NQ: Weekly Prep 34/2025

The market tested 23920 resistance last week and faded into 23800. Bias remains responsive inside 23800–23920, with risk of breakdown if 23800 fails.

Weekly Briefing:

📊 Nasdaq Futures Report

📆 33/2025:

🕓 Analysis Window: 33/2025: Sunday-Friday

🕓 Game Plan Window: 34/2025: Sunday-Friday

💡 Focus: Order intensity, structure, and directional bias

🔍 Narrative Summary

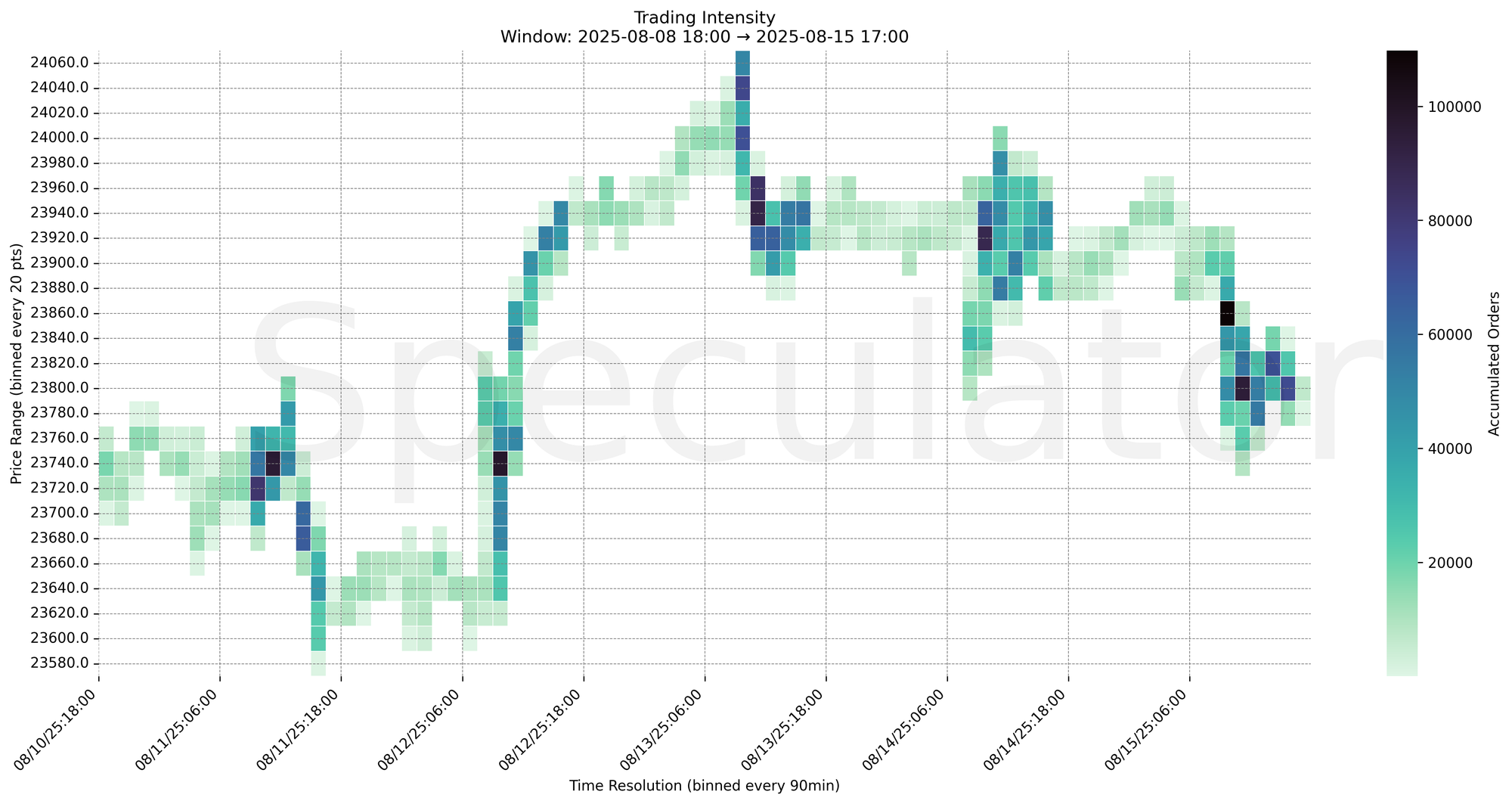

Last week’s session (Week 33) was marked by heavy rotations inside the 23800–24040 band. Order intensity peaked multiple times near 23860 and 23920, creating a ceiling that capped upside momentum. Buyers defended 23800 repeatedly, but late-week supply pressure eroded the zone, closing with weakness into 23780.

The key takeaway: the market continues to show responsive two-way trade, with 23800 as the pivotal inflection. Acceptance above 23920 opens continuation higher, but failure to defend 23800 risks a downside rotation.

📌 Note: Next week Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| Building Permits | 08/19 | 08:30 |

| Housing Starts | 08/19 | 08:30 |

| FOMC | 08/20 | 14:00 |

| Existing Home Sales | 08/20 | 10:00 |

| Jackson Hole Symposium Day 1 | 08/20 | 20:00 |

| Jobless Claims | 08/21 | 08:30 |

| PMI | 08/21 | 09:45 |

| Jackson Hole Symposium Day 2 | 08/21 | 20:00 |

| Fed Chair Speech | 08/22 | 10:00 |

| Jackson Hole Symposium Day 3 | 08/22 | 20:00 |

🔮 Next Week (34/2025) Game Plan

📈 Base Case – Responsive Range

Open Inside 23800–23920

→ Expect fades from 23920 into 23800

→ Price likely oscillates around 23860 as magnet zone

📉 Breakdown Risk

Loss of 23800

→ Clears Demand/support

→ Exposes downside ladder: 23750 → 23680 → 23550 → 23400

⚠️ 23750 (4H) = Trend demand zone

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23920

→ Clears Supply/resistance

→ Opens path toward 23960 → 24040 → 24120 → 24250

⚠️ 23960 (90m) = Trend supply zone

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23800 → 72,344 @ 08/15 15:00 – Heavy absorption, late-session defense but weak close

🔹 23860 → 109,758 @ 08/15 09:00 – Strong sell response capped intraday rally

🔹 23920 → 88,823 @ 08/14 09:00 – Supply response, ceiling of the week

🔹 24040 → 73,815 @ 08/13 09:00 – Failed breakout, quick rejection

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23870 / 23860 / 23810 | Short-term responsive fades, intraday HVN clusters |

| 30min | 23865 / 23805 | Strong rotational pivots, capped both rallies & fades |

| 1H | 23920 / 23860 / 23800 | Key reaction zones, order absorption noted |

| 4H | 23925 / 23800 / 23750 | Major demand/supply inflections in broader structure |

| 1D | 23200 / 23500 / 23900 | Composite HVNs, framing higher timeframe structure |

| 2D | 22950 / 23550 / 23850 | Long-term demand shelf and composite resistance |

📈 Stay objective. Trade your plan with context.