NQ: Before the Bell 06/24/2025

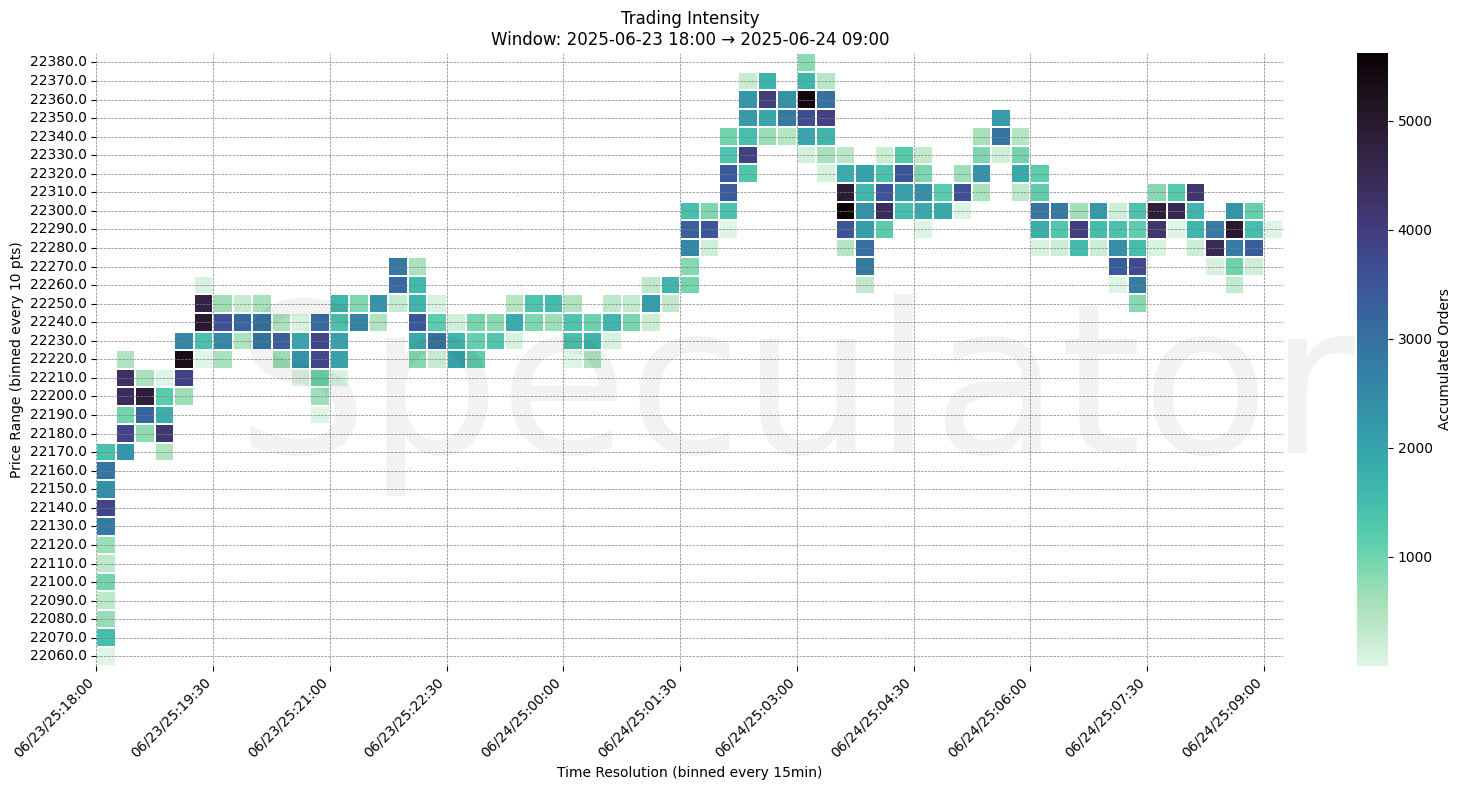

MNQ held 22200 overnight, bid into 22360s before sellers appeared. Bullish bias holds above 22150 into RTH.

Pre-market briefing for the Tuesday RTH open:

📊 MNQ Report

📆 Tuesday Open: June 24, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

Overnight session held bullish structure following Monday’s breakout. MNQ climbed from the 22100 handle, pausing at 22250 and surging into 22370 before rotating lower. Notable absorption emerged at 22360s and 22280s as buyers became more passive. The move was orderly with pullbacks being absorbed. Heading into RTH with red folder news at 10:00 ET (Fed Chair Powell Testimony), directional bias favors strength above 22200, with buyers in control unless price fails 22150.

📌 Note: Today is a Red Folder News Day (Fed Chair Powell Testimony @ 10:00 ET), trade accordingly, manage risk.

🔮 Tuesday Game Plan

📈 Base Case – Responsive Range

Open Inside 22200–22280 zone

→ Expect fades from 22360 into 22230–22200

→ Price likely oscillates around 22250–22270 magnet zone

📉 Breakdown Risk

Loss of 22150

→ Clears Demand/support

→ Exposes 22050 → 21975 → 21900

⚠️ 22050 (2D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22360

→ Clears Supply/resistance

→ Opens path toward 22420 → 22500

⚠️ 22100 (1D) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22360 → 5200 @ 06:15 – Heavy absorption at highs, initiating pullback

🔹 22300 → 4600 @ 04:45 – Consolidation area, buyers defend value

🔹 22250 → 3900 @ 03:30 – Strong activity as price builds support

🔹 22180 → 4400 @ 01:30 – Structural pivot zone held overnight

🔹 22120 → 4100 @ 00:30 – Initial demand response sets overnight tone

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 21800, 21860, 22040, 22050 | Microstructure and responsive prints |

| 30min | 21990, 21945, 21870, 22050 | Ledges and developing structure |

| 1H | 21860, 21820, 22000, 21980 | HVNs and reactive pivots |

| 4H | 21825, 21850, 21875, 22050 | Intermediate structure support |

| 1D | 21700, 21900, 22000, 22100 | Macro context — key swing zones |

| 2D | 21600, 20400, 22050, 19200 | Long-term value zones and mean-reversion anchors |

📈 Stay objective. Trade your plan with context.