NQ: Weekly Prep 27/2025

MNQ surged through 22800 overnight, showing signs of exhaustion at highs. Responsive demand remains strong with 22600 as key support. Watching for breakout continuation or mean-reversion setup.

📊 MNQ Report

📆 Analysis Week of 26/2025

🕓 Game Plan Week of 27/2025

💡Focus Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

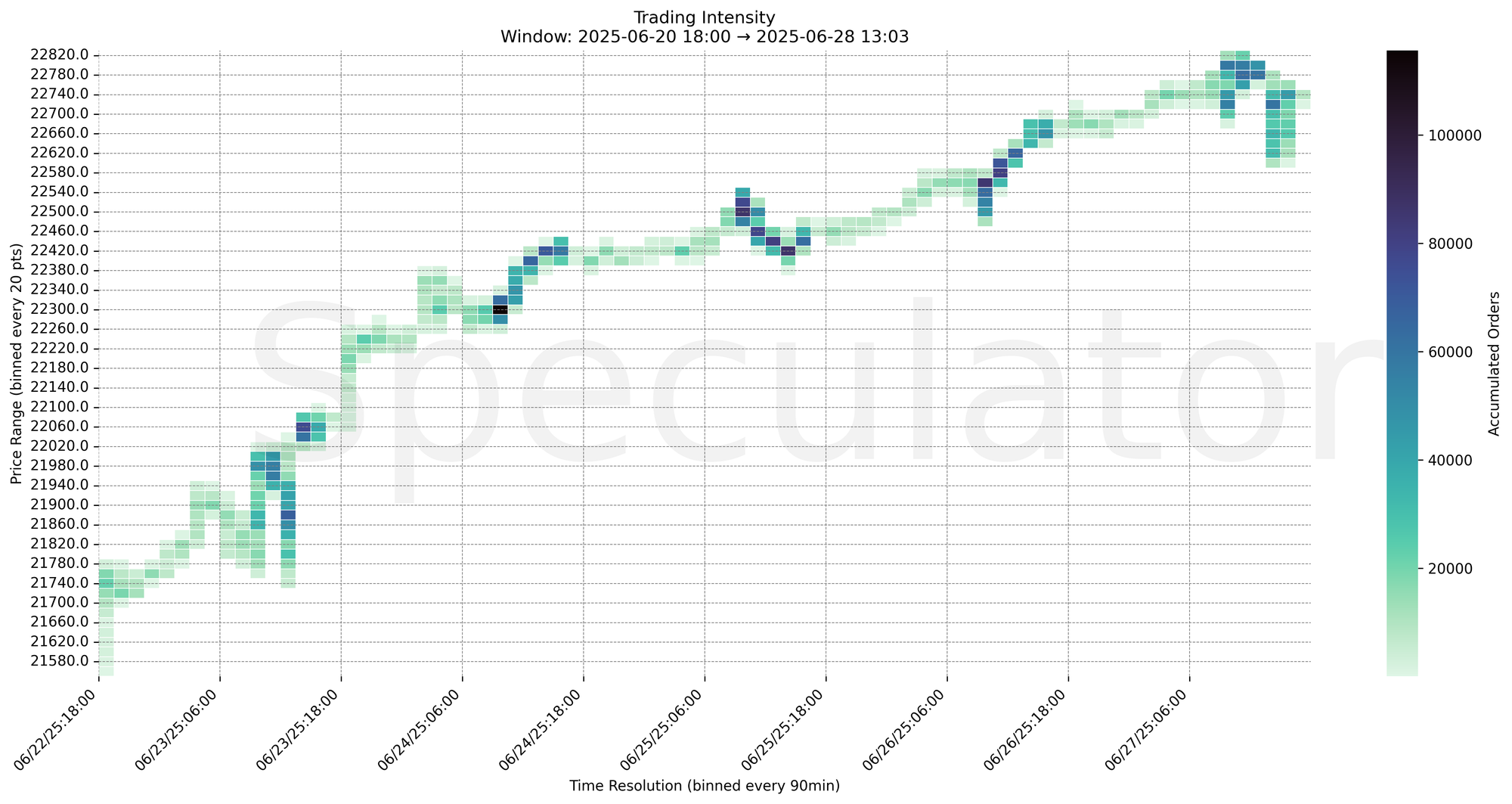

The MNQ advanced steadily through the week, grinding higher with moderate pullbacks, closing near highs into Friday’s early afternoon session. Notably, aggressive accumulation began building from 22300 on 6/24 and stair-stepped through 22420, 22560, and ultimately into 22800. Friday morning showed a climax of volume at 22800 before retracing slightly. Responsive buying at each 20–40 point dip hinted at persistent demand flow.

Key breakout levels like 22425 and 22500 became springboards, especially after consolidation on 6/25–6/26. The Friday session offered a sharp final push and potential short-term exhaustion signals above 22800.

📌 *Note: This upcoming week includes the July 4th holiday with early closes on 7/3 and 7/4.

📌 *Note: Red Folder Economic Events Scheduled Next Week:

- Fed Chair Powell Speech – July 1 @ 09:30 ET

- S&P PMI – July 1 @ 09:45 ET

- ISM PMI – July 1 @ 10:00 ET

- JOLTS – July 1 @ 14:00 ET

- ADP Employment Change – July 2 @ 08:15 ET

- NFP (June), Unemployment Claims – July 3 @ 08:30 ET

- Final PMI – July 3 @ 09:45 and 10:00 ET

🔮 Next Week (27/2025) Game Plan

📈 Base Case – Responsive Range

Open Inside 22560–22720 zone

→ Expect fades from 22800 or 22780 into 22600–22560 support

→ Price likely oscillates around 22690–22720 magnet zone

📉 Breakdown Risk

Sustained loss below 22560

→ Clears Demand/support

→ Exposes 22420 → 22300 → 22050

⚠️ 22425 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22800

→ Clears Supply/resistance

→ Opens path toward 22920 → 23000 → 23180

⚠️ 22800 (1H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22300 → 115,594 @ 06/24 09:00 – Strong demand response and buildup initiated trend week

🔹 22500 → 189,238 @ 06/25 08:00 – Key level rotation zone before breakout continuation

🔹 22560 → 84,917 @ 06/26 09:00 – Support confirmed during session dip

🔹 22800 → 92,149 @ 06/27 10:00 – Friday morning volume climax into short-term exhaustion

🔹 22720 → 55,375 @ 06/27 09:00 – Pinned resistance became support by session close

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22720–22810 | Friday session intraday rejection/fade zones |

| 30min | 22725–22800 | Short-term breakout zone tested and absorbed |

| 1H | 22560–22800 | Intraday HVN and final exhaustion points |

| 4H | 22300–22500 | Strong trending shelf formed over midweek |

| 1D | 21900–22100 | Weekly composite demand zone, macro context |

| 2D | 21600–22050 | High-volume base and structural support |

📈 Stay objective. Trade your plan with context.