NQ: Before the Bell 06/26/2025

MNQ rejected 22570 zone overnight, flushed on 08:30 news releases. Downside bias into 22425

Pre-market briefing for the Thursday RTH open:

📊 MNQ Report

📆 Thursday Open: June 26, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

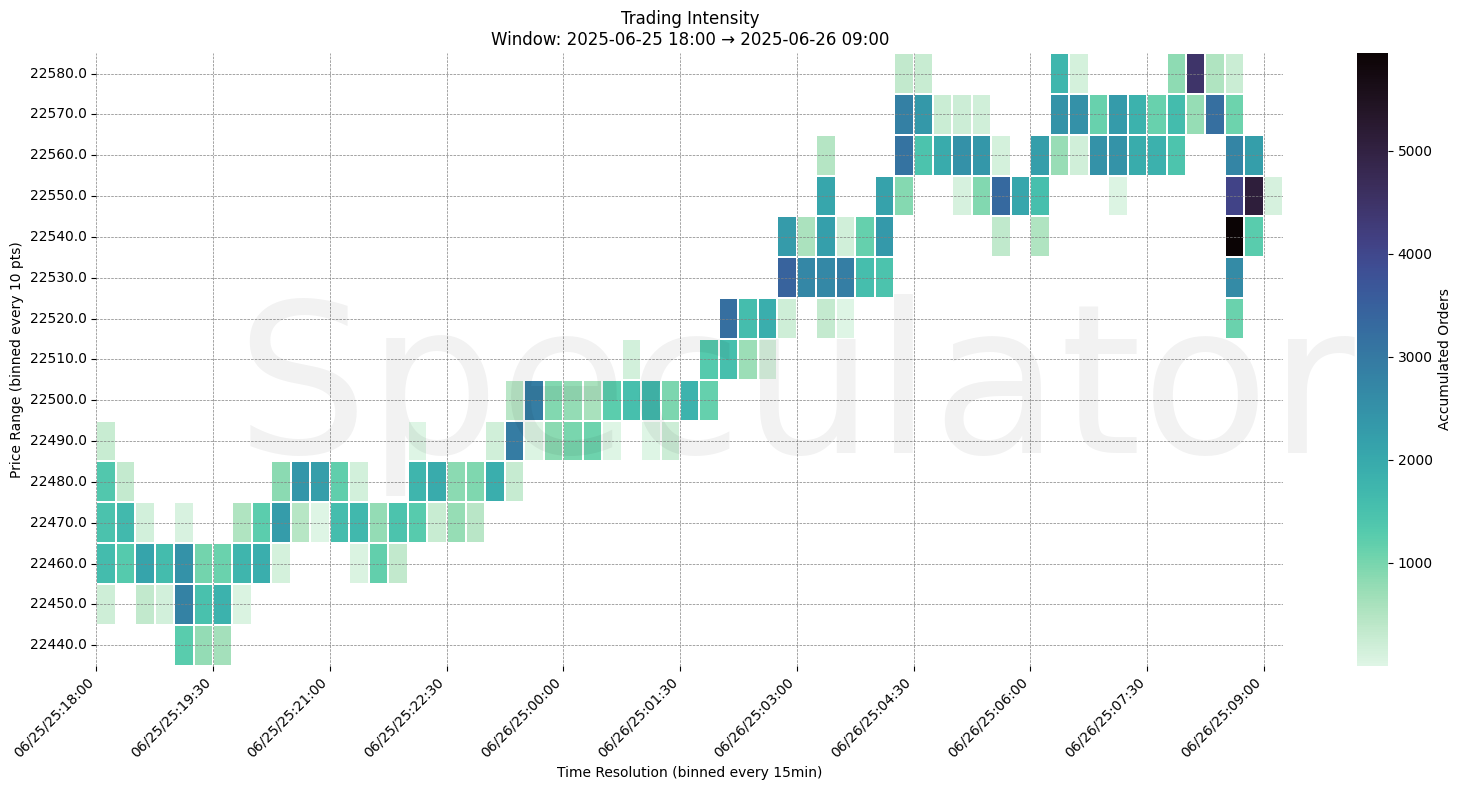

Overnight MNQ session extended gains before stalling near the 22570–22580 range, showing early absorption and then sharp selling pressure leading into 09:00 ET.

A notable cluster of high-volume orders appeared during the selloff, especially below 22540, pointing to increased liquidation and reactive order flow.

Price climbed steadily through the Asian and early European session, with aggressive initiative buying across 22480–22530 before exhaustion.

The 08:30 ET economic data dump (Job Claims, GDP, Durable Goods, and Trade Balance) triggered a sell program post-distribution, pushing MNQ back toward mid-range.

📌 Note: Today is a Red Folder News Day, trade accordingly, manage risk.

🔮 Thursday Game Plan

📈 Base Case – Responsive Range

Open Inside 22460–22520

→ Expect fades from 22550–22570 into 22480–22500

→ Price likely oscillates around 22500 (volume magnet zone)

📉 Breakdown Risk

Loss of 22460

→ Clears Demand/support

→ Exposes 22425 → 22300 → 22050

⚠️ 22425 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22570

→ Clears Supply/resistance

→ Opens path toward 22620 → 22680 → 22800

⚠️ 22570 (Intraday tail high) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22540 → 5622 @ 08:45 – Heavy absorption followed by sharp downside impulse

🔹 22560 → 4322 @ 08:30 – News-driven spike into supply followed by rejection

🔹 22520 → 3860 @ 07:15 – Initiative buying attempt, later reversed

🔹 22490 → 3155 @ 04:45 – Early Europe session absorption and rotation

🔹 22460 → 2890 @ 01:00 – Structural support build ahead of Asia open

🔹 22440 → 2483 @ 18:30 – Initial Globex fade before trend formed

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22540, 22520, 22510, 22500 | High-frequency rotations from RTH fade area |

| 30min | 22530, 22515, 22500, 22485 | Volume shelf forming above yesterday’s midpoint |

| 1H | 22300, 22320, 22520, 22500, 22480, 22460 | Prior HVNs, reaction pivots |

| 4H | 21875, 22050, 22300, 22425, 22500 | Macro range levels; 22425–22500 key shelf |

| 1D | 22100, 22000, 21900 | Composite support clusters |

| 2D | 19200, 19800, 20100, 20400, 21600, 22050 | Long-term inflection levels for mean reversion context |

📈 Stay objective. Trade your plan with context.