NQ: Before the Bell 06/30/2025

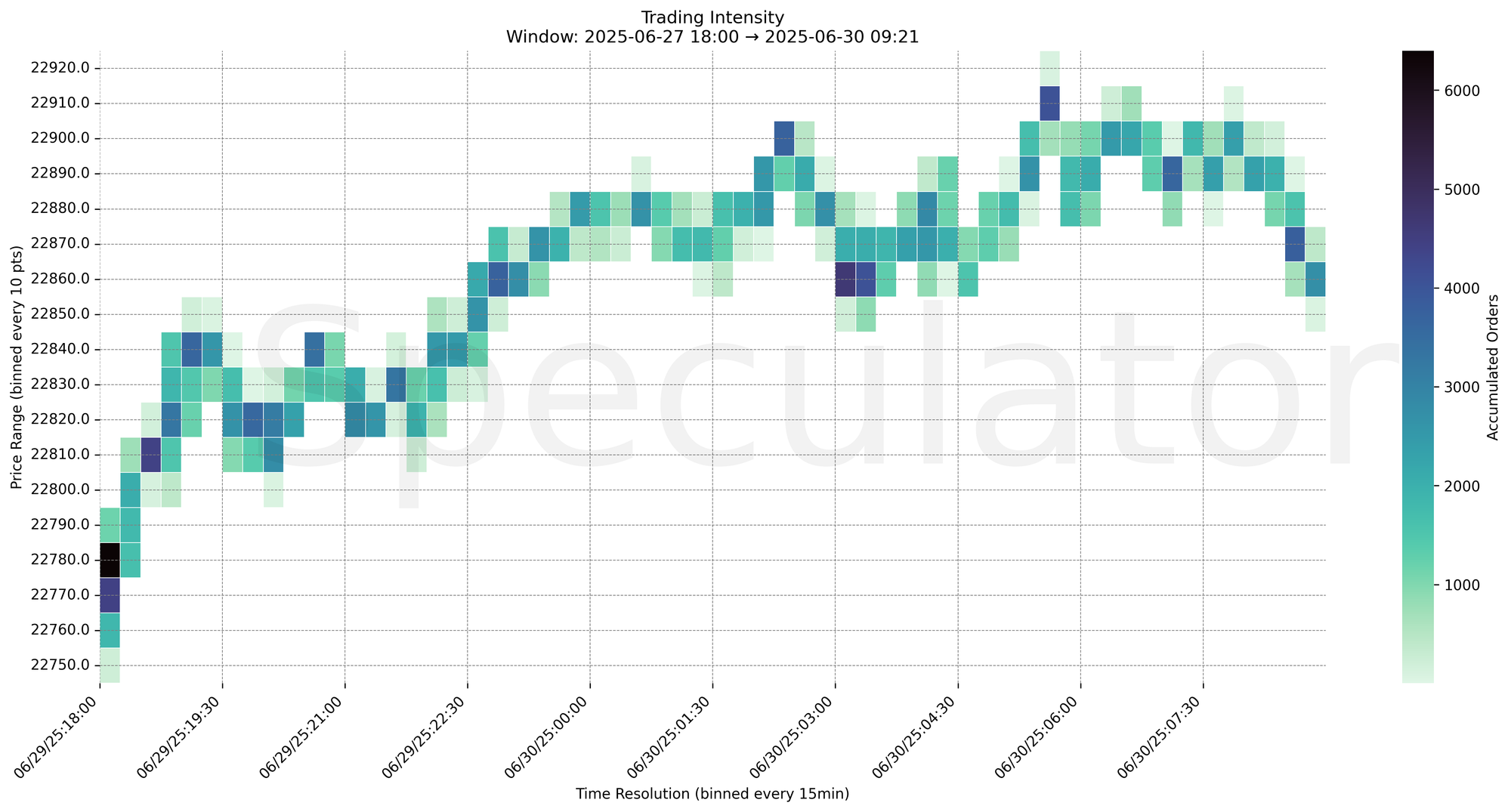

MNQ lifted off 22770 overnight, stalling near 22920. Balance forming around 22860–22910 band. Bias: responsive fades unless breakout over 22920 holds.

Pre-market briefing for the Monday RTH open:

📊 MNQ Report

📆 Monday Open: June 30, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (18:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

Globex opened with strength from the 22770–22790 base, lifting steadily through overnight resistance pockets into 22920s.

Initial absorption near 22810 was resolved via demand absorption, flipping into support.

Highest liquidity clusters appeared between 22860–22910, creating an inflection band.

Final hours saw rotation and cooling, suggesting balance just below 22920.

📌 Note: Last trading day of the month and Q2 — rebalancing volatility likely into RTH.

🔮 Monday Game Plan

📈 Base Case – Responsive Range

Open Inside 22860–22910 band

→ Expect fades from 22920 into 22860-22830 pocket

→ Price likely oscillates around 22860 (Globex HVN / 30m cluster)

📉 Breakdown Risk

Loss of 22810 / 22780

→ Clears Demand/support

→ Exposes 22740 → 22700 → 22575

⚠️ 22575 (12H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22920

→ Clears Supply/resistance

→ Opens path toward 22980 → 23040 → 23120

⚠️ 22980–23040 (prior gap fill zone) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22920 → 3834 @ 08:45 – Large cluster forms resistance, capped upside move

🔹 22910 → 4058 @ 05:30 – Repeated absorption near highs, minor stall

🔹 22860 → 4650 @ 03:00 – Strong interest cluster, price magnet overnight

🔹 22810 → 4415 @ 18:30 – Initial absorption flipped into support

🔹 22780 → 6397 @ 18:00 – Globex open anchor, strong base built early

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22770, 22780, 22810, 22860, 22910 | Responsive pockets; intraday inflection areas |

| 30min | 22770, 22785, 22860 | Globex HVNs & liquidity bands |

| 1H | 22720, 22740, 22780, 22800 | Strong shelf in low 22700s; responsive interest seen |

| 4H | 22425, 22500, 22800 | Key structural shelves from last week |

| 1D | 21900, 22000, 22100 | Composite HVNs and long-term demand zones |

| 2D | 19200, 19800, 20100, 20400, 21600, 22050 | Mean-reversion & macro structure zones |

📈 Stay objective. Trade your plan with context.

Follow up 06/30/2025:

-

Practicing today. I couldn't give my full attention to the market this morning. Rather than risk money it's better to practice.

-

Short after NY Open, add on retracement, exit at prior supply line.

-

D4D.