NQ: Before the Bell 06/19/2025

Pre-market briefing for the Thursday RTH open:

📊 MNQ Report

📆 Thursday Open: June 19, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (00:00 → 09:15 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

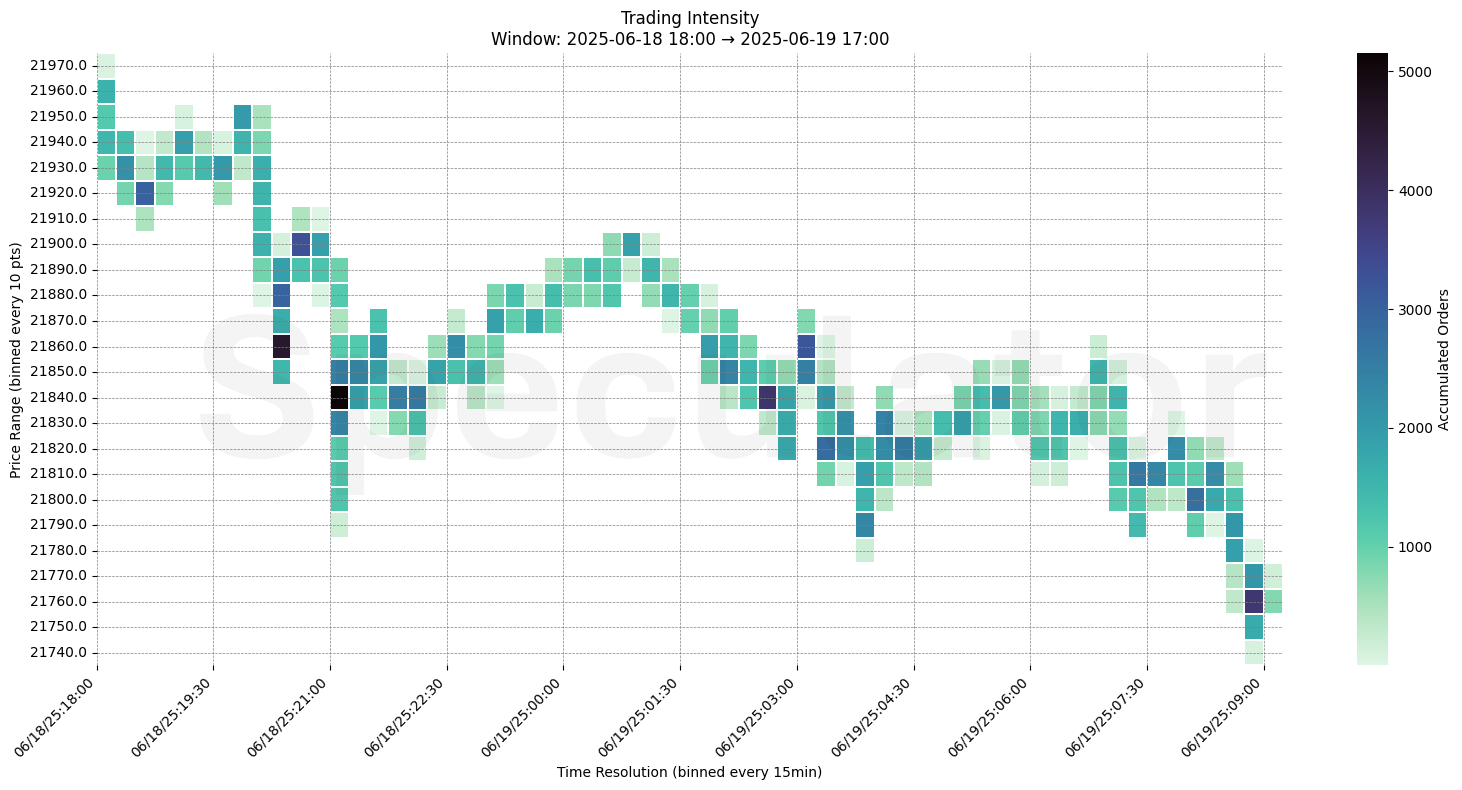

Globex continued its bearish trajectory overnight, cascading lower from the 21950s toward 21740 into the early morning. Heavy order clusters emerged around 21850 and 21840, forming a shelf of aggressive selling. Every rally attempt was met with distribution.

Major structural support sits below at 21700, but intraday liquidity remains thin. Watch for reactive buyers near prior demand, but if 21700 gives, 21500 opens quickly.

📌 Note: Today is a holiday (Juneteenth) and a partial trading day — the market closes early at 1:00 PM ET. Trade accordingly, manage risk.

🔮 Thursday Game Plan

📈 Base Case – Responsive Range

Open Inside 21780–21860

→ Expect fades from 21880–21900 into 21800–21750

→ Price likely oscillates around 21830 as a magnet zone

📉 Breakdown Risk

Loss of 21700

→ Clears Demand/support

→ Exposes 21500, 21350, 21100

⚠️ 21700 (1D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 21950–21980

→ Clears Supply/resistance

→ Opens path toward 22050, 22100, 22175

⚠️ 22100 (4H/1D) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 21850 → 5,106 @ 2025-06-18 21:00 – Heavy aggressive sell block, initial sign of structural resistance

🔹 21840 → 5,058 @ 2025-06-18 21:15 – Strong continuation selling, stacked liquidity under pressure

🔹 21820 → 3,411 @ 2025-06-19 03:15 – Support absorbed and failed, signaling downtrend continuation

🔹 21790 → 3,050 @ 2025-06-19 08:00 – Temporary bounce attempt met with selling

🔹 21750 → 3,470 @ 2025-06-19 08:45 – Support shelf in question going into open

🔹 21740 → 2,982 @ 2025-06-19 09:00 – Latest print into lows, risk of flush if breached

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22090, 22080, 22070 | Short-term memory and responsive pivots |

| 30min | 22125, 22080, 22050 | Resistance stacks at upper end of prior RTH range |

| 1H | 22100, 22080, 22060 | Compression and inflection zone from Wednesday |

| 4H | 22175, 22100, 22075 | Key distribution shelves in mid-term structure |

| 1D | 22100, 22000, 21700 | Major volume clusters across longer sessions |

| 2D | 22050, 21600, 20400 | Long-term mean reversion and value area reference |

📈 Stay objective. Trade your plan with context.

Trade(s) Taken

Short

- Entry

- Stop Management

- Exit