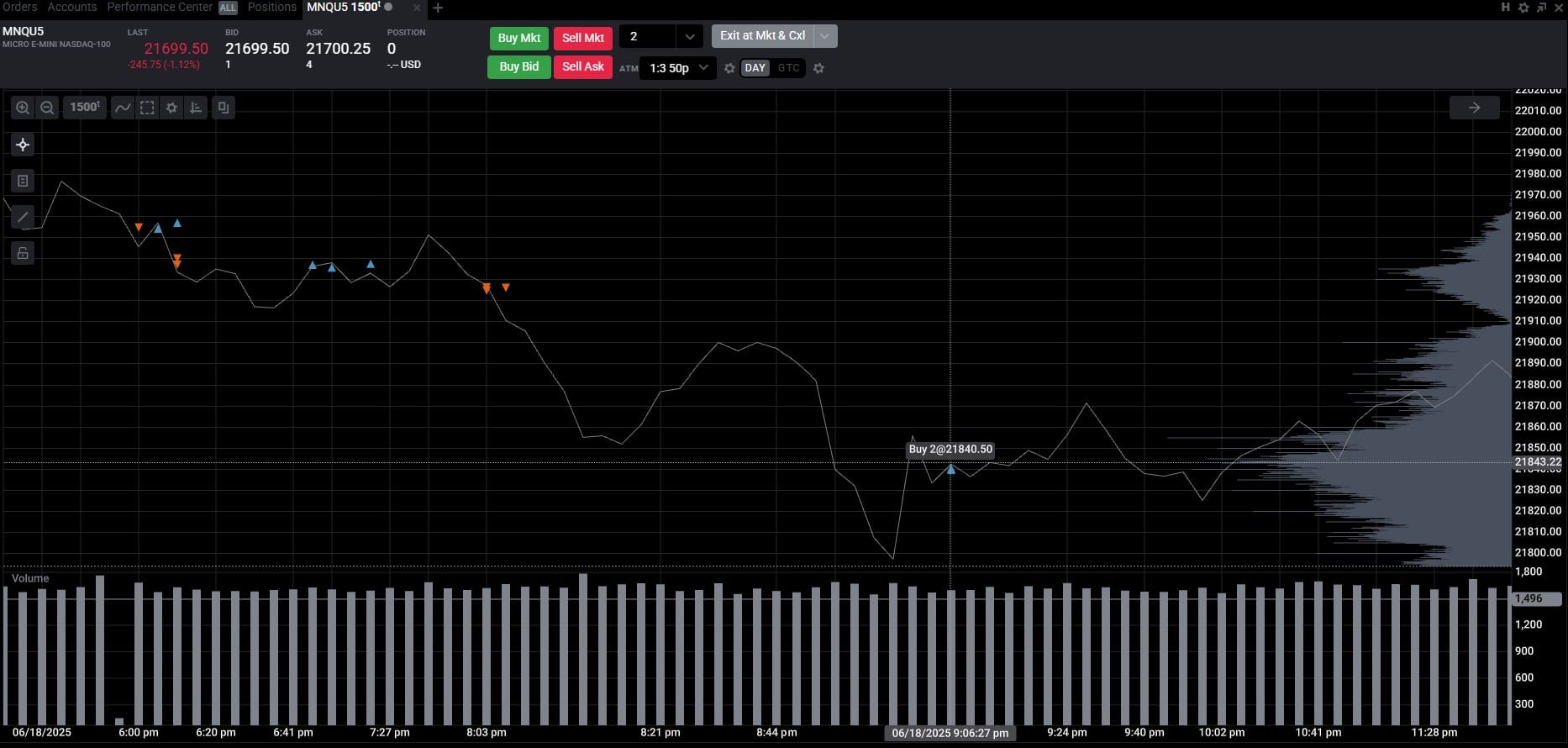

NQ: EOD 06/18/2025

MNQ rejected 22100 overnight and faded to 21930. Responsive sellers remain active with 22000 acting as a magnet. Eyes on 22080 reclaim or 21700 flush.

Post-market briefing for Wednesday

📊 MNQ Post-Market Report

🕓 Analysis Window: Regular Trading Hours (Open → Close ET) + higher timeframe structure

💡 Focus: Order accumulation, intraday structure, and directional bias

🔍 Narrative Summary

MNQ opened within a 22050–22080 congestion zone and failed to hold early strength above 22100, a high volume resistance area. Selling pressure initiated from 22080 into 21930, which became the session's downside magnet. Price briefly stabilized around 22000 but struggled to reclaim initiative. Responsive selling dominated the session, and the close below 22000 opens the door to deeper Globex exploration. Key areas to watch: 22050 (12H resistance), 21950–21930 (4H support), and 22080 (RTH resistance shelf).

🔮 Wednesday Globex Overnight Game Plan

📈 Base Case – Responsive Range

Open Inside 21930–22050 – Two-way participation inside prior value

→ Expect fades from 22050 into 21950/21930

→ Price likely oscillates around 22000 magnet zone

📉 Breakdown Risk

Loss of 21930 – Weak structural shelf gives way

→ Exposes 21700, 21500

⚠️ 21700 (1D) = Trend support zone or structural inflection

Watch for volume confirmation — avoid chasing into low-liquidity zones

🚀 Breakout Scenario

Sustained acceptance above 22080 – Reclaiming failed auction zone

→ Clears resistance

→ Opens path toward 22125, 22175

Watch for volume confirmation — avoid chasing into low-liquidity zones

🧊 Key Heatmap Observations

- 22080 → 31,743 @ 10:30 – Heavy rejection selling initiated

- 22000 → 55,189 @ 14:00 – Magnet price with persistent absorption

- 21960 → 50,514 @ 15:00 – Late support response, failed lift

- 21930 → 26,014 @ 15:00 – Defensive bid holding final hour

- 22060 → 56,254 @ 11:00 – Prior RTH shelf retested and faded

🔧 Price Clusters by Timeframe

| Timeframe | Price Levels | Notes |

|---|---|---|

| 15min | 22090, 22080, 22070 | Most active short-term levels |

| 30min | 22125, 22110, 22095 | Stacked resistance zone |

| 1H | 22100, 22080, 22060 | Compression zone highs |

| 4H | 22175, 22100, 22075 | Top of mid-term range |

| 1D | 22100, 22000, 21700 | Long-term interest builds at 22000 |

| 2D | 22050, 21600, 20400 | Broader structure forming below 22050 |

📈 Stay objective. Trade your plan with context.

Trades Taken

- Short