NQ: Weekly Prep 33/2025

The market broke above 23600 last week, holding strong into 23700. Bullish continuation bias for next week.

Weekly Briefing:

📊 Nasdaq Futures Report

📆 32/2025:

🕓 Analysis Window: 32/2025: Sunday-Friday

🕓 Game Plan Window: 33/2025: Sunday-Friday

💡 Focus: Order intensity, structure, and directional bias

🔍 Narrative Summary

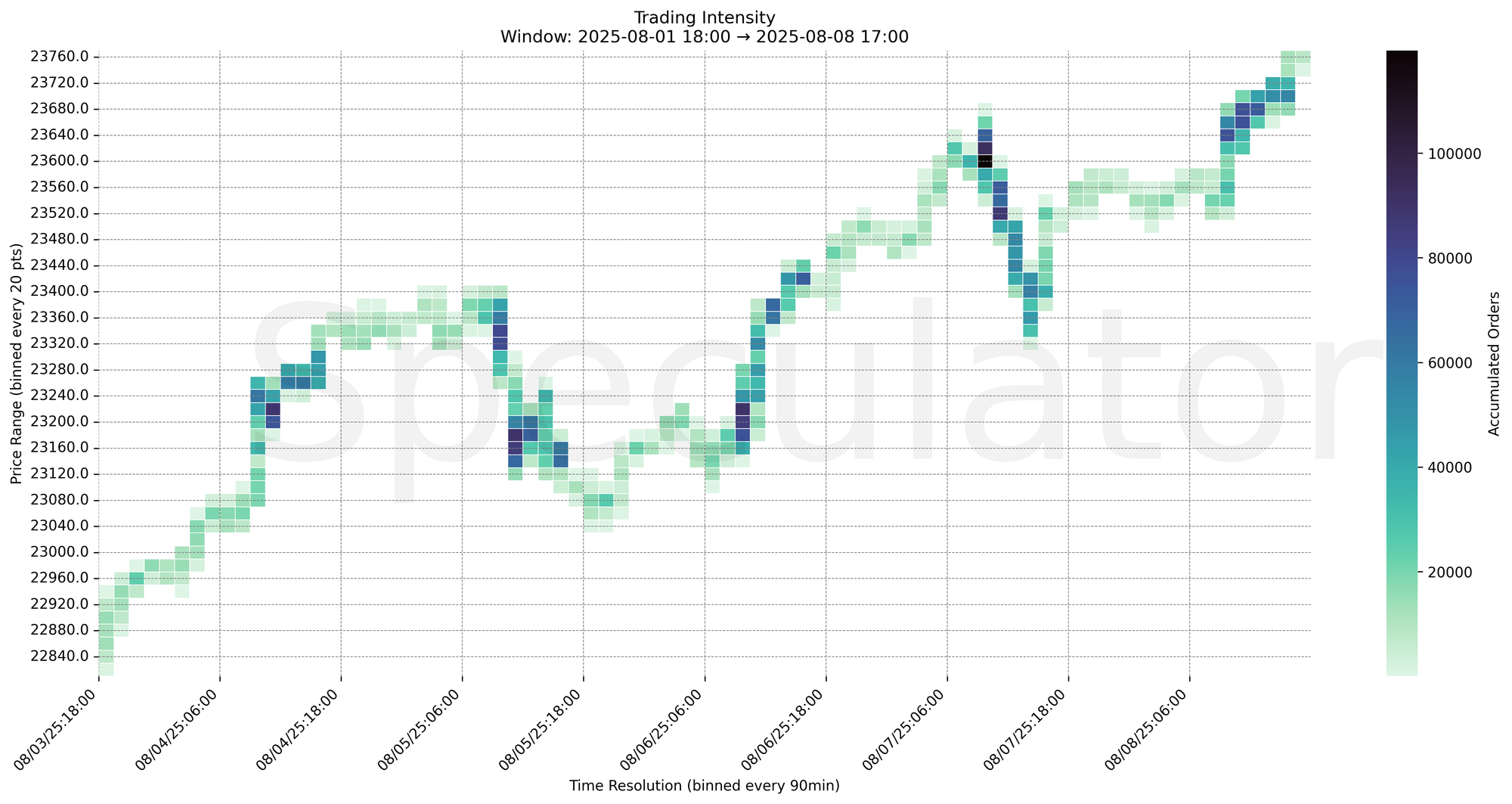

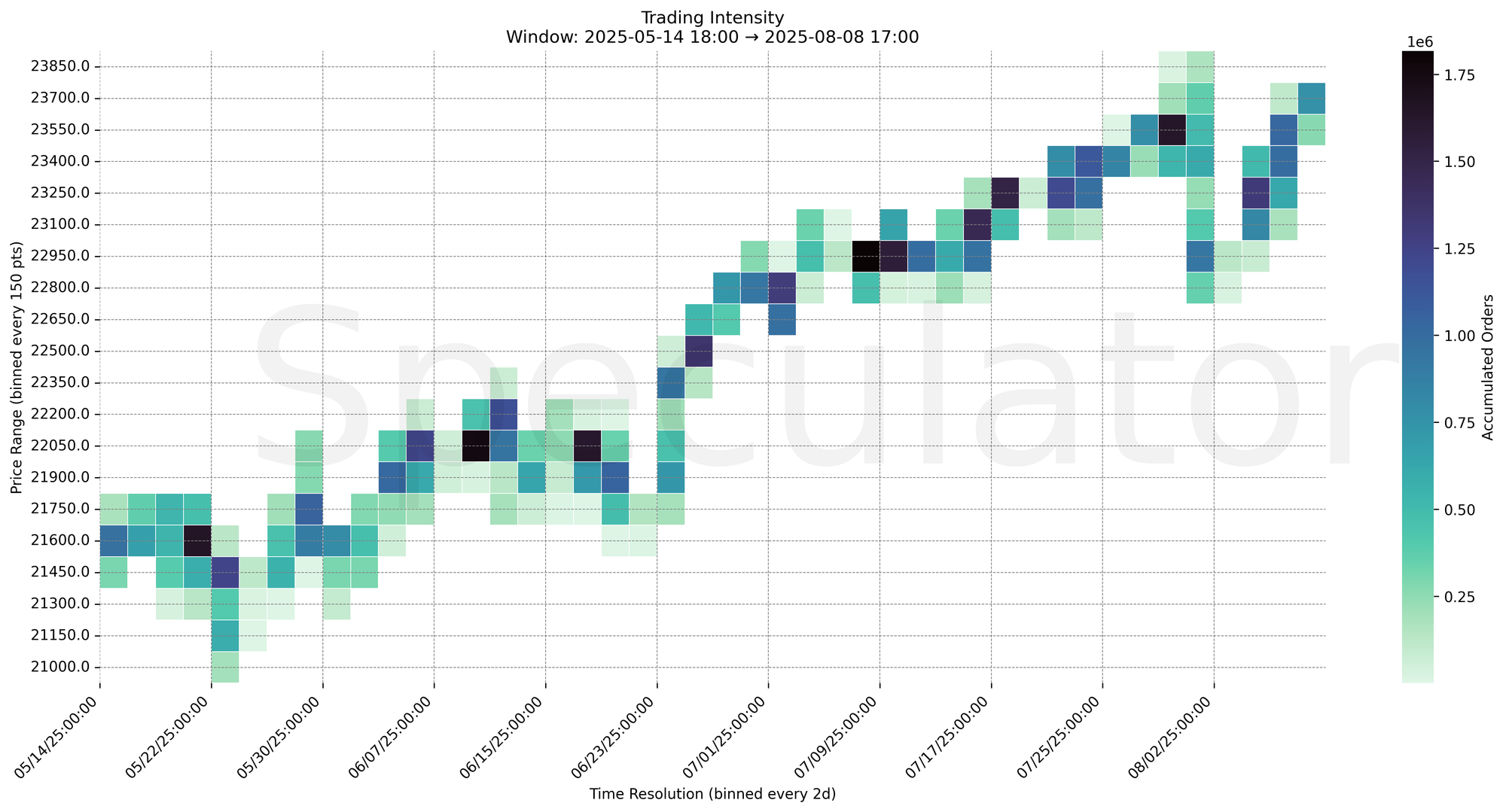

The Nasdaq Futures advanced strongly last week, building on prior momentum with a decisive move above 23600 and testing the 23700 area into the weekly close. Intense buying clustered between 23550–23660 highlighted sustained demand absorption. Mid-week dips toward 23160–23220 were met with aggressive responsive buying, confirming a bullish order flow bias.

Breakout momentum faded slightly into Friday, but no significant supply absorption was detected at the highs, suggesting continuation potential if 23650–23700 holds early in the week. Downside risk emerges only on a decisive loss of 23500, which would open the door to deeper retracement.

Bias for the prior week: Bullish

Projected bias for the upcoming week: Bullish continuation with breakout watch above 23700

📌 Note: Next week Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| CPI | 08/12 | 08:30 |

| Inflation Rate | 08/12 | 08:30 |

| PPI | 08/14 | 08:30 |

| Jobless Claims | 08/14 | 08:30 |

| Retail Sales | 08/15 | 08:30 |

| NY Manufacturing Index | 08/15 | 08:30 |

| Michigan Consumer Sentiment | 08/15 | 10:00 |

🔮 Next Week (33/2025) Game Plan

📈 Base Case – Responsive Range

Open Inside 23600–23700

→ Expect fades from 23700–23720 into 23620–23650

→ Price likely oscillates around 23650 as a magnet zone

📉 Breakdown Risk

Loss of 23500

→ Clears Demand/support

→ Exposes 23380 → 23220 → 23160 → 23000

⚠️ 23160–23220 (4H) = Trend demand zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23700

→ Clears Supply/resistance

→ Opens path toward 23800 → 23920 → 24000 → 24150

⚠️ 23700 (4H) = Trend supply zone or structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23680 → 76,154 @ 08/08 10:30 – Strong buyer interest holding high prints into late week

🔹 23660 → 72,700 @ 08/08 10:00 – Persistent bid absorption near breakout trigger

🔹 23600 → 119,589 @ 08/07 09:00 – Aggressive buying initiating mid-week rally leg

🔹 23180 → 90,067 @ 08/05 10:30 – Demand defended key swing low support

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23630–23660 | Short-term resistance cluster into breakout highs |

| 30min | 23655–23700 | Intraday resistance shelf |

| 1H | 23520–23660 | HVN and key rally base |

| 4H | 23650–23700 | Supply/resistance clustering near weekly highs |

| 1D | 23500–23600 | Composite HVN supporting current structure |

| 2D | 22950–23550 | Macro demand base and breakout staging area |

📈 Stay objective. Trade your plan with context.