NQ: Weekly Prep 35/2025

NQ defended 23200 demand last week, rebounded into 23620 resistance. Bias shifts to balanced-to-bullish with upside open if 23630 clears.

Weekly Briefing:

📊 Nasdaq Futures Report

📆 34/2025:

🕓 Analysis Window: 34/2025: Sunday-Friday

🕓 Game Plan Window: 35/2025: Sunday-Friday

💡 Focus: Order intensity, structure, and directional bias

🔍 Narrative Summary

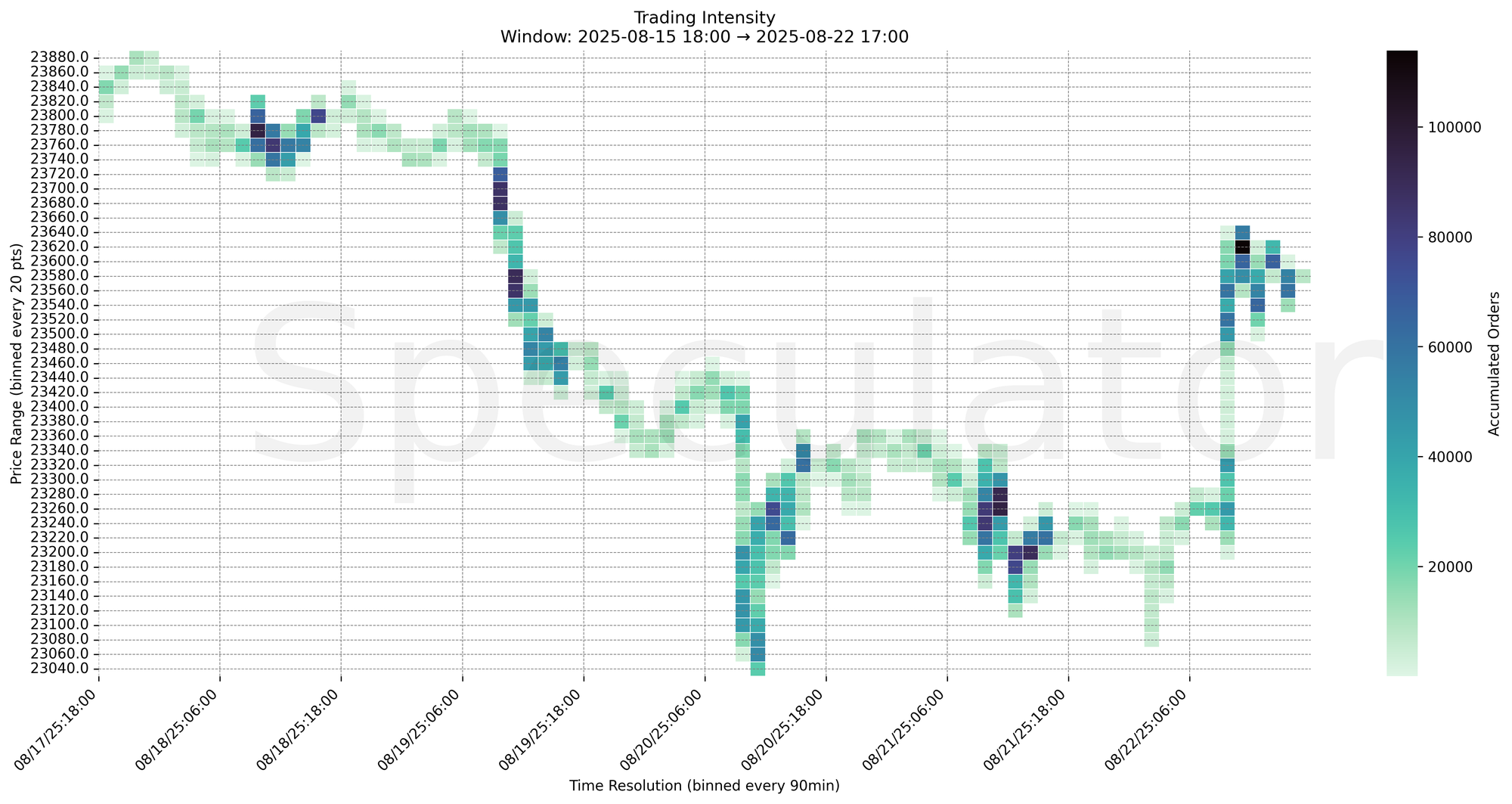

Nasdaq Futures traded through a volatile week, breaking lower early before finding strong demand around the 23200–23280 shelf. Intense order flow clustered here provided the base for a late-week rebound. Resistance emerged near 23620–23630, capping upside momentum into Friday.

Bias last week: Bearish-to-Neutral, with demand emerging mid-week.

Projected bias next week: Balanced-to-Bullish, with key focus on whether demand shelf at 23200–23280 continues to hold and if acceptance develops above 23620–23630.

📌 Note: Next week Red Folder Economic Events:

| Event | Date | Time (ET) |

|---|---|---|

| New Home Sales | 08/25 | 10:00 |

| Durable Goods | 08/26 | 08:30 |

| UC Claims | 08/28 | 08:30 |

| PCE | 08/29 | 08:30 |

| Michigan Consumer Sentiment | 08/29 | 10:00 |

🔮 Next Week (35/2025) Game Plan

📈 Base Case – Responsive Range

Open Inside 23300–23600

→ Expect fades from 23620–23630 into 23300–23280

→ Price likely oscillates around 23480–23560 magnet zone

📉 Breakdown Risk

Loss of 23200

→ Clears Demand/support

→ Exposes 23120 → 23040 → 22950 → 22800 downside ladder

⚠️ 23200–23280 (1H/4H) = Trend demand zone / structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 23630

→ Clears Supply/resistance

→ Opens path toward 23760 → 23850 → 23925 → 24050 upside ladder

⚠️ 23620–23630 (1H/4H) = Trend supply zone / structural inflection

→ Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

🔹 23620 → 113,856 @ 08/22 10:30 – Heavy resistance cluster, capped rebound

🔹 23260 → 95,351 @ 08/21 10:30 – Intense buy defense, formed demand shelf

🔹 23700 → 86,405 @ 08/19 09:00 – Early-week supply rejection, marked downtrend start

🔹 23760 → 83,255 @ 08/18 10:30 – Supply block, reinforced resistance ceiling

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 23520–23630 | Micro supply/demand tug-of-war late week |

| 30min | 23505–23625 | Intraday HVNs around resistance |

| 1H | 23200–23620 | Demand shelf & capped rebound |

| 4H | 23200–23625 | Broad supply/resistance clustering |

| 1D | 23200–23800 | Macro shelf support with overhead resistance |

| 2D | 22950–23850 | Long-term composite range, mean reversion candidates |

📈 Stay objective. Trade your plan with context.