NQ: Weekly Prep 31/2025

The market reclaimed the 23400 zone last week, rejecting downside and attracting aggressive buyers. Bullish bias holds while 23320 supports.

Weekly Briefing:

📊 Nasdaq Futures Report

📆 30/2025:

🕓 Analysis Window: 30/2025: Sunday-Friday

🕓 Game Plan Window: 31/2025: Sunday-Friday

💡 Focus: Order intensity, structure, and directional bias

🔍 Narrative Summary

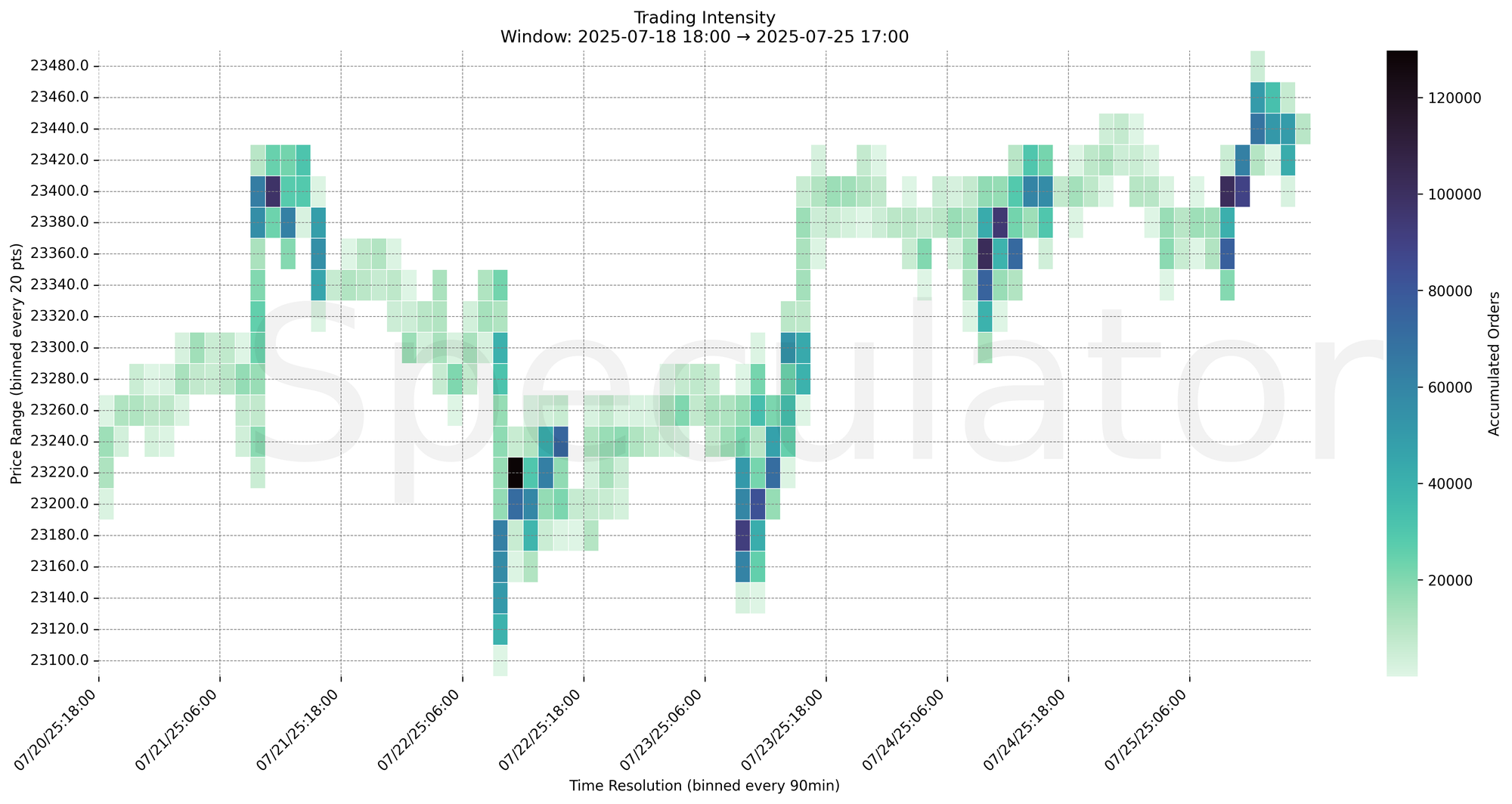

Nasdaq futures exhibited strong rotational behavior last week, testing downside liquidity early in the week near 23180–23220 before pivoting sharply higher into 23450 by Friday. Intensity heatmaps show heavy buying interest clustered between 23360–23400 across multiple timeframes, signaling absorption and initiative behavior. Sharp downside rejection on 7/23 and 7/24 sets up the potential for responsive or breakout moves early in the upcoming week.

📌 Note: Next week Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Goods Trade Balance | 7/29 | 08:30 |

| JOLTs Job Openings | 7/29 | 10:00 |

| ADP Employment Change | 7/30 | 08:15 |

| GDP Growth Rate | 7/30 | 08:30 |

| FOMC | 7/30 | 14:00 |

| FOMC Press Conference | 7/30 | 14:30 |

| UC Claims | 7/31 | 08:30 |

| Core PCE | 7/31 | 08:30 |

| Personal Income | 7/31 | 08:30 |

| Personal Spending | 7/31 | 08:30 |

| Unemployment Rate | 8/01 | 08:30 |

| NFP | 8/01 | 08:30 |

| S&P PMI | 8/01 | 09:45 |

| Michigan Consumer Sentiment | 8/01 | 10:00 |

| ISM PMI | 8/01 | 10:00 |

🔮 Next Week (31/2025) Game Plan

📈 Base Case – Responsive Range

Open Inside 23360–23410

→ Expect fades from 23450–23480 into 23360–23400

→ Price likely oscillates around 23400 zone as HVN/magnet

📉 Breakdown Risk

Loss of 23320–23280

→ Clears Demand/support

→ Exposes 23180 → 23000 → 22900 → 22750

⚠️ 23180 (1H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23480

→ Clears Supply/resistance

→ Opens path toward 23520 → 23600 → 23740 → 23900

⚠️ 23450 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23420 → 18,141 @ 07/25 15:45 – Strong buyer interest into close; continuation setup

🔹 23410 → 22,694 @ 07/25 10:30 – Heavy buy absorption near HVN

🔹 23360 → 76,714 @ 07/25 09:00 – Structural node and intraday magnet

🔹 23220 → 129,698 @ 07/22 10:30 – Sharp absorption after breakdown attempt

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23360, 23390, 23400, 23410 | Short-term HVN cluster – intraday rotations |

| 30min | 23355, 23370, 23400 | Opening drive & absorption areas |

| 1H | 23360, 23380, 23400 | Structural HVNs – control zones for reaction |

| 4H | 23350, 23400, 23450 | Supply/resistance clustering zone |

| 1D | 22900, 23000 | Prior macro shelf & absorption base |

| 2D | 22950, 22050, 21600 | Long-term context – swing demand zone |

📈 Stay objective. Trade your plan with context.