NQ: Post-Market Analysis 06/23/2025

MNQ broke above 22050 today, confirming strength. Bullish bias intact above 21950.

Post-market briefing for the Monday RTH open to close:

📊 MNQ Report

📆 Monday: June 23, 2025

🕓 Analysis Window: Regular Trading Hours (09:30 → 17:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

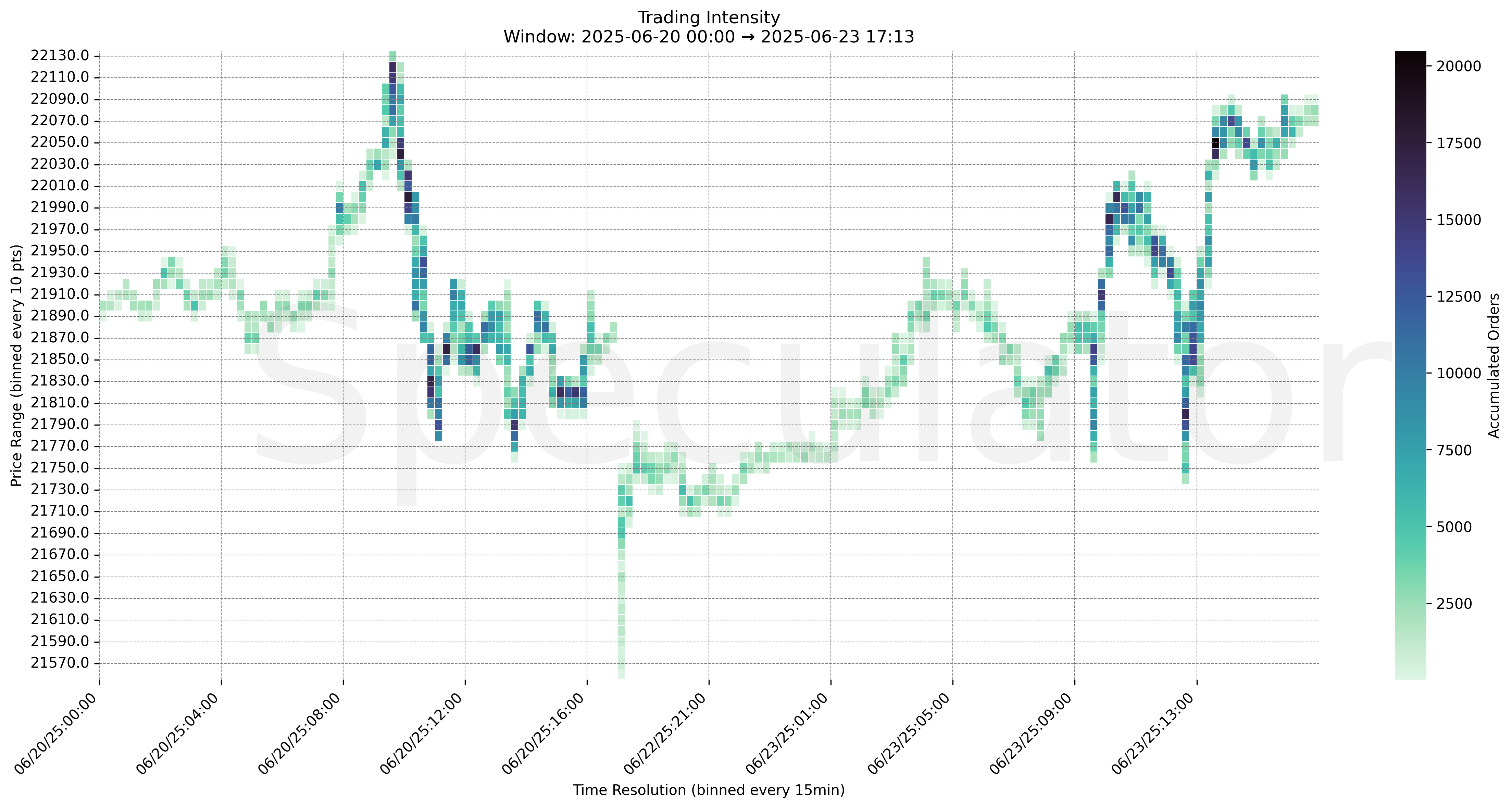

🔍 Narrative Summary

Monday opened with a muted tone but quickly saw responsive buying from the 21860–21800 demand cluster. The session pivoted around 21950 before breaking higher with strong order flow into the 22040–22050 resistance band. Afternoon activity was dominated by a sustained push into recent highs near 22090, backed by aggressive buying. Notably, two large absorption events occurred at 22050, confirming the breakout. Bias remains bullish as long as price holds above 21950.

🔮 Globex (Overnight) Game Plan

📈 Base Case – Responsive Range

Open Inside 21900–21950 zone

→ Expect fades from 22050 into 21980–21900

→ Price likely oscillates around 21990–22000 magnet zone

📉 Breakdown Risk

Loss of 21860–21800

→ Clears Demand/support

→ Exposes 21700 → 21600 → 21300

⚠️ 21600 (2D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22050

→ Clears Supply/resistance

→ Opens path toward 22100 → 22200 → 22400

⚠️ 22100 (1D) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 21860 → 14172 @ 09:30 – Buyers defend opening demand pocket

🔹 22000 → 16507 @ 10:15 – Intense lift into supply zone, breakout forming

🔹 21950 → 14024 @ 11:30 – Buyers reload midpoint support

🔹 21800 → 16495 @ 12:30 – Deep responsive bid at base of range

🔹 22050 → 20489 @ 13:30 – Major absorption → led breakout continuation

🔹 22050 → 13679 @ 14:30 – Continuation orderflow confirms strength above key resistance

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 21860, 21910, 21980, 22000, 21950, 21800, 22040, 22050 | Microstructure pivot zones and reactive prints |

| 30min | 21990, 21855, 21825, 21975, 21945, 22050, 22065 | Volume ledges and intraday structure |

| 1H | 22040, 22020, 22000, 21980, 21960, 21860, 21820, 21880 | High-volume nodes and balance zones |

| 4H | 22100, 21950, 22025, 22000, 21875, 21850, 21825, 22050 | Key structural inflections, supply/demand zones |

| 1D | 21700, 22100, 22000, 21900 | Composite zones, watch for longer-term turns |

| 2D | 19200, 19800, 20100, 20400, 21600, 22050 | Macro mean-reversion and institutional anchor zones |

📈 Stay objective. Trade your plan with context.