NQ: Before the Bell 06/27/2025

MNQ tested into 22790 overnight, rejected hard post-PCE. Two-way flows likely. Watch 22720 for control. Red Folder risk remains high.

Pre-market briefing for the Thursday RTH open:

📊 MNQ Report

📆 Thursday Open: June 27, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

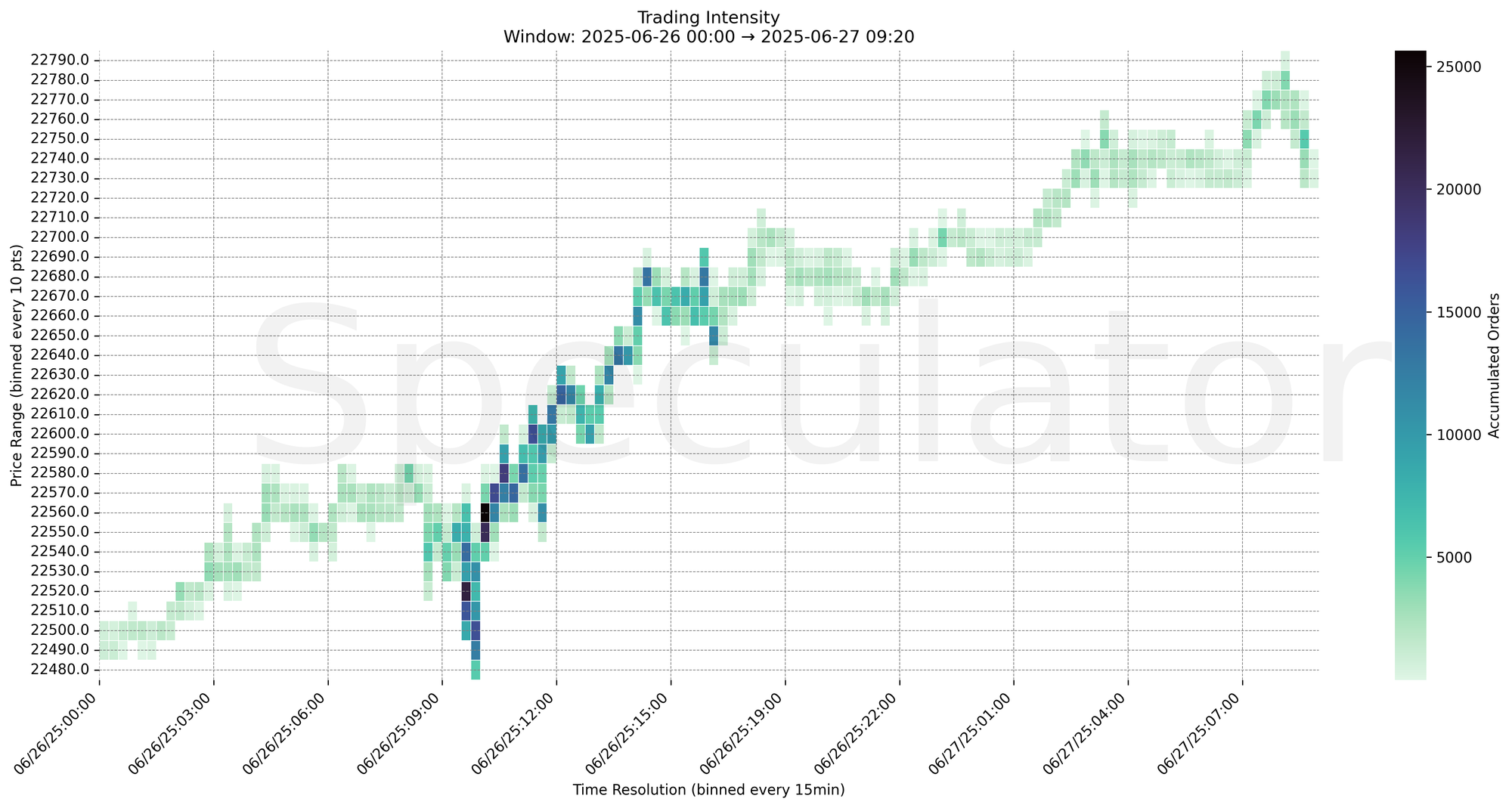

The overnight session in MNQ was defined by an early dip into 22660s before steady accumulation lifted price through the 22700 handle. Notable absorption occurred just above 22770 with intensity peaking into 22790 before early profit-taking pulled price back. This forms a short-term upper boundary with evidence of trapped longs above 22780.

Price remains inside the broader range formed on Wednesday, creating potential for two-sided trade. Today's session is framed by high-impact Red Folder news at both 08:30 (PCE, Personal Spending) and 10:00 (Michigan Consumer Sentiment), both of which may amplify volatility and shift directional conviction.

📌 Note: Today is a Red Folder News Day, trade accordingly, manage risk.

🔮 Thursday Game Plan

📈 Base Case – Responsive Range

Open Inside 22700–22750

→ Expect fades from 22770–22790 into 22680–22700

→ Price likely oscillates around 22720 magnet zone

📉 Breakdown Risk

Loss of 22660

→ Clears Demand/support

→ Exposes 22620 → 22560 → 22500

⚠️ 22500 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22790

→ Clears Supply/resistance

→ Opens path toward 22840 → 22900

⚠️ 22790 (15m) = Short-term rejection area

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22790 → 5534 @ 08:30 – Strong absorption into macro news release; rejection followed

🔹 22780 → 4742 @ 08:15 – Pre-news lift attempt met with aggressive sellers

🔹 22730 → 3601 @ 06:45 – Accumulation node, likely passive buyer present

🔹 22690 → 2938 @ 03:30 – Volume spike on rotation back into lower support zone

🔹 22660 → 2784 @ 00:15 – Initial Globex session low set with buying response

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22500, 22540, 22550, 22560 | High interest near 22500–22560 on previous day opens |

| 30min | 22500, 22515, 22530, 22560 | Demand layer forming just under key breakout zone |

| 1H | 22460, 22480, 22500, 22560 | Overlapping HVNs; structure-rich zone below |

| 4H | 22300, 22425, 22500, 22620 | Composite support shelf, potential pullback area |

| 1D | 21900, 22000, 22100 | Long-term support structure context |

| 2D | 19200, 19800, 20100, 20400, 21600, 22050 | Major composite support and mean-reversion zones |

📈 Stay objective. Trade your plan with context.