NQ: Before the Bell 06/25/2025

MNQ climbed above 22460 overnight, consolidating near 22510 into red folder news. Bias leans bullish above 22420.

Pre-market briefing for the Wednesday RTH open:

📊 MNQ Report

📆 Wednesday Open: June 25, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

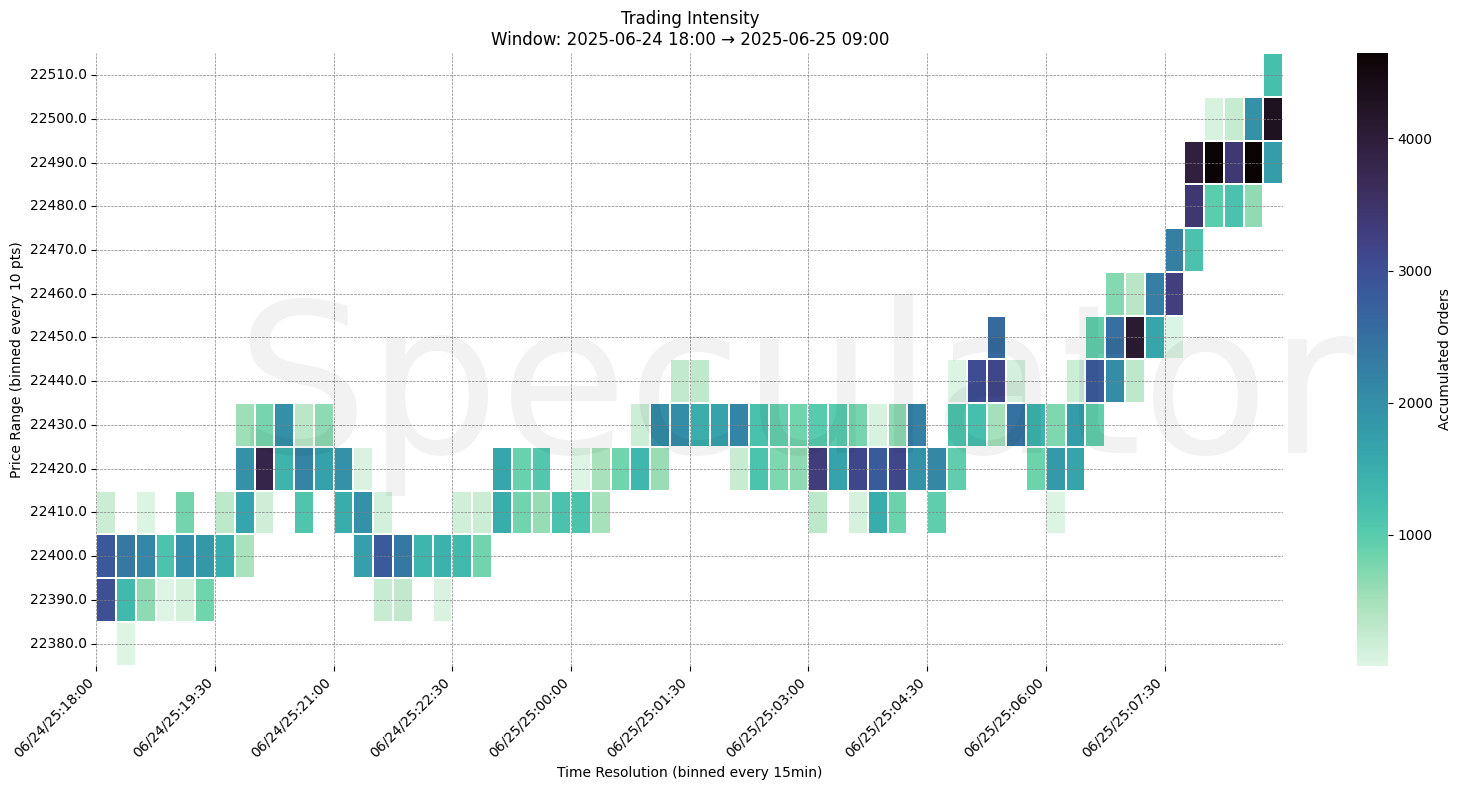

Overnight MNQ trade displayed methodical accumulation on the climb from 22380 to a pre-market high at 22510. Trading intensity steadily escalated into the NY open, especially between 22460–22500, where clustered dark prints signal strong buyer initiative.

Structurally, price cleared the prior day’s resistance shelf (22420–22440), confirming bullish control.

Immediate upside momentum faces potential exhaustion risk at 22510+, with caution warranted into high-impact 10:00 ET news.

📌 Note: Today is a Red Folder News Day — Fed Chair Powell Testimony and New Home Sales @ 10:00 ET. Trade accordingly, manage risk.

🔮 Wednesday Game Plan

📈 Base Case – Responsive Range

Open Inside 22480–22510

→ Expect fades from 22510 into 22440–22460

→ Price likely oscillates around 22480 magnet zone

📉 Breakdown Risk

Loss of 22440–22420

→ Clears Demand/support

→ Exposes 22380 → 22320 → 22300

⚠️ 22300 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22510

→ Clears Supply/resistance

→ Opens path toward 22600 → 22720

⚠️ 22510+ (no cluster) = Uncharted highs, momentum-driven breakout

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22500 → 4,400+ orders @ 08:45 – Heavy buyer absorption on final leg of rally

🔹 22480 → 3,600+ orders @ 08:30 – Stacked intensity ahead of 09:00 open

🔹 22460 → 3,200+ orders @ 08:15 – Sustained bid into upper quadrant of range

🔹 22420 → 3,300+ orders @ 06:15 – Demand shelf, critical for structural bias

🔹 22390 → 2,800+ orders @ 04:00 – Initiative buying from lower balance

🔹 22380 → 2,100+ orders @ 03:30 – Pre-breakout accumulation base

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22300, 22290, 22320, 22310 | Microstructure balance + early day support |

| 30min | 22305, 22320, 22290, 22425 | Confirmed auction zones and late session resistance |

| 1H | 22300, 22320, 22420 | HVNs and afternoon demand zones |

| 4H | 22300, 22425, 22050 | Strong structural inflections, breakout ledges |

| 1D | 22000, 22100, 21900, 21700 | Composite balance, major structural levels |

| 2D | 21600, 22050, 20400, 20100 | Macro reversion points and long-term context |

📈 Stay objective. Trade your plan with context.