/22/25 18:30 – Heavy accumulation post-open after US-Iran shock

🔹 21780.0 → 5000+ @ 06/22/25 20:00 – Defended zone on re-test, early range base

🔹 21810.0 → 4800+ @ 06/23/25 02:45 – Demand spike after small pullback, initiates leg higher

🔹 21860.0 → 5200+ @ 06/23/25 04:30 – Strong lift reaction and volume cluster near current high

🔹 21900.0 → 4500+ @ 06/23/25 06:15 – Initial rejection from 4H supply zone

🔹 21750.0 → 5300+ @ 06/22/25 19:45 – Consolidation absorption zone during geopolitical panic fade

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 21940, 21860, 21830, 21820, 21790 | Microstructure pivots; session absorption zones |

| 30min | 22110, 22095, 22050, 21990 | Intraday HVNs and reaction shelves |

| 1H | 22080, 22060, 22000, 21860, 21820 | Reaction shelf at 21860, composite interest below |

| 4H | 22100, 22000, 21950, 21875, 21825 | Overhead supply shelf formed across last 3 sessions |

| 1D | 22100, 22000, 21900, 21700 | Macro resistance ceiling at 22100 |

| 2D | 22050, 21600, 20400, 20100 | Major demand zone at 21600; mean-reversion context |

📈 Stay objective. Trade your plan with context.