NQ: Weekly Prep 29/2025

Demand defended 22860-22900 last week, then rejected 23080-23120 supply zone. Bias leans responsive within range while prepping for CPI.

Weekly Briefing:

📊 Nasdaq Futures Report

📆 28/2025:

🕓 Analysis Window: 28/2025:Sunday-Friday

🕓 Game Plan Window: 29/2025: Sunday-Friday

💡 Focus: Order intensity, structure, and directional bias

🔍 Narrative Summary

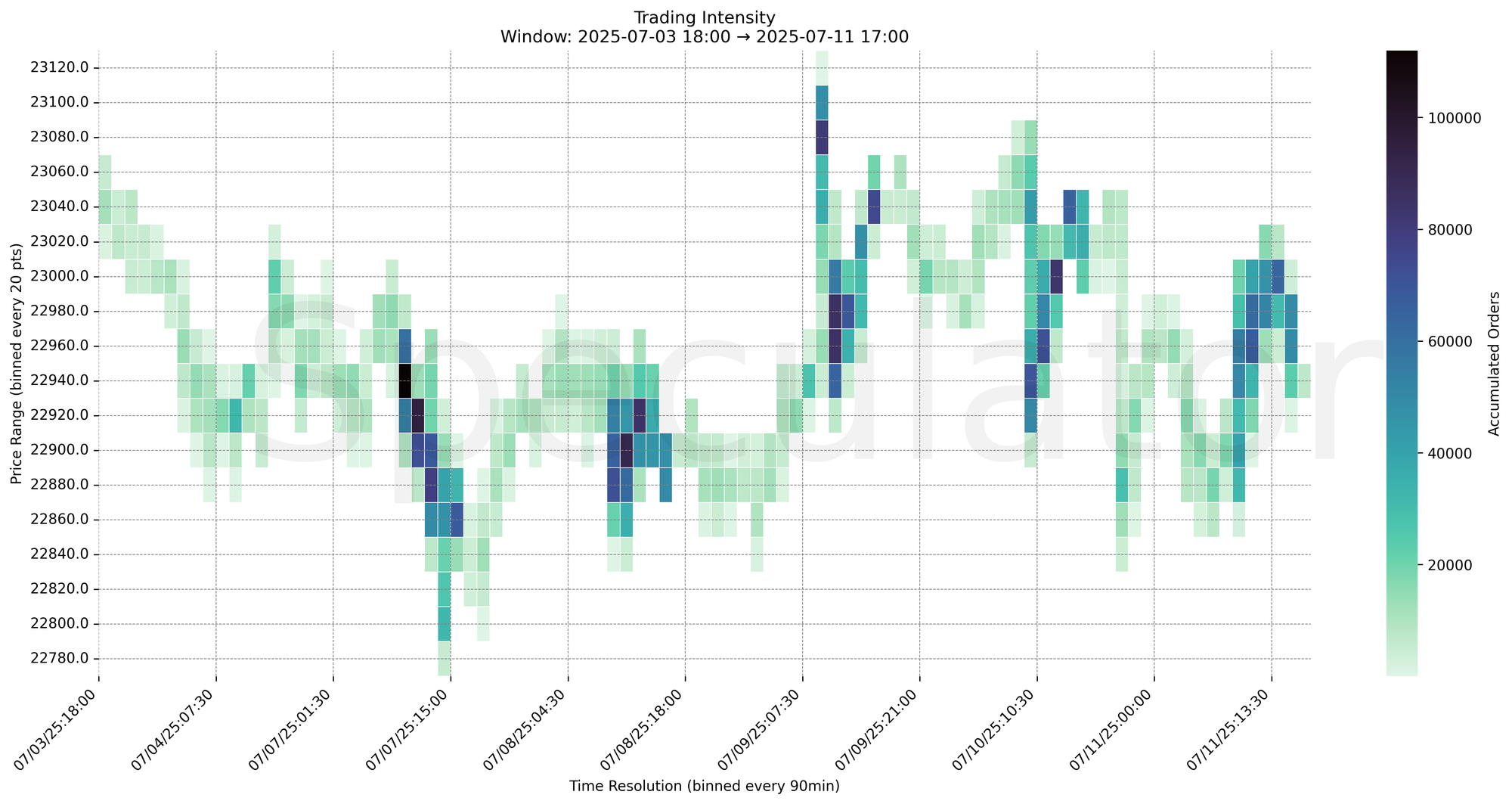

Nasdaq futures traded within a well-defined range last week, oscillating between supply pressure at 23080–23100 and demand interest around 22860–22900. Price briefly tested below structural support on July 8th but demand reasserted control by midweek, lifting price back toward the 23000 region. Activity clustered tightly around the 22950–23000 level—establishing it as a strong magnet zone. Notably, on July 10–11, price ranged near this area with increasingly shallow pullbacks, hinting at underlying demand strength. However, breakout attempts above 23080 faded as volume thinned into the upper zones.

📌 Note: Next week Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| CPI | 7/15 | 08:30 |

| PPI | 7/16 | 08:30 |

| UC Claims | 7/17 | 08:30 |

| Auto Sales | 7/17 | 08:30 |

| Retail Sales | 7/17 | 08:30 |

| Housing Starts | 7/18 | 08:30 |

| Building Permits | 7/18 | 08:30 |

| Michigan Consumer Sentiment | 7/18 | 08:30 |

🔮 Next Week (29/2025) Game Plan

📈 Base Case – Responsive Range

Open Inside 22940–23020 zone

→ Expect fades from 23080–23120 into 22960–22900 zone

→ Price likely oscillates around 22980–23000 magnet zone

📉 Breakdown Risk

Loss of 22880–22860

→ Clears Demand/support

→ Exposes 22820 → 22760 → 22640 → 22500

⚠️ 22900 (1D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23120

→ Clears Supply/resistance

→ Opens path toward 23240 → 23300 → 23420 → 23550

⚠️ 23080 (90min) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 22970 → 14509 @ 07/11 15:45 – Late session defense at prior magnet zone

🔹 22970 → 14896 @ 07/11 12:00 – Intraday bounce held firm after morning fade

🔹 22990 → 14995 @ 07/11 10:30 – Buy interest met mid-zone supply

🔹 22940 → 79243 @ 07/10 10:00 – Strong bid absorption at intraday lows

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22940–23010 | Short-term rotations near session VWAP and response |

| 30min | 22935–23010 | Microstructure support/resistance intraday |

| 1H | 22940–23000 | HVNs and responsive range anchors |

| 4H | 22900–22975 | Demand shelf with defensive bid zones |

| 1D | 22900–23000 | Composite magnet and consolidation area |

| 2D | 22950 (key) | Long-term mean reversion pivot |

📈 Stay objective. Trade your plan with context.