NQ: Weekly Prep 30/2025

The market defended 23160 last week, reversing higher into 23280 resistance. Bullish structure with breakout potential above key supply.

Weekly Briefing:

📊 Nasdaq Futures Report

📆 29/2025:

🕓 Analysis Window: 29/2025:Sunday-Friday

🕓 Game Plan Window: 30/2025: Sunday-Friday

💡 Focus: Order intensity, structure, and directional bias

🔍 Narrative Summary

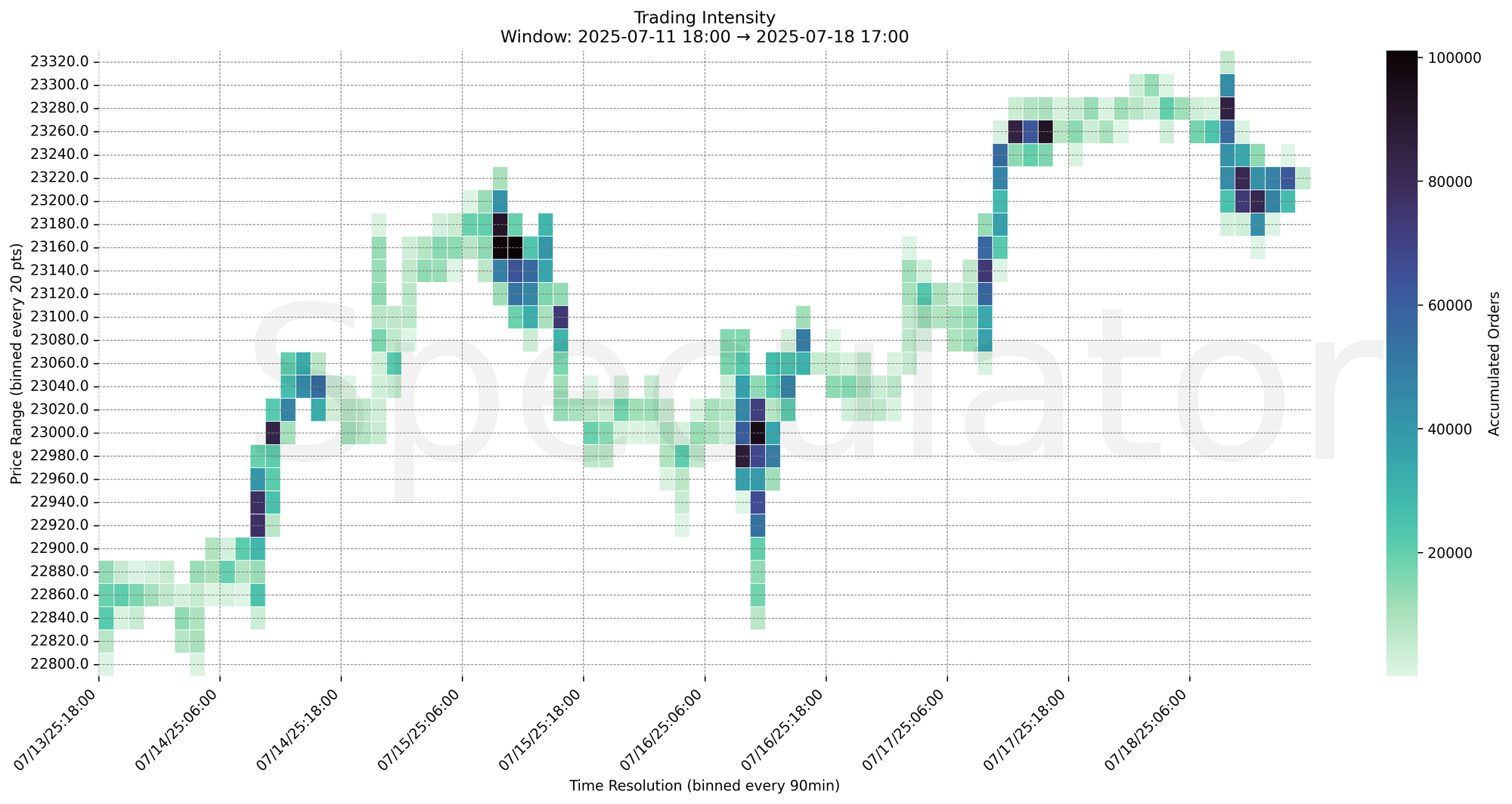

Nasdaq futures advanced in a choppy but constructive manner, navigating a path of higher lows and higher highs through Week 29. Early week activity balanced near 23000 with moderate dip buying evident, followed by a Wednesday shakeout that flushed to test 22980 before recovering.

From Thursday into Friday, strong participation near 23160–23260 set the tone, culminating in a late-week breakout to 23280, which was met with some responsive selling into the close. Several intensity spikes formed clear demand shelves below, setting the stage for responsive behavior in the event of early weakness next week.

📌 Note: Next week Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Fed Chair Speech | 7/22 | 08:30 |

| Existing Home Sales | 7/23 | 10:00 |

| UC Claims | 7/24 | 08:30 |

| Global PMI | 7/24 | 09:45 |

| New Home Sales | 7/24 | 10:00 |

| Durable Goods | 7/25 | 08:30 |

🔮 Next Week (30/2025) Game Plan

📈 Base Case – Responsive Range

Open Inside 23180–23250

→ Expect fades from 23280–23300 into 23180–23220

→ Price likely oscillates around 23220–23240 magnet zone

📉 Breakdown Risk

Loss of 23160–23130

→ Clears Demand/support

→ Exposes 23080 → 23000 → 22950 → 22880

⚠️ 22950 (2D) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23280–23300

→ Clears Supply/resistance

→ Opens path toward 23360 → 23400 → 23460 → 23600

⚠️ 23300+ (1D) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23280 → 80.5K @ 07/18 09:00 – Breakout surge with strong continuation

🔹 23260 → 92.2K @ 07/17 15:00 – Absorption zone prior to breakout

🔹 23160 → 101.0K @ 07/15 10:30 – Structural low defended with intensity spike

🔹 23000 → 96.1K @ 07/16 10:30 – Midweek flush reversal with strong buyer interest

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23270–23210 | Micro-imbalances, short-term trade management zone |

| 30min | 23280–23205 | Balance break + responsive zones |

| 1H | 23280–23220 | HVNs and volume-weighted support |

| 4H | 23250–23000 | Broad structure with defended shelves |

| 1D | 23000–22900 | Composite value, recent structural base |

| 2D | 22950 | Long-term mean-reversion and prior resistance flip |

📈 Stay objective. Trade your plan with context.