NQ: Before the Bell 06/20/2025

Pre-market briefing for the Friday RTH open:

📊 MNQ Report

📆 Friday Open: June 20, 2025 @ 09:30 ET

🕓 Analysis Window: Overnight Globex (00:00 → 09:00 ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

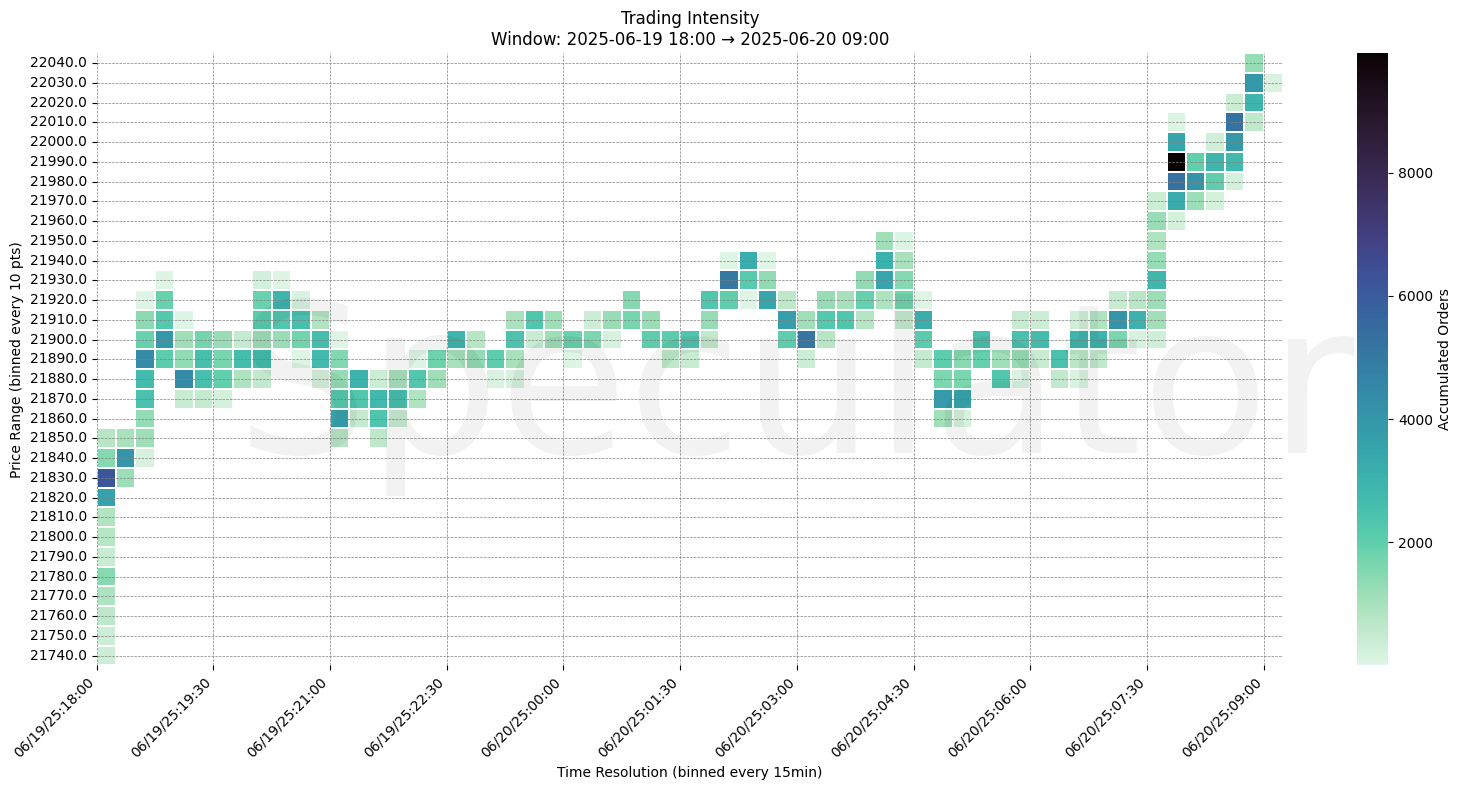

Overnight session exhibited steady accumulation with a strong continuation push in the final 90 minutes of Globex. Trading intensity sharply increased between 21990 and 22040, signaling buyer initiative. Price held above the prior balance zone (21920–21960), then launched toward 22040 with notable conviction. Highest heatmap print occurred during this late surge, suggesting potential continuation into RTH.

Price is now probing above 22040, testing a prior HVN cluster area with meaningful supply seen in 4H/1D structure. A pullback into the 21980–22000 region would be a healthy retest if buyers remain in control.

Watch 22050+ for resistance from prior composite structure. Downside failure would be evidenced by a breakdown through 21920, invalidating the bullish continuation thesis.

🔮 Friday Game Plan

📈 Base Case – Responsive Range

Open Inside 21980–22010 zone

→ Expect fades from 22050 into 21980

→ Price likely oscillates around 22000 magnet zone

📉 Breakdown Risk

Loss of 21920–21900

→ Clears Demand/support

→ Exposes 21850 → 21780 → 21700

⚠️ 21700 (1D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22050

→ Clears Supply/resistance

→ Opens path toward 22100 → 22150

⚠️ 22100 (1D/4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22030 → 9000+ @ 08:45 – Aggressive buyer prints into breakout zone

🔹 22010 → 7000+ @ 08:30 – Continuation demand following consolidation

🔹 21990 → 6000+ @ 08:15 – First initiation of strong buy-side pressure

🔹 21940 → 5200+ @ 04:15 – Mid-session response to pullback support

🔹 21900 → 5000+ @ 00:45 – Early Globex support; buyers defended prior low

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 21990, 21950, 21980, 21930 | Recent responsive zones during prior day close |

| 30min | 21960, 21975, 21930, 22035 | Layered balance and volume shelves into breakout |

| 1H | 21980, 21960, 22020, 22000 | HVN clusters around balance and breakout structure |

| 4H | 22025, 22000, 21975, 21950 | Supply/resistance clustering near current price |

| 1D | 22000, 22100, 21700, 21500 | Composite structure showing demand below |

| 2D | 22050, 21600, 20400, 20100 | Longer-term zones — mean reversion, breakout targets |

📈 Stay objective. Trade your plan with context.